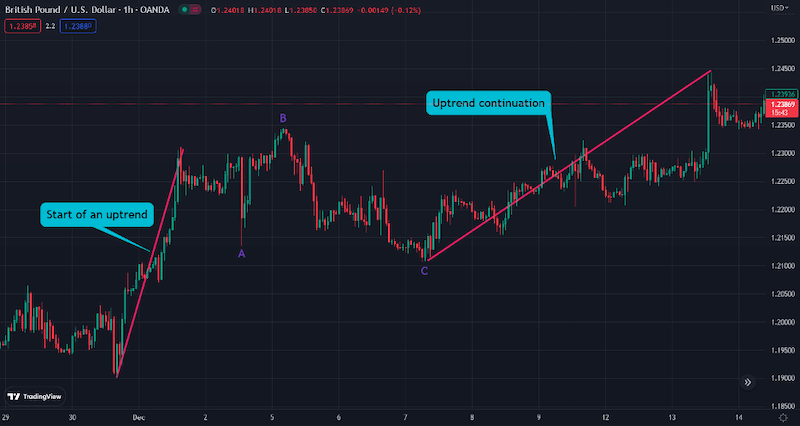

ABC correction pattern forex mein ek commonly used technical analysis hai. Is pattern ko traders use karte hain, takay price action ko identify kar sakein aur trading decisions le sakein. Is pattern mein, market mein price ka trend ek specific direction mein move karta hai, phir correction phase mein aata hai, aur phir wapis trend direction mein move karta hai.

A- Wave:

A wave ka matlab hota hai, jab price trend direction mein move karta hai. Agar price up trend mein hai, to A wave upward hoga. Agar price down trend mein hai, to A wave downward hoga. Is phase mein, traders prices ko identify kar sakte hain aur trading decisions le sakte hain.

B- Wave:

B wave ka matlab hota hai, jab price correction phase mein aata hai. Is phase mein, price trend direction se opposite direction mein move karta hai. Agar price up trend mein hai, to B wave downward hoga. Agar price down trend mein hai, to B wave upward hoga. Is phase mein, traders ko price action ko carefully observe karna chahiye aur trading decisions ko adjust karna chahiye.

C- Wave:

C wave ka matlab hota hai, jab price phir se trend direction mein move karta hai. Agar price up trend mein hai, to C wave upward hoga. Agar price down trend mein hai, to C wave downward hoga. Is phase mein, traders ko buy ya sell ke decisions lena chahiye.

Conclusion

ABC correction pattern forex mein bahut hi useful hai, lekin isko properly interpret karna zaroori hai. Is pattern mein, traders ko price action ko carefully observe karna chahiye aur trading decisions ko adjust karna chahiye.

تبصرہ

Расширенный режим Обычный режим