Bulls Trap Aur Bears Trap.

Bulls Trap Kya Hai?

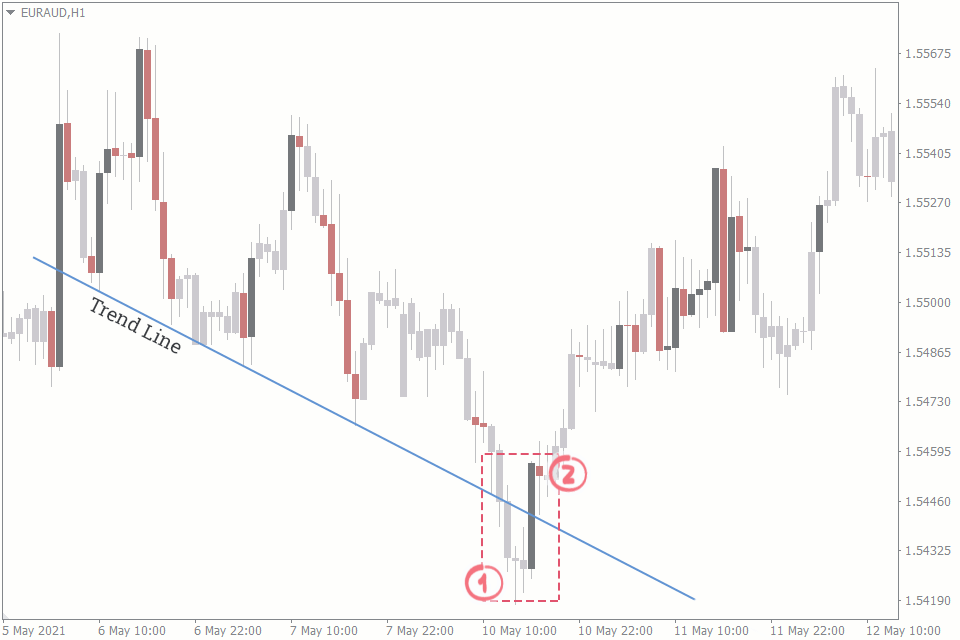

Bulls Trap aik aisi situation hai jo stock market mein hoti hai jab investors ko lagta hai ke prices barh rahin hain, lekin asal mein yeh aik temporary increase hota hai aur uske baad prices gir jaati hain. Yeh investors ko mislead karne ka kaam karti hai ke woh stocks khareed lein jabke asal mein market downward trend mein hota hai.

Bulls Trap Ki Nishaniyan.

Bulls Trap Se Kaise Bachain.

Bulls Trap Ka Asar.

Bulls Trap investors ko financial loss deti hai kyunke woh higher prices pe stocks khareedte hain aur phir prices gir jaati hain. Yeh unki capital ko affect karta hai aur kabhi kabhi significant losses bhi ho sakti hain.

Bears Trap Kya Hai?

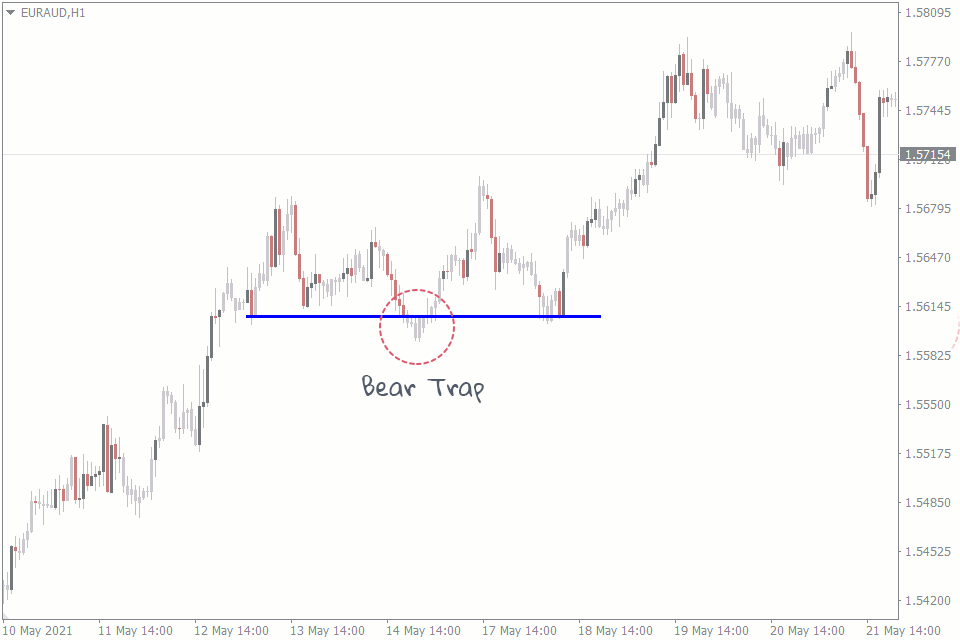

Bears Trap aik aisi situation hai jab investors ko lagta hai ke prices gir rahin hain, lekin asal mein yeh aik temporary decline hota hai aur uske baad prices barh jaati hain. Yeh investors ko mislead karti hai ke woh stocks bech dein jabke market upward trend mein hota hai.

Bears Trap Ki Nishaniyan.

Bears Trap Se Kaise Bachain.

Bears Trap Ka Asar.

Bears Trap investors ko financial loss deti hai kyunke woh lower prices pe stocks bechte hain aur phir prices barh jaati hain. Yeh unki potential gains ko affect karta hai aur kabhi kabhi significant missed opportunities bhi ho sakti hain.

Bulls Aur Bears Traps Mein Farq.

Common Strategies To Avoid Traps.

Bulls Trap Kya Hai?

Bulls Trap aik aisi situation hai jo stock market mein hoti hai jab investors ko lagta hai ke prices barh rahin hain, lekin asal mein yeh aik temporary increase hota hai aur uske baad prices gir jaati hain. Yeh investors ko mislead karne ka kaam karti hai ke woh stocks khareed lein jabke asal mein market downward trend mein hota hai.

Bulls Trap Ki Nishaniyan.

- Temporary Price Increase: Price temporarily barhti hai jo investors ko attract karti hai.

- Low Trading Volume: Trading volume kam hota hai, jo yeh batata hai ke interest itna ziada nahi hai.

- Resistance Levels: Price aik certain level pe jaake wapis gir jaati hai.

- Technical Indicators: Moving averages aur other technical indicators misleading signals dete hain.

Bulls Trap Se Kaise Bachain.

- Proper Analysis: Fundamental aur technical analysis dono ka istemal karein.

- Stop Loss Orders: Apne investments ko protect karne ke liye stop loss orders lagayein.

- Market Trends: Overall market trend ko dekhkar decision lein.

- Patience: Jaldbazi se kaam na lein, aur market ke move ko observe karein.

Bulls Trap Ka Asar.

Bulls Trap investors ko financial loss deti hai kyunke woh higher prices pe stocks khareedte hain aur phir prices gir jaati hain. Yeh unki capital ko affect karta hai aur kabhi kabhi significant losses bhi ho sakti hain.

Bears Trap Kya Hai?

Bears Trap aik aisi situation hai jab investors ko lagta hai ke prices gir rahin hain, lekin asal mein yeh aik temporary decline hota hai aur uske baad prices barh jaati hain. Yeh investors ko mislead karti hai ke woh stocks bech dein jabke market upward trend mein hota hai.

Bears Trap Ki Nishaniyan.

- Temporary Price Decline: Prices temporarily girti hain jo investors ko panic mein daalti hai.

- Low Trading Volume: Trading volume kam hota hai jo yeh batata hai ke interest itna ziada nahi hai.

- Support Levels: Price aik certain level pe girke wapis recover ho jaati hai.

- Technical Indicators: Moving averages aur other technical indicators misleading signals dete hain.

Bears Trap Se Kaise Bachain.

- Proper Analysis: Fundamental aur technical analysis ka sahara lein.

- Stop Loss Orders: Apne investments ko protect karne ke liye stop loss orders lagayein.

- Market Trends: Overall market trend ko dekh kar apna decision lein.

- Patience: Jaldbazi se kaam na lein, aur market ke move ko observe karein.

Bears Trap Ka Asar.

Bears Trap investors ko financial loss deti hai kyunke woh lower prices pe stocks bechte hain aur phir prices barh jaati hain. Yeh unki potential gains ko affect karta hai aur kabhi kabhi significant missed opportunities bhi ho sakti hain.

Bulls Aur Bears Traps Mein Farq.

- Direction: Bulls Trap mein prices temporarily barhti hain jabke Bears Trap mein prices temporarily girti hain.

- Investor Action: Bulls Trap mein investors khareedte hain jabke Bears Trap mein investors bechte hain.

- Outcome: Bulls Trap ke baad prices girti hain aur Bears Trap ke baad prices barhti hain.

Common Strategies To Avoid Traps.

- Diversification: Apne portfolio ko diversify karein taake kisi aik stock pe ziada depend na karna pare.

- Technical Analysis: Chart patterns aur indicators ko study karein.

- Stay Informed: Market news aur updates se hamesha ba-khabar rahein.

- Long-Term Perspective: Short-term fluctuations pe focus na karein, balki long-term goals ko madde nazar rakhein.

تبصرہ

Расширенный режим Обычный режим