Assalamu Alaikum Dosto!

Forex Trading Mein Round Numbers

Market ki technical analysis aik mukhtalif asbaab par mabni hai jese ke maqami indicators aur support/resistance levels, Fibonacci Retracement, trend lines, waghera. Lekin aik aur tool hai jo khaas taur par kisi bhi classical analysis mein kam zikr hota hai, aur is liye traders mein bari dilchaspi paida karta hai, jisay "round levels" kehte hain.

Round levels ka aik psyhological asool hai. Asal zindagi mein, hamain aksar round numbers se guzarna parta hai, jin par kai marketing strategies mabni hoti hain, aur aam log tens aur hundreds ki tarah round numbers se aadi hotay hain.

Forex market mein bhi yehi halat hai: jab keemat aik round level tak pohanchti hai, traders apni positions band karnay ki koshish karte hain, kyun ke unka khayal hai ke is level par positions band hon gi aur mukhalif orders open ho jayenge. Agar hum market ke kisi randomly select shuda hissay mein circular levels par lines khenchein, toh unki ahmiyat saaf nazar aayegi.

Round Numbers Types

Round levels mukhtalif qisam ki hoti hain, inke rounding darajay ke mutabiq:

- Parity Levels: Sab se mazboot levels jin ka maximum rounding darjah hota hai (1.0000, 2.0000, waghera). Aise levels ko mahineo tak trading ke liye reference point ke tor par istemal kiya ja sakta hai.

- Thousandth Levels: Daswon mein rounding (1.1000, 1.2000).

- Hundredth Levels: Sowon mein rounding (1.1100, 1.1200) jo kisi khaas trading session ke liye ahmiyat rakhti hain.

Round Levels Par Strategies Kaise Kaam Karti Hain?

Kuch expert traders ke mutabiq, round levels price ke liye aik magnate ki tarah kaam kartay hain, aur agar aap chart dekhein toh is raaz se ittefaq karna mushkil nahi hai. Is raaz ki jawab duniaaye insani fitrat mein chhupa hua hai.

Haqiqatan mein, insani dimagh ko asaan karne ki adat hai, isi liye round levels Stop Loss aur Take Profit orders rakhne ke liye bohat attractive nazar aate hain. Ye asaan hota hai ke puray level par in orders ko set karna, jese ke 1.1500, balkay ke 1.1487 par set karna. Is tarah information yaad rakhna aur hisaab karna asaan ho jata hai.

Aksar, yeh levels ek range boundary ki tarah nazar aate hain, khaas kar jab market mein aam volatility ke doraan intraday movement hoti hai. Maan lijiye, din 1.1300 ke qareeb shuru hua, agar trading system round levels ko mad e nazar rakhti hai, toh do qareebi mazboot points 1.1400 aur 1.1200 honge.

Subha mein keemat ne aik dheere say girawat shuru ki aik qareeb 1.1280 level tak, iski breakout ne ek muqam banaya, aur keemat 1.1250 tak gir gayi. Ye level rozana ke price movement ka beech ka hissa ho sakta hai, jis par kuch sellers ne short positions band ki aur aik chhota pullback banaya.

Dopahar mein girawat 1.1220 level se jari rahi, is level par bear traders ne faisla kia ke aaj ka nichayi harkat ka imkan khatam ho chuka hai (taqreeban 80-85% potential daily movement guzargaya gaya tha). Isi liye sales fix karne ka daur shuru ho gaya. Lekin, yeh sabhi levels itna asar daalne wale nahi hote, kuch mein price movement par koi khaas asar nahi hota.

Round Levels Trading Mein Live Trading Mein Kaise Istemal Hoti Hain?

Aap ko samajhna hoga ke mamooli traders jo apne orders round levels par place karte hain, unka price movement par taasir khatam hoti hai, aur unki volume market makers ke mawafiq nahi hoti. Is liye yeh aksar hota hai ke price round levels ko mad e nazar nahi rakhta, is liye aap ko sirf unpar pura bharosa rakhna munasib nahi.

Isi tarah, round levels par Stop Loss aur Take Profit set karna bhi mushkil hai, behtar hai ke aap yeh sochein ke price un tak thodi der mein pohanchay gi. Agar aap ne Take Profit 1.1500 par set karna hai, toh behtar hai ke aap ise thoda neeche, say 1.1495-1.1497 par set karein.

Round levels ke breakout par enter karne ki koshish bhi risky hoti hai. Pehle toh aisa breakout jhoota ho sakta hai (price kuch dair ke liye zaroori direction mein move karegi kyun ke aik ziada se ziada orders ek sath activate hote hain), aur dosri taraf, jump-like movement ki wajah se requotes bhi ho sakti hain.

Round levels ko asal trading mein sirf doosre instruments ke saath istemal karne ke liye hi istemal karna chahiye, taa ke hasil ki gayi signal ko confirm kiya ja sake. Isi tarah, graphical patterns aur candlestick combinations par bhi tawajjuh deni chahiye. Is moqay par, round level ke qareeb hone ki mojudgi trading strategy se hasil ki gayi signal ko mazeed barhane wala aik extra factor ban jaegi.

Forex Strategies Jo Round Levels Par Mabni Hain?

Round levels bohat say traders ke liye aik psychological point hotay hain. Is liye, jab price kisi bhi level tak pohanchti hai, toh aisay levels par mukhtalif qisam ke orders ke clusters hone ka foran asar hota hai. Unki taqat itni zyada hoti hai ke kabhi kabhi taqatwar khabron ki movement mein inke rastay mein rukawat bhi paida ho sakti hai. Is ko asal trading mein kaise istemal kiya jaa sakta hai?

Inhe aik moassar strategy ke liye supplement kiya ja sakta hai. Maslan, agar aapko signal milta hai aur price ka rukh kisi round level ke qareeb hai toh aap trade mein dakhil hone se inkaar kar sakte hain.

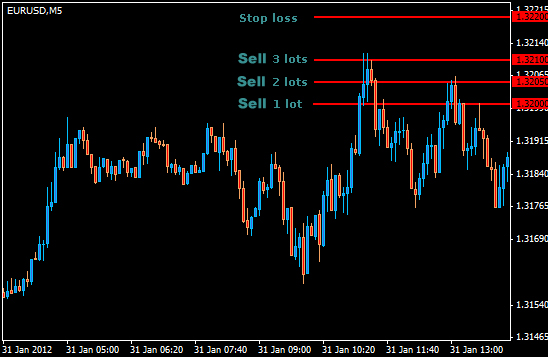

Agar trading signal aise level ke qareeb mojood hai toh ye uski sakti ko taayeed deti hai. Bohat si aisi strategies bhi hain jo sirf round levels par mabni hain. Inmein se kuch dekhte hain.[LIST][*] Double Zero:

Aik scalping strategy hai jo 00 aur 50 levels ka istemal karti hai aur ye sabit shuda version hai. Isme M5 aur M15 time frames par trading hoti hai aur Stop Loss ko price ke peeche chhota sa fasla dena hota hai.

M15 time frame par trading karte waqt, dosron ke levels aur EMA (Exponential Moving Average) ka istemal hota hai jiska period 20 hai. Yeh strategy multiple currencies par kam karti hai aur isse maahana takreeban 120 points ka munafa hota hai.

Short position mein entry karne ke liye zaroori points ye hain:

- EMA price se kafi neeche hai aur oopar ki taraf mudi hui hai.

- Price aik round level (jese ke 1.1500) tak pohanchti hai, aur aglay candle ne isay cross kar ke band kiya hai.

- Agar market level ke bahir mud jaati hai aur agla candle ise level ke upar band karta hai, toh aap short position dakhil karenge. EMA ab bhi price chart ke oopar hona chahiye.

- Stop Loss market entry ke 20 points neeche set karenge, aur jab trade 20 points in positive direction jaati hai, toh ise breakeven par shift karenge.

- Profit ko trade mein dakhil hone ke baad 40 points ke baad band karenge.

Long position mein enter karne ki leye zarori points yeh hain:

- EMA price se kafi oopar hai aur neeche ki taraf mudi hui hai.

- Price aik round level (jese ke 1.1500) tak pohanchti hai, aur aglay candle ne isay cross kar ke neeche band kiya hai.

- Agar market level ke andar mud jaati hai aur agla candle ise level ke neeche band karta hai, toh aap buy order dakhil karenge. EMA ab bhi price chart ke neeche hona chahiye.

- Stop Loss market entry ke 20 points upar set karenge, aur jab trade 20 points in positive direction jaati hai, toh ise breakeven par shift karenge.

- Profit ko trade mein dakhil hone ke baad 40 points ke baad band karenge.

Round Levels Trading With Pending Orders

Pending orders k case mein, sirf levels jo do zeros ke sath hain aur mid-levels ka istemal hoga, mid-levels ko nazar andaz kiya jaega. Market entry sirf pending orders ke zariye kiya jaega, koi indicators ka istemal nahi hoga aur currency pair kuch bhi ho sakta hai, lekin is strategy ko zyada volatile assets par lagana munasib nahi hai.

Strategy is tarteeb se implement hoti hai:

- Do-pehere (London Stock Exchange ke khulne se pehle) price ko kisi round level ke qareeb hone chahiye, behtareen toh yeh hai ke yeh level pura waqt ke liye qareeb hi rahe.

- Is level se 25 points upar aur neeche gaye hokar pending buy aur sell orders lagayen.

- Take Profit 25 points par set karen, aur Stop Loss 50 points par. Potential profit aur loss ka ratio behtar nahi hai, lekin is nuksan ko maaf karne wala factor hai ke munaafa dete waqt haarne wale trades se kai zyada hoti hain.

Jab aik order trigger hota hai, toh doosra foran delete kar diya jata hai. Open position ko aglay din tak nahi le ja sakta, lekin aise mauqay bohat kam hote hain jab na Stop Loss trigger hota hai aur na hi Take Profit, is liye trades ko aksar manual band karna parega.

Non-Indicator Round Levels Strategy

Non-indicator strategy kisi bhi indicators ka istemal nahi karti, iski rules sirf jama shuda statistics ki study par mabni hain. Yahan hum sirf un levels ka istemal karte hain jo 100 ka multiple hain, yaani ke 2 zeros ke sath.

Kuch possible scenarios hain:

- False Breakout: Price level ko breakout karti hai aur isay zyada se zyada 23 points ki duri par chhod deti hai. Amooman, triggered orders ka ikhraj price ko thoda sa resistance ke bahir jane ke liye encourage karta hai, is halat mein hum breakout ko ghalat samajhte hain aur price ke pullback par trade karte hain.

- Breakout par Trade Karna: Hum level ke breakout par bhi trade kar sakte hain, lekin is case mein throw ka maqdar kam se kam 25 pips hona chahiye.

- Agar Price 5 Points Tak Support/Resistance Nahi Pohanchti: Toh hum breakout par bhi trade karenge.

Market entry sirf pending orders ke zariye ki jati hai. Pending order placement ke liye, aik trader ko signal candle ke close price mein 20 points add karke intended trade ke rukh mein add karna hoga, aur phir is level par pending order place karna hoga.

Strategy ki mazeed kuch rules hain:

- Aap ko ek hi waqt mein zyada se zyada 1 trade open nahi rakhna chahiye.

- Stop Loss aur Take Profit orders zaroori hain. SL 40-45 points ke barabar hota hai, aur TP lagbhag 70-75 points ke barabar hota hai.

- Aap standard Trailing Stop ka istemal kar sakte hain, lekin behtar hai ke aap apne SL ko manual taur par last candle ke Close price se 30 points door shift karen.

- Jab bhi Stop Loss trigger hota hai, toh us level ko us din ke liye mad e nazar nahi lena chahiye.

- Agar 15 ghanton ke andar trade ya to Take Profit par close nahi hoti ya phir Stop Loss par, toh hum ise manual taur par band kardenge.

- Agar pending order signal candle ke banne ke baad trigger nahi hoti, toh ise delete kar diya jata hai, aur us level ke signals ko iske baad istemal nahi kiya jata.

Is strategy ki ek khami hai ke isme round levels par poori tarah se market analysis nahi hoti. Phir bhi, behtar hota hai ke hasil ki gayi signal mein kam se kam kuch filters, kam az kam Moving Averages, shamil kiye jaaye.

Summary

Round levels strategies bohat he simple trading algorithms hain. Inmein se kuch itni simple hoti hain ke yeh roulette ki tarah lagti hai, lekin kuch kaam karne wale systems bhi hain.

Round levels ki asar price ke ponchne par koi shak nahi hai, yeh fact aap khud check kar sakte hain, bas apne terminal ko kholen aur inke aas paas ke price behavior ko dekhen. Masla yeh hai ke yeh pattern sab traders ko maloom hai, chahay woh aam traders hon ya market makers. Is liye jab koi in levels ko bina kisi additional filters ke istemal ki koshish karta hai, toh wahan tamam mushkilat paida hoti hain.

Jo log round levels par trading karna chahte hain, unhe mashwara diya ja sakta hai ke woh apne trading system ko unpar poori tarah na mabni karen, balki unhe ek pehle se kaam kar rahi strategy mein integrate karne ki koshish karen. Yeh wohi hai jo logic hai ke price is level se rebound karegi ya phir isay break karegi, is par andaza lagane ke bajaye.

تبصرہ

Расширенный режим Обычный режим