Bearish Wolf Wave candlestick trading strategy aik advanced technique hai jo market ke price movements ko analyze kar ke potential reversal points identify karti hai. Yeh strategy traders mein popular hai kyunke yeh high probability trading setups ko pinpoint karti hai. Is strategy ko effectively use karne ke liye aapko technical analysis aur chart patterns ki samajh honi chahiye.Bearish Wolf Wave candlestick trading strategy aik effective aur reliable method hai bearish market conditions ko trade karne ke liye. Yeh strategy accurate identification aur disciplined risk management par depend karti hai. Isse implement karne ke liye practice aur experience zaroori hai, lekin agar sahi tareeke se use kiya jaye to yeh consistent profits generate kar sakti hai.

Wolf Wave Pattern Kya Hai?

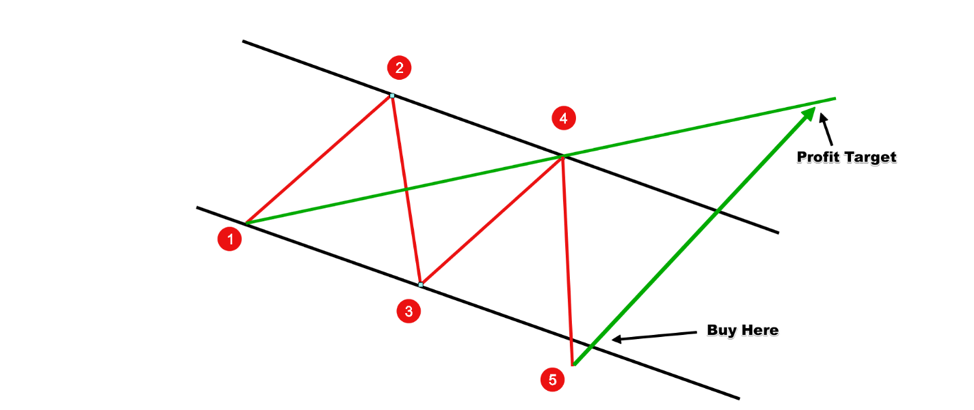

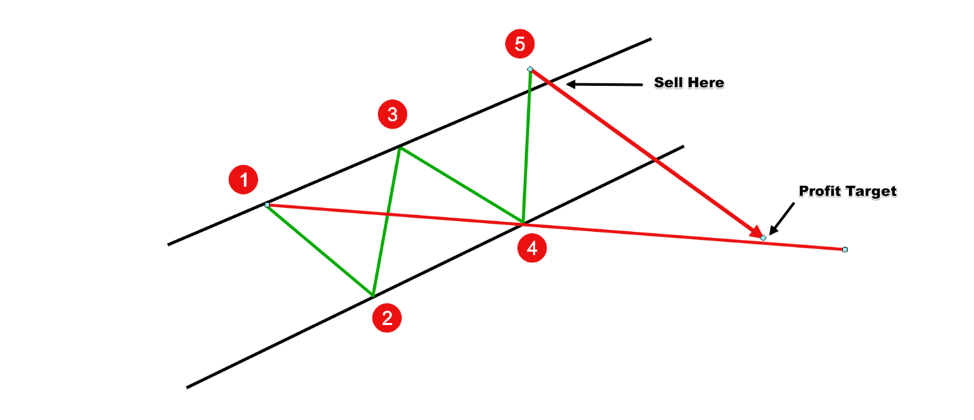

Wolf Wave aik price pattern hai jo 5 waves se milkar banta hai. Yeh waves naturally market ki supply aur demand forces ki wajah se banti hain. Wolf Wave pattern ko bullish aur bearish dono tarah se identify kiya ja sakta hai. Yahaan hum bearish Wolf Wave pattern ka zikar karenge jo price ke downward movement ko indicate karta hai.

Bearish Wolf Wave Pattern Ki Pehchan.

Bearish Wolf Wave pattern mein 5 waves hoti hain:

Wave 1: Price ka initial high point.

Wave 2:Price ka low point jo Wave 1 ke baad aata hai.

Wave 3: Price ka lower high jo Wave 2 ke baad aata hai.

Wave 4 Price ka lower low jo Wave 3 ke baad aata hai.

Wave 5: Final wave jo Wave 4 ke baad aata hai aur yeh price reversal point hota hai.

Pattern Drawing Technique.

Sabse pehle, aapko Wave 1 se lekar Wave 3 tak ka trendline draw karna hota hai.

- Wave 3 ko identify karte waqt dhyaan rakhein ke yeh Wave 1 se lower high hona chahiye.Phir, Wave 2 se Wave 4 tak ka trendline draw karein.Wave 4 ko identify karte waqt yeh ensure karna hota hai ke yeh Wave 2 se lower low ho.

Projection Line:

Ab, aapko Wave 1 aur Wave 4 ko milate hue ek projection line draw karni hoti hai.

Yeh projection line Wave 5 ka potential target hota hai.

Trading Setup.

Entry tab consider karte hain jab Wave 5 projection line ko touch kare ya uske paas ho. Yeh ek strong reversal point hota hai.

Iss point par bearish candlestick patterns jese ke bearish engulfing, shooting star, ya evening star dekhne chahiye.Stop loss ko Wave 5 ke thoda upar place karna chahiye.

Yeh isliye taake agar market aur upar jaye to loss control mein rahe.Profit target ko Wave 4 ke level par ya usse niche place karna chahiye.yeh conservative target hai jo high probability ke sath achieve ho sakta hai.

Agar aap yeh sab points follow kareinge to Bearish Wolf Wave candlestick trading strategy aapke trading arsenal mein aik powerful tool ban sakti hai. Isse aap bearish market conditions mein bhi profitably trade kar sakte hain aur consistent trading success achieve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим