ARIMA Indicator Defination.

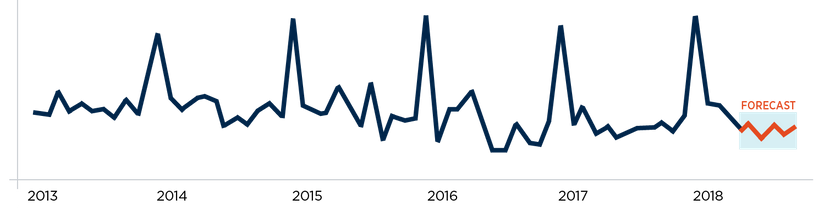

Auto-Regressive Integrated Moving Average (ARIMA) indicator ek statistical tool hai jo time-series data ke patterns ko analyze karne ke liye use kiya jaata hai. ARIMA indicator mein time-series data ke past values aur trends ko analyze karke future predictions kiye jaate hain.

ARIMA Indicator Trend prediction.

ARIMA indicator forex trading mein trend analysis ke liye use kiya jaata hai. Iske through traders price movements aur trend directions ko analyze kar sakte hain aur future price movements ke predictions kar sakte hain.

ARIMA Indicator Parameters.

ARIMA indicator ke liye kuch important parameters hote hain:

1. P (Auto-regressive parameter): Is parameter se past values ko analyze kiya jaata hai.

2. D (Integrated parameter): Is parameter se data ko stationary banane ke liye analyze kiya jaata hai.

3. Q (Moving average parameter): Is parameter se errors ko analyze kiya jaata hai.

ARIMA Indicator Benefits.

ARIMA indicator forex trading mein bahut useful hai. Iske kuch benefits hain:

1. Trend analysis: ARIMA indicator ke through traders price movements aur trend directions ko analyze kar sakte hain.

2. Future predictions: Iske use se traders future price movements ke predictions kar sakte hain.

3. Data analysis: ARIMA indicator ke use se data ko analyze karke traders apne trading strategies ko improve kar sakte hain.

ARIMA Indicator Performance.

ARIMA indicator ka performance forex trading mein bahut accha hai. Iske use se traders ko bahut saari information milti hai jaise ki trend analysis, future predictions aur data analysis.

Is ke use se traders apne trading strategies ko improve kar sakte hain aur profitable trades kar sakte hain.

Points of learnings.

Auto-Regressive Integrated Moving Average (ARIMA) indicator forex trading mein bahut useful hai. Iske use se traders trend analysis aur future predictions kar sakte hain aur apne trading strategies ko improve kar sakte hain. Iske use se traders profitable trades kar sakte hain.

Auto-Regressive Integrated Moving Average (ARIMA) indicator ek statistical tool hai jo time-series data ke patterns ko analyze karne ke liye use kiya jaata hai. ARIMA indicator mein time-series data ke past values aur trends ko analyze karke future predictions kiye jaate hain.

ARIMA Indicator Trend prediction.

ARIMA indicator forex trading mein trend analysis ke liye use kiya jaata hai. Iske through traders price movements aur trend directions ko analyze kar sakte hain aur future price movements ke predictions kar sakte hain.

ARIMA Indicator Parameters.

ARIMA indicator ke liye kuch important parameters hote hain:

1. P (Auto-regressive parameter): Is parameter se past values ko analyze kiya jaata hai.

2. D (Integrated parameter): Is parameter se data ko stationary banane ke liye analyze kiya jaata hai.

3. Q (Moving average parameter): Is parameter se errors ko analyze kiya jaata hai.

ARIMA Indicator Benefits.

ARIMA indicator forex trading mein bahut useful hai. Iske kuch benefits hain:

1. Trend analysis: ARIMA indicator ke through traders price movements aur trend directions ko analyze kar sakte hain.

2. Future predictions: Iske use se traders future price movements ke predictions kar sakte hain.

3. Data analysis: ARIMA indicator ke use se data ko analyze karke traders apne trading strategies ko improve kar sakte hain.

ARIMA Indicator Performance.

ARIMA indicator ka performance forex trading mein bahut accha hai. Iske use se traders ko bahut saari information milti hai jaise ki trend analysis, future predictions aur data analysis.

Is ke use se traders apne trading strategies ko improve kar sakte hain aur profitable trades kar sakte hain.

Points of learnings.

Auto-Regressive Integrated Moving Average (ARIMA) indicator forex trading mein bahut useful hai. Iske use se traders trend analysis aur future predictions kar sakte hain aur apne trading strategies ko improve kar sakte hain. Iske use se traders profitable trades kar sakte hain.

تبصرہ

Расширенный режим Обычный режим