Bullish Engulfing Candlestick Pattern.

Bullish Engulfing Candlestick Pattern ek technical analysis tool hai jo market trends ko analyze karne mein istemal hota hai. Ye pattern normal candlestick patterns ki tarah hota hai, lekin iska significance market ke trend ki reversal ko indicate karne mein hota hai.Bullish Engulfing Candlestick Pattern tab hota hai jab ek downtrend ke baad ek lambi bearish candle ko ek choti bullish candle engulf karta hai. Iska matlab hota hai ke bullish momentum bearish momentum ko overcome kar raha hai aur market ka trend change hone wala hai.

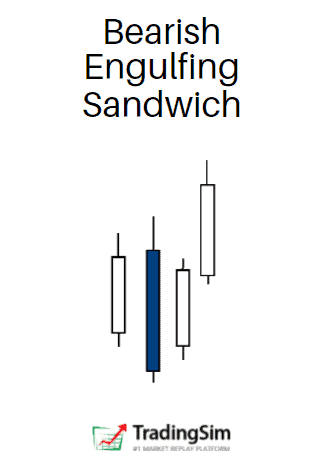

Stick Sandwich Candlestick Pattern.

Stick Sandwich Candlestick Pattern bhi ek reversal pattern hai jo market ke trend ko indicate karta hai. Ye pattern do bullish candles ke darmiyan ek choti si bearish candle ko shamil karta hai.Is pattern ka matlab hota hai ke market mein bearish pressure hai lekin bullish momentum bhi mojud hai. Jab ye pattern dekha jata hai toh ye indicate karta hai ke market ka trend change hone wala hai aur bullish trend shuru hone wala hai.

Bullish Engulfing Stick Sandwich Candlestick Pattern.

Bullish Engulfing Stick Sandwich Candlestick Pattern ek combination hai Bullish Engulfing aur Stick Sandwich patterns ka. Is pattern mein ek bullish engulfing candle ek bearish stick sandwiched hoti hai.Yeh pattern bullish trend ki shuruaat ko darust karta hai jab bearish trend ke baad dekha jata hai. Is pattern mein bearish pressure aur bullish momentum dono ko represent kiya jata hai. Jab ek bearish trend ke baad yeh pattern dekha jata hai, toh ye indicate karta hai ke market mein bullish reversal hone wala hai.

Bullish Engulfing Stick Sandwich Candlestick Pattern ki Tafseel.

Bullish Engulfing Stick Sandwich Candlestick Pattern ka Istemal.

Bullish Engulfing Stick Sandwich Candlestick Pattern ko market trends ko predict karne aur trading strategies banane ke liye istemal kiya jata hai. Is pattern ko dekhte hue traders bullish trend ke shuruat ko identify karte hain aur market mein entry points ko confirm karte hain.Traders is pattern ko dusre technical indicators ke saath combine karke aur confirm karte hain, jaise ke moving averages, RSI (Relative Strength Index), aur trend lines. Is tarah se, wo market ka overall picture banate hain aur trading decisions lete hain.

Bullish Engulfing Candlestick Pattern ek technical analysis tool hai jo market trends ko analyze karne mein istemal hota hai. Ye pattern normal candlestick patterns ki tarah hota hai, lekin iska significance market ke trend ki reversal ko indicate karne mein hota hai.Bullish Engulfing Candlestick Pattern tab hota hai jab ek downtrend ke baad ek lambi bearish candle ko ek choti bullish candle engulf karta hai. Iska matlab hota hai ke bullish momentum bearish momentum ko overcome kar raha hai aur market ka trend change hone wala hai.

Stick Sandwich Candlestick Pattern.

Stick Sandwich Candlestick Pattern bhi ek reversal pattern hai jo market ke trend ko indicate karta hai. Ye pattern do bullish candles ke darmiyan ek choti si bearish candle ko shamil karta hai.Is pattern ka matlab hota hai ke market mein bearish pressure hai lekin bullish momentum bhi mojud hai. Jab ye pattern dekha jata hai toh ye indicate karta hai ke market ka trend change hone wala hai aur bullish trend shuru hone wala hai.

Bullish Engulfing Stick Sandwich Candlestick Pattern.

Bullish Engulfing Stick Sandwich Candlestick Pattern ek combination hai Bullish Engulfing aur Stick Sandwich patterns ka. Is pattern mein ek bullish engulfing candle ek bearish stick sandwiched hoti hai.Yeh pattern bullish trend ki shuruaat ko darust karta hai jab bearish trend ke baad dekha jata hai. Is pattern mein bearish pressure aur bullish momentum dono ko represent kiya jata hai. Jab ek bearish trend ke baad yeh pattern dekha jata hai, toh ye indicate karta hai ke market mein bullish reversal hone wala hai.

Bullish Engulfing Stick Sandwich Candlestick Pattern ki Tafseel.

- Shuruat (Beginning): Bullish Engulfing Stick Sandwich Candlestick Pattern bearish trend ke baad shuru hota hai. Jab market mein bearish trend hota hai aur price down ja rahi hoti hai, tab ye pattern dekha jata hai.

- Bearish Stick (Bearish Candle): Shuruwat mein ek bearish candle dekha jata hai jo bearish trend ko represent karta hai. Ye candle normal size ka hota hai aur bearish momentum ko darust karta hai.

- Bullish Engulfing Candle: Dusri candle, jo bullish engulfing hoti hai, pehli candle ko poori tarah engulf karti hai. Iska matlab hota hai ke bullish momentum bearish momentum ko overcome kar raha hai.

- Bearish Stick (Bearish Candle): Teesri candle phir se bearish hoti hai aur pehli candle ke bilkul neeche close hoti hai. Ye candle bearish momentum ko darust karta hai, lekin iski size choti hoti hai.

- Trend Reversal (Trend Ka Ulta Hona): Jab ye pattern dekha jata hai, toh ye indicate karta hai ke bearish trend khatam hone wala hai aur bullish trend shuru hone wala hai. Is waqt traders ko buying ki opportunities dekhai deti hain.

Bullish Engulfing Stick Sandwich Candlestick Pattern ka Istemal.

Bullish Engulfing Stick Sandwich Candlestick Pattern ko market trends ko predict karne aur trading strategies banane ke liye istemal kiya jata hai. Is pattern ko dekhte hue traders bullish trend ke shuruat ko identify karte hain aur market mein entry points ko confirm karte hain.Traders is pattern ko dusre technical indicators ke saath combine karke aur confirm karte hain, jaise ke moving averages, RSI (Relative Strength Index), aur trend lines. Is tarah se, wo market ka overall picture banate hain aur trading decisions lete hain.

تبصرہ

Расширенный режим Обычный режим