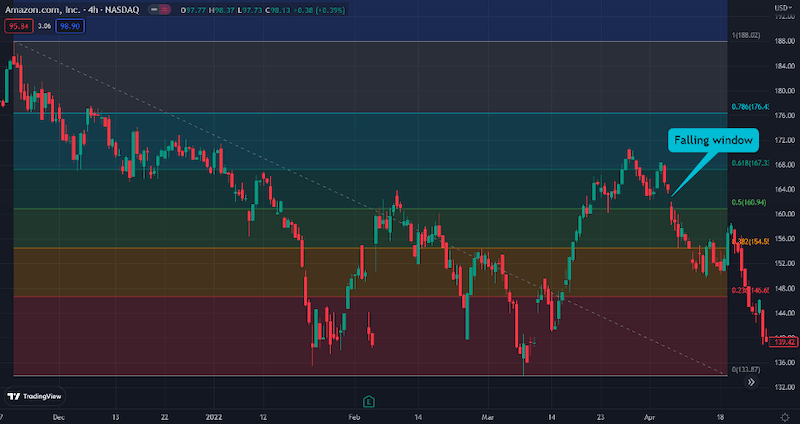

What is Falling Window Candlestick Pattern?

Falling Window Candlestick Pattern ek trading indicator hai jo market ki trend ki reversal ki prediction karne mein madad karta hai.Falling Window Candlestick Pattern ek reversal indicator hai jo traders ko market ki trend ki reversal ki prediction karne mein madad karta hai. Is pattern ki madad se traders safe trading kar sakte hain aur market ki volatility ki prediction kar sakte hain.

How is Falling Window formed?

Falling Window pattern do candlesticks ki combination se bana ta hai:

First Candle:Ek bullish candle

Second Candle:_ Ek bearish candle jo first candle ke lower side par close hota hai

What does Falling Window indicate?

Falling Window pattern ek reversal indicator hai jo show karta hai ki market ki trend palatne wali hai Traders is pattern ki madad se short positions liye ja sakte hain.

Falling Window Trading Formula.

Sell Signal: Jab Falling Window pattern bana ta hai, to traders ko sell signal milta hai (when the Falling Window pattern forms, traders get a sell signal).

Stop Loss: Traders ko stop loss lagana chahiye first candle ke upper side par (traders should put a stop loss on the upper side of the first candle).

Target:Traders ko target lagana chahiye second candle ke lower side par.

Dear friends agr ek stock ki price $80 se $70 tak girti hai (a stock's price falls from $80 to $70). Phir ek Falling Window pattern bana ta hai jo show karta hai ki market ki trend palatne wali hai.Traders ko sell signal milta hai aur traders short positions liye ja sakte hain.

Falling Window Candlestick Pattern ek trading indicator hai jo market ki trend ki reversal ki prediction karne mein madad karta hai.Falling Window Candlestick Pattern ek reversal indicator hai jo traders ko market ki trend ki reversal ki prediction karne mein madad karta hai. Is pattern ki madad se traders safe trading kar sakte hain aur market ki volatility ki prediction kar sakte hain.

How is Falling Window formed?

Falling Window pattern do candlesticks ki combination se bana ta hai:

First Candle:Ek bullish candle

Second Candle:_ Ek bearish candle jo first candle ke lower side par close hota hai

What does Falling Window indicate?

Falling Window pattern ek reversal indicator hai jo show karta hai ki market ki trend palatne wali hai Traders is pattern ki madad se short positions liye ja sakte hain.

Falling Window Trading Formula.

Sell Signal: Jab Falling Window pattern bana ta hai, to traders ko sell signal milta hai (when the Falling Window pattern forms, traders get a sell signal).

Stop Loss: Traders ko stop loss lagana chahiye first candle ke upper side par (traders should put a stop loss on the upper side of the first candle).

Target:Traders ko target lagana chahiye second candle ke lower side par.

Dear friends agr ek stock ki price $80 se $70 tak girti hai (a stock's price falls from $80 to $70). Phir ek Falling Window pattern bana ta hai jo show karta hai ki market ki trend palatne wali hai.Traders ko sell signal milta hai aur traders short positions liye ja sakte hain.

تبصرہ

Расширенный режим Обычный режим