Ascending channel use in forex trading?

### Forex Trading Mein Ascending Channel Ka Istemaal

Forex trading mein ascending channel aik popular technical analysis tool hai jo ke traders ko bullish market trends ko identify karne aur trading opportunities ko exploit karne mein madad karta hai. Ascending channel tab banta hai jab price action aik upward sloping trend ke andar move kar raha hota hai, jisme har successive high aur low pehle se higher hota hai.

#### Ascending Channel Ki Pehchaan

1. **Parallel Trend Lines**: Ascending channel do parallel trend lines se mil kar banta hai.

- **Upper Trend Line**: Yeh line successive higher highs ko connect karti hai.

- **Lower Trend Line**: Yeh line successive higher lows ko connect karti hai.

2. **Price Action**: Price action in do lines ke darmiyan oscillate karta hai. Jab price lower trend line ko touch karta hai, to yeh support level hota hai, aur jab upper trend line ko touch karta hai, to yeh resistance level hota hai.

#### Ascending Channel Ka Istemaal

1. **Identifying Entry Points**: Ascending channel ko use karke traders potential buy signals ko identify kar sakte hain.

- **Buy at Support**: Jab price lower trend line (support level) ke qareeb ho aur wahan se rebound karne lage, to yeh buy signal hota hai.

- **Stop Loss Placement**: Stop loss lower trend line ke niche place karna chahiye taake risk ko minimize kiya ja sake.

2. **Setting Profit Targets**: Ascending channel resistance level ko target karte hue profit targets set karne mein madadgar hota hai.

- **Sell at Resistance**: Jab price upper trend line (resistance level) ke qareeb ho, to yeh sell signal hota hai.

3. **Trend Continuation and Reversal**: Ascending channel se trend continuation aur reversal patterns ko identify karne mein bhi madad milti hai.

- **Breakout Above Resistance**: Agar price upper trend line ko break kar jaye, to yeh strong bullish signal hota hai aur trend continuation indicate karta hai.

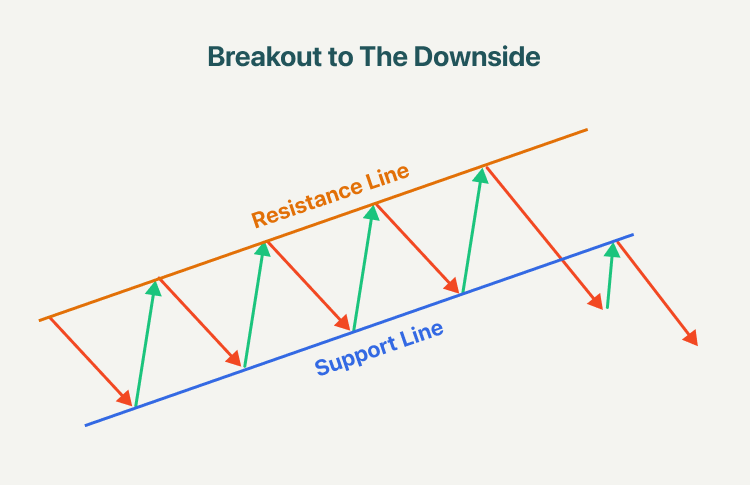

- **Break Below Support**: Agar price lower trend line ko break kar jaye, to yeh bearish reversal signal hota hai aur trend change indicate karta hai.

#### Ascending Channel Ki Limitations

1. **False Breakouts**: Kabhi-kabhi price temporary breakouts dikhata hai jo ke false signals ho sakte hain. Isliye confirmation indicators, jaise ke volume aur other technical indicators ko use karna zaroori hai.

2. **Market Conditions**: Ascending channels trending markets mein zyada effective hote hain. Choppy aur sideways markets mein inka istemaal mushkil hota hai.

#### Conclusion

Ascending channel forex trading mein aik valuable tool hai jo traders ko bullish trends ko identify karne aur profitable trading decisions lene mein madadgar hota hai. Yeh tool entry aur exit points ko effectively pinpoint kar sakta hai aur risk management ko enhance kar sakta hai. Lekin, false breakouts aur market conditions ko dhyan mein rakhte hue additional confirmation indicators ka istemaal karna chahiye taake successful trading strategies develop ki ja sakein.

### Forex Trading Mein Ascending Channel Ka Istemaal

Forex trading mein ascending channel aik popular technical analysis tool hai jo ke traders ko bullish market trends ko identify karne aur trading opportunities ko exploit karne mein madad karta hai. Ascending channel tab banta hai jab price action aik upward sloping trend ke andar move kar raha hota hai, jisme har successive high aur low pehle se higher hota hai.

#### Ascending Channel Ki Pehchaan

1. **Parallel Trend Lines**: Ascending channel do parallel trend lines se mil kar banta hai.

- **Upper Trend Line**: Yeh line successive higher highs ko connect karti hai.

- **Lower Trend Line**: Yeh line successive higher lows ko connect karti hai.

2. **Price Action**: Price action in do lines ke darmiyan oscillate karta hai. Jab price lower trend line ko touch karta hai, to yeh support level hota hai, aur jab upper trend line ko touch karta hai, to yeh resistance level hota hai.

#### Ascending Channel Ka Istemaal

1. **Identifying Entry Points**: Ascending channel ko use karke traders potential buy signals ko identify kar sakte hain.

- **Buy at Support**: Jab price lower trend line (support level) ke qareeb ho aur wahan se rebound karne lage, to yeh buy signal hota hai.

- **Stop Loss Placement**: Stop loss lower trend line ke niche place karna chahiye taake risk ko minimize kiya ja sake.

2. **Setting Profit Targets**: Ascending channel resistance level ko target karte hue profit targets set karne mein madadgar hota hai.

- **Sell at Resistance**: Jab price upper trend line (resistance level) ke qareeb ho, to yeh sell signal hota hai.

3. **Trend Continuation and Reversal**: Ascending channel se trend continuation aur reversal patterns ko identify karne mein bhi madad milti hai.

- **Breakout Above Resistance**: Agar price upper trend line ko break kar jaye, to yeh strong bullish signal hota hai aur trend continuation indicate karta hai.

- **Break Below Support**: Agar price lower trend line ko break kar jaye, to yeh bearish reversal signal hota hai aur trend change indicate karta hai.

#### Ascending Channel Ki Limitations

1. **False Breakouts**: Kabhi-kabhi price temporary breakouts dikhata hai jo ke false signals ho sakte hain. Isliye confirmation indicators, jaise ke volume aur other technical indicators ko use karna zaroori hai.

2. **Market Conditions**: Ascending channels trending markets mein zyada effective hote hain. Choppy aur sideways markets mein inka istemaal mushkil hota hai.

#### Conclusion

Ascending channel forex trading mein aik valuable tool hai jo traders ko bullish trends ko identify karne aur profitable trading decisions lene mein madadgar hota hai. Yeh tool entry aur exit points ko effectively pinpoint kar sakta hai aur risk management ko enhance kar sakta hai. Lekin, false breakouts aur market conditions ko dhyan mein rakhte hue additional confirmation indicators ka istemaal karna chahiye taake successful trading strategies develop ki ja sakein.

تبصرہ

Расширенный режим Обычный режим