Bullish Spike Pattern k Faiday

teze ke brrhte hoe'e aspae'k ko khas kendl stk petrn say zahr kea jata hay، jo fareks tredng men teze kay rjhan ke nshandhe krta hay۔ je han، market men qemton men achank aor nmaean azafh hoa hay۔ blsh spae'ek kendl stk aek tjarte nmonh hay jo market men teze kay rjhan ke nshandhe krta hay۔ yh petrn pchhlay aek say bht mlta jlta hay، nchlay sae'ay aor chhote bade ko chhorr kr۔ as say zahr hota hay kh khredaron pr khredare ka zbrdst dbaؤ hay۔

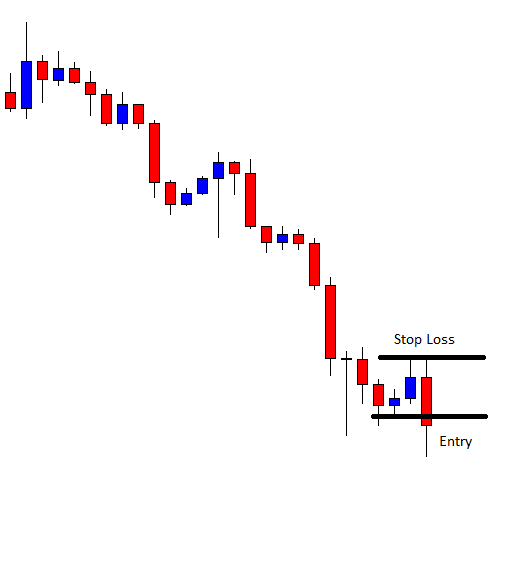

Pattern Identify:

aek lmbe loe'r shedo hote hay aor chhota jsm، jo apr aend fe hota hay، jo teze ke brrhte hoe'e aspae'ek petrn men aek lmbe hay۔ mgr phr jld bazeab ho kr hae'e fe kloz hote hay، aska mtlb hay ke qemt phle grte hay۔

Interpretation

yh kendl stk petrn yh btanay ka aek achha treqh hay kh market kb bdlnay oale hay، js say zahr hota hay kh khredar ntae'j pr qabo rkhtay hen aor qemt brrhnay oale hay۔ market men teze kay alt janay kay aasar dkhae'e day rhay hen۔

Significance

antre poae'nt: agr agle kendl teze kay sath aspae'k petrn kay sath khlte hay، to yh khrednay ka aek achha moqa hoga۔ Candlestick ke high ke uper buy order place Karte Aam Tor Par Traders۔

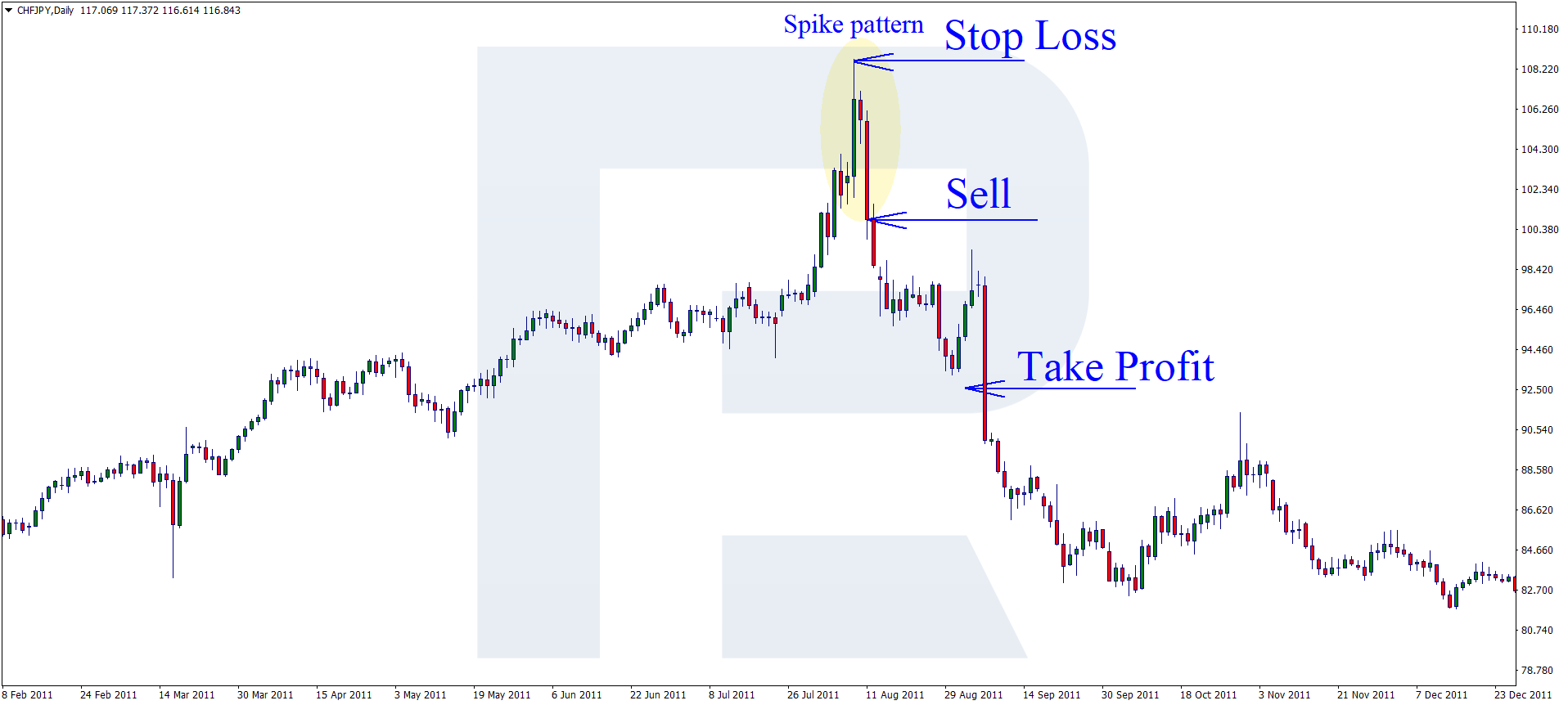

Trading Strategy

loe'r stap los shedo kay taq gheay، mnfe phlo ka antzam kren khtray kay leay۔ agr petrn sae'ay say km hay، to stap nqsan hona chaheay keonkh sae'ay aek taq men hay js ka antzam kea ja skta hay۔

Take Profit

rsk reoard resho kay mtabq mnafa ka hdf maze ke mzahmte sthon ko mtabq pr set kea gea hay۔ mnafa ka hdf haleh blnde pr qae'm kea jana chaheay، jo kh mzahmte sth bhe hay۔

teze ke brrhte hoe'e aspae'k ko khas kendl stk petrn say zahr kea jata hay، jo fareks tredng men teze kay rjhan ke nshandhe krta hay۔ je han، market men qemton men achank aor nmaean azafh hoa hay۔ blsh spae'ek kendl stk aek tjarte nmonh hay jo market men teze kay rjhan ke nshandhe krta hay۔ yh petrn pchhlay aek say bht mlta jlta hay، nchlay sae'ay aor chhote bade ko chhorr kr۔ as say zahr hota hay kh khredaron pr khredare ka zbrdst dbaؤ hay۔

Pattern Identify:

aek lmbe loe'r shedo hote hay aor chhota jsm، jo apr aend fe hota hay، jo teze ke brrhte hoe'e aspae'ek petrn men aek lmbe hay۔ mgr phr jld bazeab ho kr hae'e fe kloz hote hay، aska mtlb hay ke qemt phle grte hay۔

Interpretation

yh kendl stk petrn yh btanay ka aek achha treqh hay kh market kb bdlnay oale hay، js say zahr hota hay kh khredar ntae'j pr qabo rkhtay hen aor qemt brrhnay oale hay۔ market men teze kay alt janay kay aasar dkhae'e day rhay hen۔

Significance

antre poae'nt: agr agle kendl teze kay sath aspae'k petrn kay sath khlte hay، to yh khrednay ka aek achha moqa hoga۔ Candlestick ke high ke uper buy order place Karte Aam Tor Par Traders۔

Trading Strategy

loe'r stap los shedo kay taq gheay، mnfe phlo ka antzam kren khtray kay leay۔ agr petrn sae'ay say km hay، to stap nqsan hona chaheay keonkh sae'ay aek taq men hay js ka antzam kea ja skta hay۔

Take Profit

rsk reoard resho kay mtabq mnafa ka hdf maze ke mzahmte sthon ko mtabq pr set kea gea hay۔ mnafa ka hdf haleh blnde pr qae'm kea jana chaheay، jo kh mzahmte sth bhe hay۔

تبصرہ

Расширенный режим Обычный режим