AVERAGE TRUE RANGE (A.T.R.) FOREX

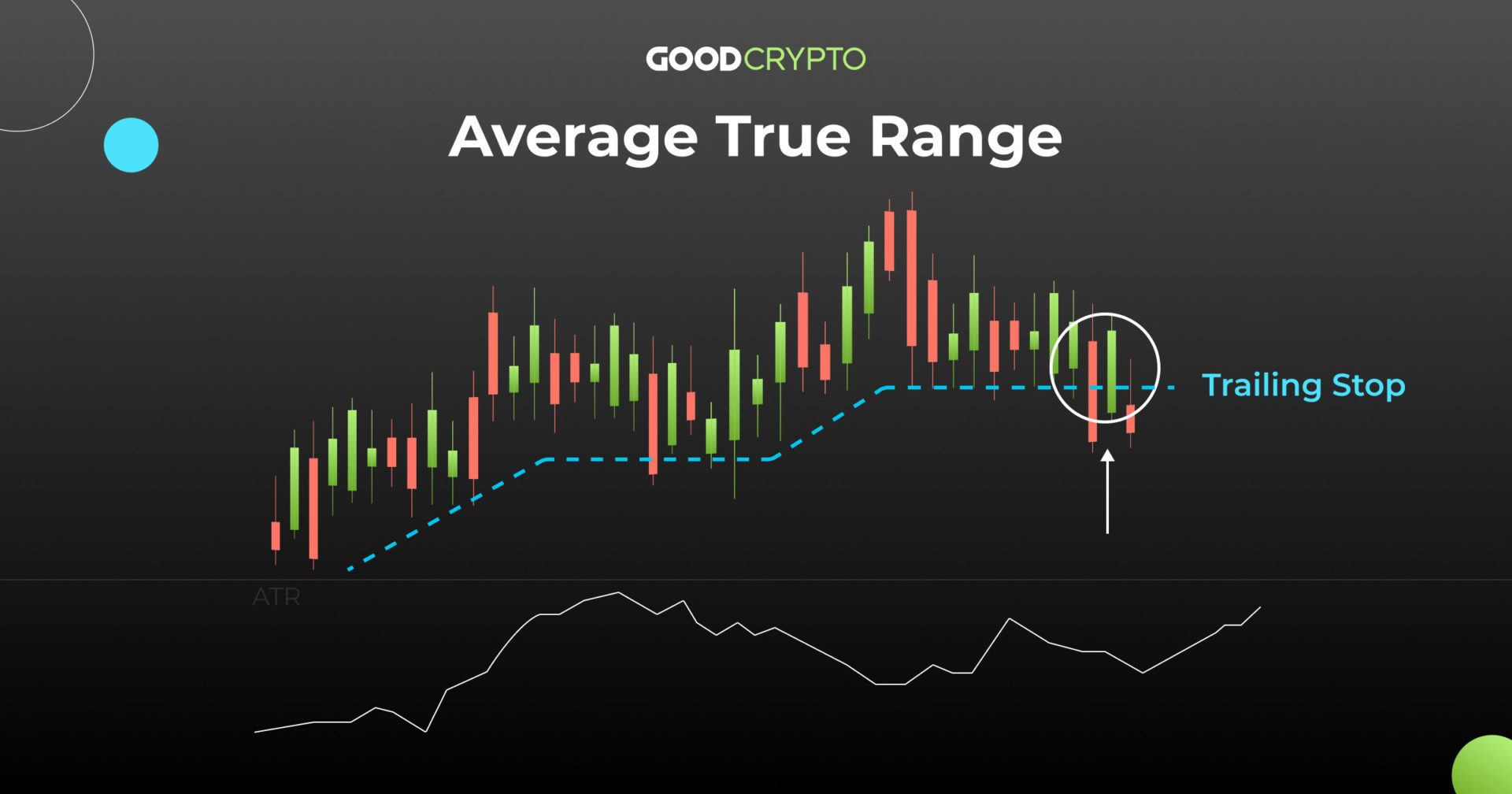

Average True Range (A.T.R.) ek technical analysis indicator hai jo Forex market mein volatility ko measure karne ke liye istemal hota hai. Yeh indicator traders ko market ki expected price movement ka andaza dene mein madad karta hai. A.T.R. price range ko analyze karta hai aur ek average range calculate karta hai, jo market ki volatility ko darust taur par reflect karta hai. Isse traders ko samajh mein aata hai ke market kitna volatile hai aur kis had tak price movement ho sakta hai.

PROFIT TARGETS

Traders A.T.R. ko istemal karke stop-loss levels aur profit targets ko set karte hain. Iske zariye, wo market ki volatility ke hisaab se apne trades ko adjust kar sakte hain aur risk ko manage kar sakte hain.A.T.R. price range ko analyze karta hai aur ek average range calculate karta hai, jo market ki volatility ko darust taur par reflect karta hai.

A.T.R. FORMULA

A.T.R. ka formula simple hai:

A.T.R. = (Current High - Current Low) + (Previous Close - Current High) + (Previous Close - Current Low)

Average True Range (A.T.R.) Forex trading mein ek ahem tool hai jo traders ko market ki volatility ko samajhne mein madad karta hai aur unhein apne trades ko manage karne mein madad deta hai. Iska istemal kar ke traders apne trading strategies ko optimize kar sakte hain. A.T.R. price range ko analyze karta hai aur ek average range calculate karta hai, jo market ki volatility ko darust taur par reflect karta hai.

Isse traders ko samajh mein aata hai ke market kitna volatile hai aur kis had tak price movement ho sakta hai.

Average True Range (A.T.R.) ek technical analysis indicator hai jo Forex market mein volatility ko measure karne ke liye istemal hota hai. Yeh indicator traders ko market ki expected price movement ka andaza dene mein madad karta hai. A.T.R. price range ko analyze karta hai aur ek average range calculate karta hai, jo market ki volatility ko darust taur par reflect karta hai. Isse traders ko samajh mein aata hai ke market kitna volatile hai aur kis had tak price movement ho sakta hai.

PROFIT TARGETS

Traders A.T.R. ko istemal karke stop-loss levels aur profit targets ko set karte hain. Iske zariye, wo market ki volatility ke hisaab se apne trades ko adjust kar sakte hain aur risk ko manage kar sakte hain.A.T.R. price range ko analyze karta hai aur ek average range calculate karta hai, jo market ki volatility ko darust taur par reflect karta hai.

A.T.R. FORMULA

A.T.R. ka formula simple hai:

A.T.R. = (Current High - Current Low) + (Previous Close - Current High) + (Previous Close - Current Low)

Average True Range (A.T.R.) Forex trading mein ek ahem tool hai jo traders ko market ki volatility ko samajhne mein madad karta hai aur unhein apne trades ko manage karne mein madad deta hai. Iska istemal kar ke traders apne trading strategies ko optimize kar sakte hain. A.T.R. price range ko analyze karta hai aur ek average range calculate karta hai, jo market ki volatility ko darust taur par reflect karta hai.

Isse traders ko samajh mein aata hai ke market kitna volatile hai aur kis had tak price movement ho sakta hai.

تبصرہ

Расширенный режим Обычный режим