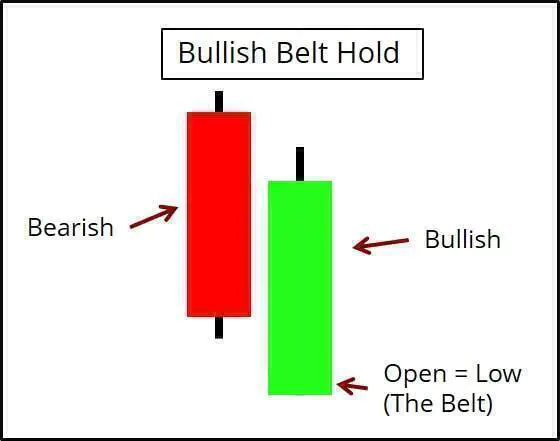

Bullish Belt Hold Pattern ek bullish candlestick pattern hai. Is pattern mein ek lambi bullish candlestick hoti hai jo market mein uptrend ki shuruwat ko darsata hai. Is pattern ke baare mein kuch ahem maloomat neeche di gayi hain:

1.what is Bullish Belt Hold Pattern?

Bullish Belt Hold Pattern ek single candlestick pattern hai jo uptrend ki shuruwat ko darsata hai. Is pattern mein ek lambi bullish candlestick hoti hai jo kisi bhi bearish trend ke baad aati hai.

2.Bullish Belt Hold Pattern ki pechan

Bullish Belt Hold Pattern ko pehchane ke liye ek lambi bullish candlestick dekhna hota hai. Is candlestick mein opening price se upper wick nahi hoti hai aur closing price se lower wick nahi hoti hai. Is tarah ki candlestick bullish trend ki shuruwat ko darsata hai.

3. Bullish Belt Hold Pattern ko confirm karna

Haan, Bullish Belt Hold Pattern ko confirm karna zaruri hai. Is pattern ko confirm karne ke liye ek doosri bullish candlestick ki zarurat hoti hai. Agar doosri bullish candlestick bhi is pattern ke baad aati hai to yeh pattern confirm ho jata hai.

4. Bullish Belt Hold Pattern ko buy karna

Haan, Bullish Belt Hold Pattern ke baad buy karna chahiye. Is pattern ke baad market mein uptrend ki shuruwat hoti hai, isliye yeh ek buy signal ke roop mein consider kiya jata hai.

5. Bullish Belt Hold Pattern ke baad stop loss rakhna

Haan, Bullish Belt Hold Pattern ke baad stop loss rakhna zaruri hai. Stop loss ko rakhne se trade ko protect kiya ja sakta hai aur market mein sudden drop hone par loss ko kam kiya ja sakta hai.

Conclusion

Is tarah se, Bullish Belt Hold Pattern ek important bullish candlestick pattern hai jo market mein uptrend ki shuruwat ko darsata hai. Is pattern ko pehchana aur confirm karna zaruri hai taki sahi buy signal liya ja sake.

تبصرہ

Расширенный режим Обычный режим