Bullish and Bearish Mat Hold Candlestick Pattern.

Introduction.

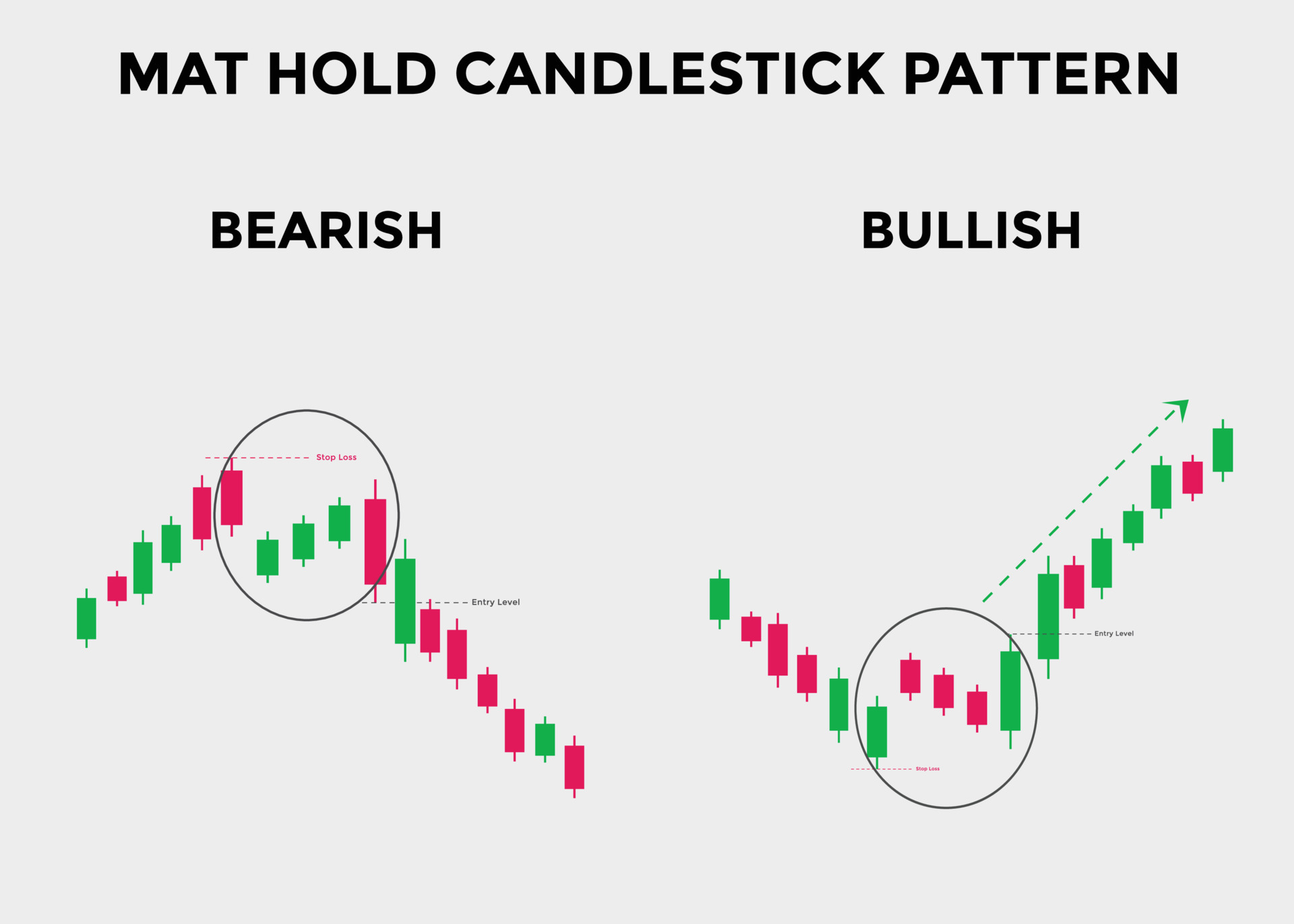

Bullish aur bearish mat hold candlestick pattern ek technical analysis tool hai jo price action ko analyze karne mein istemal hota hai. Ye pattern market ke trend ko determine karne aur future price movement ko predict karne mein madadgar hota hai.

Bullish And Barish Mat Hold Candlestick Pattern.

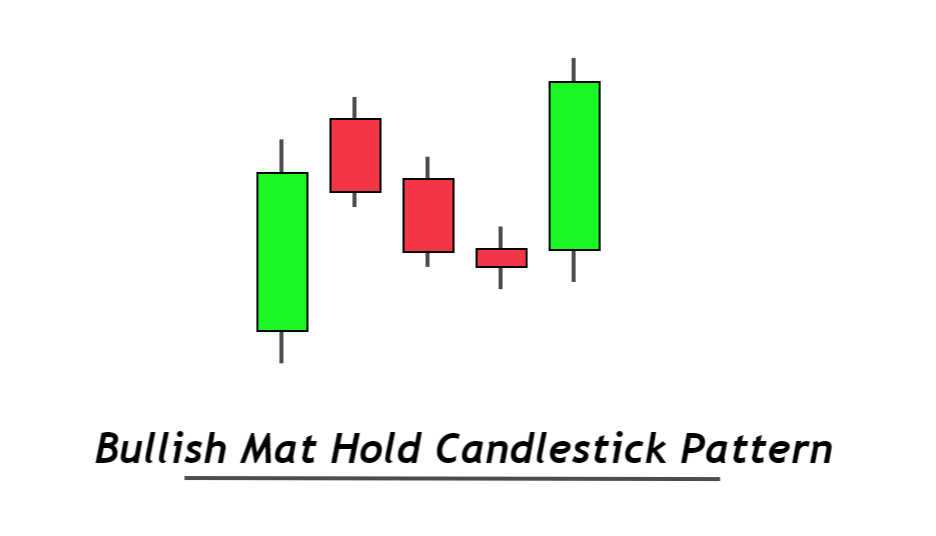

Bullish mat hold candlestick pattern ek bullish continuation pattern hai jo uptrend ke doran paida hota hai. Is pattern mein ek lambi green candlestick followed hoti hai jo uptrend ko darust karti hai. Phir isay chhote green candlesticks follow karte hain jo uptrend ke continuation ko indicate karte hain. Ye chhote candlesticks is liye important hote hain kyunki ye uptrend ke doran thori si retracement ko darust karte hain. Is pattern mein last wali lambi green candlestick pehli candlestick se zyada high par close hoti hai, jo ke uptrend ke mazboot hone ka indication hota hai.Bearish mat hold candlestick pattern ek bearish continuation pattern hai jo downtrend ke doran paida hota hai. Is pattern mein ek lambi red candlestick followed hoti hai jo downtrend ko darust karti hai. Phir isay chhote red candlesticks follow karte hain jo downtrend ke continuation ko indicate karte hain. Ye chhote candlesticks is liye important hote hain kyunki ye downtrend ke doran thori si retracement ko darust karte hain. Is pattern mein last wali lambi red candlestick pehli candlestick se zyada low par close hoti hai, jo ke downtrend ke mazboot hone ka indication hota hai.

Conditions of Bullish And Barish Mat Hold Candlestick Pattern.

Bullish mat hold candlestick pattern ki pehli shart ye hai ke market uptrend mein hona chahiye. Phir ek lambi green candlestick aani chahiye jo ke uptrend ko confirm kare. Iske baad chhote green candlesticks aani chahiye jo ke uptrend ke doran minor retracement ko darust karein. Last wali lambi green candlestick pehli candlestick se zyada high par close honi chahiye.Bearish mat hold candlestick pattern ki pehli shart ye hai ke market downtrend mein hona chahiye. Phir ek lambi red candlestick aani chahiye jo ke downtrend ko confirm kare. Iske baad chhote red candlesticks aani chahiye jo ke downtrend ke doran minor retracement ko darust karein. Last wali lambi red candlestick pehli candlestick se zyada low par close honi chahiye.

Application of Bullish And Barish Mat Hold Candlestick Pattern.

Bullish mat hold candlestick pattern ka istemal market ke trend ko identify karne aur uptrend ke continuation ko predict karne ke liye kiya jata hai. Traders is pattern ko istemal karke entry aur exit points ko identify karte hain. Agar ye pattern sahi tareeqay se confirm hota hai to traders long positions lete hain aur profit kamate hain.Bearish mat hold candlestick pattern ka istemal market ke trend ko identify karne aur downtrend ke continuation ko predict karne ke liye kiya jata hai. Traders is pattern ko istemal karke entry aur exit points ko identify karte hain. Agar ye pattern sahi tareeqay se confirm hota hai to traders short positions lete hain aur profit kamate hain.

Introduction.

Bullish aur bearish mat hold candlestick pattern ek technical analysis tool hai jo price action ko analyze karne mein istemal hota hai. Ye pattern market ke trend ko determine karne aur future price movement ko predict karne mein madadgar hota hai.

Bullish And Barish Mat Hold Candlestick Pattern.

Bullish mat hold candlestick pattern ek bullish continuation pattern hai jo uptrend ke doran paida hota hai. Is pattern mein ek lambi green candlestick followed hoti hai jo uptrend ko darust karti hai. Phir isay chhote green candlesticks follow karte hain jo uptrend ke continuation ko indicate karte hain. Ye chhote candlesticks is liye important hote hain kyunki ye uptrend ke doran thori si retracement ko darust karte hain. Is pattern mein last wali lambi green candlestick pehli candlestick se zyada high par close hoti hai, jo ke uptrend ke mazboot hone ka indication hota hai.Bearish mat hold candlestick pattern ek bearish continuation pattern hai jo downtrend ke doran paida hota hai. Is pattern mein ek lambi red candlestick followed hoti hai jo downtrend ko darust karti hai. Phir isay chhote red candlesticks follow karte hain jo downtrend ke continuation ko indicate karte hain. Ye chhote candlesticks is liye important hote hain kyunki ye downtrend ke doran thori si retracement ko darust karte hain. Is pattern mein last wali lambi red candlestick pehli candlestick se zyada low par close hoti hai, jo ke downtrend ke mazboot hone ka indication hota hai.

Conditions of Bullish And Barish Mat Hold Candlestick Pattern.

Bullish mat hold candlestick pattern ki pehli shart ye hai ke market uptrend mein hona chahiye. Phir ek lambi green candlestick aani chahiye jo ke uptrend ko confirm kare. Iske baad chhote green candlesticks aani chahiye jo ke uptrend ke doran minor retracement ko darust karein. Last wali lambi green candlestick pehli candlestick se zyada high par close honi chahiye.Bearish mat hold candlestick pattern ki pehli shart ye hai ke market downtrend mein hona chahiye. Phir ek lambi red candlestick aani chahiye jo ke downtrend ko confirm kare. Iske baad chhote red candlesticks aani chahiye jo ke downtrend ke doran minor retracement ko darust karein. Last wali lambi red candlestick pehli candlestick se zyada low par close honi chahiye.

Application of Bullish And Barish Mat Hold Candlestick Pattern.

Bullish mat hold candlestick pattern ka istemal market ke trend ko identify karne aur uptrend ke continuation ko predict karne ke liye kiya jata hai. Traders is pattern ko istemal karke entry aur exit points ko identify karte hain. Agar ye pattern sahi tareeqay se confirm hota hai to traders long positions lete hain aur profit kamate hain.Bearish mat hold candlestick pattern ka istemal market ke trend ko identify karne aur downtrend ke continuation ko predict karne ke liye kiya jata hai. Traders is pattern ko istemal karke entry aur exit points ko identify karte hain. Agar ye pattern sahi tareeqay se confirm hota hai to traders short positions lete hain aur profit kamate hain.

تبصرہ

Расширенный режим Обычный режим