Mukhtasar Tanqeed:

Bearish Flag Pattern ek technical analysis ka concept hai jo ke stock market aur trading me istemal hota hai. Ye ek price action pattern hai jo traders ko market trends ka andaza lagane me madad deta hai. Is pattern ki pehchan aur samajh stock market mein safar karne walon ke liye zaroori hai takay woh trading decisions sahi tarah se le sakein.

Bearish Flag Pattern Ki Tareef:

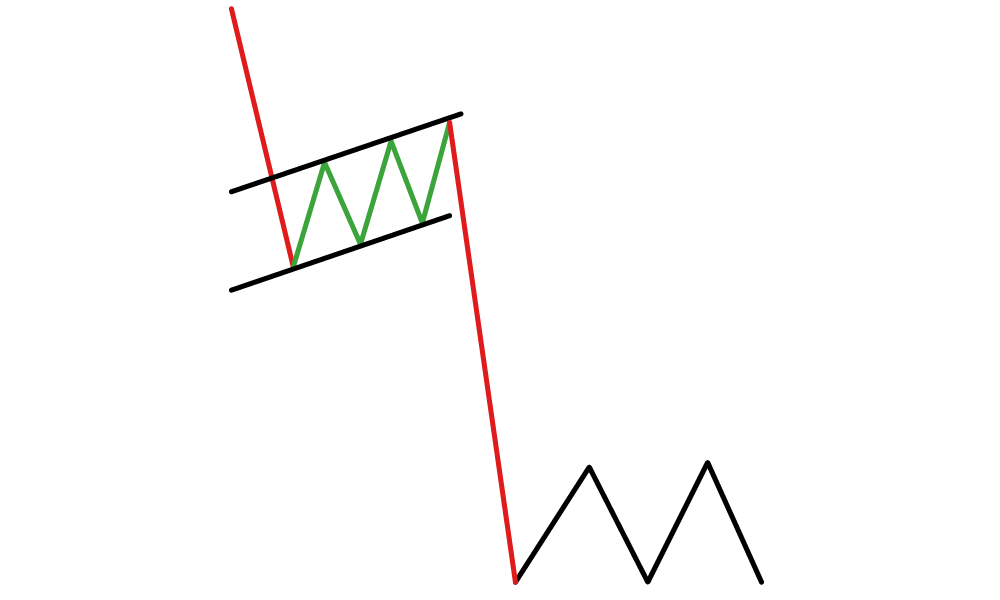

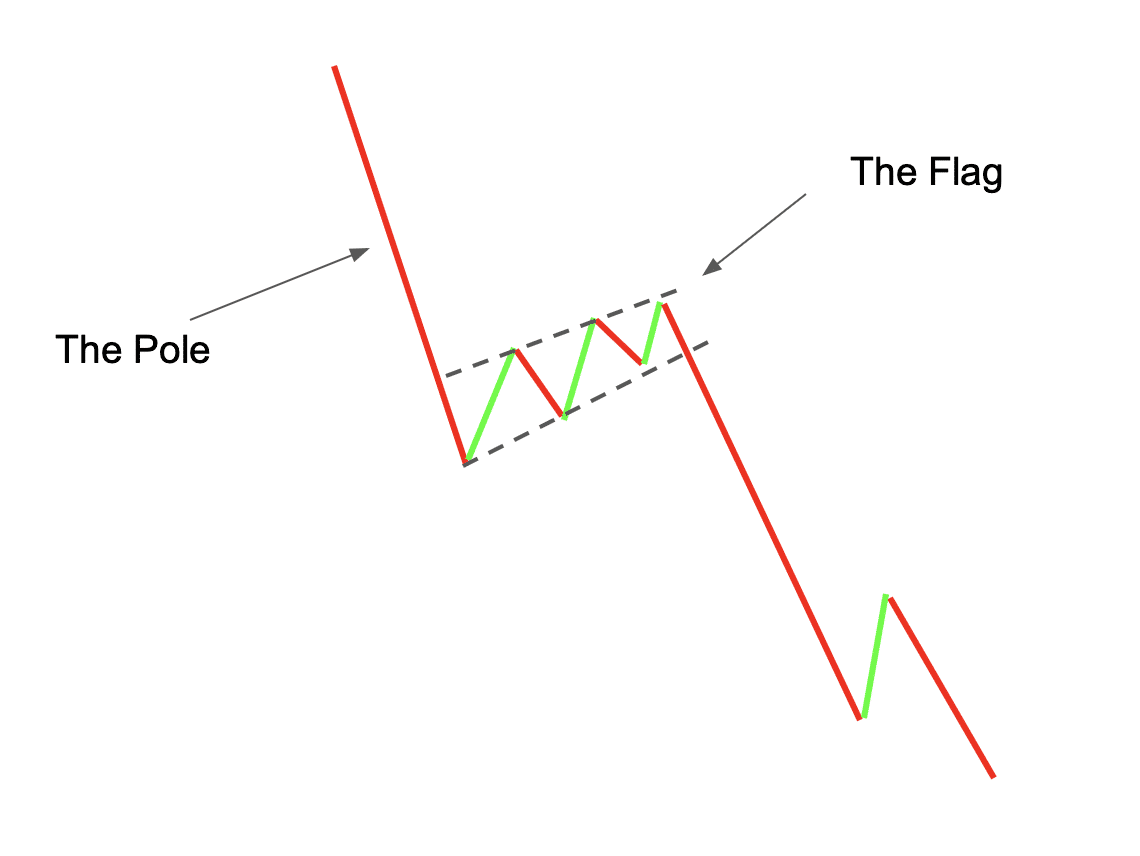

Bearish Flag Pattern ek chart pattern hai jo trading charts par dekha ja sakta hai. Ye pattern aksar downtrend ya bearish market ke doran dekha jata hai. Is pattern mein market price mein ek neeche ki taraf giraavat (downtrend) hoti hai, phir ek choti si rukawat (consolidation) ati hai, aur phir price mein mazeed giraavat hoti hai.

Mukhtalif Hissay:

Bearish Flag Pattern mein do mukhtalif hissay hote hain:

Bearish Flag Pattern Ki Mukhtasar Tafseelat:

Bearish Flag Pattern ke dekhne walon ke liye kuch zaroori tafseelat hain:

Bearish Flag Pattern Ka Istemal:

Bearish Flag Pattern ka istemal trading decisions ke liye hota hai. Ye pattern traders ko market ke trend aur possible price movements ke bare mein aik idea deta hai. Is pattern ko samajh kar traders apne trades ko manage kar sakte hain aur potential profits hasil kar sakte hain.

Nateeja:

Bearish Flag Pattern ek ahem tool hai jo traders ko market ka andaza lagane mein madad deta hai. Is pattern ko samajhna aur istemal karna trading ke liye zaroori hai. Lekin, har pattern ki tarah, is pattern ki bhi kamyabi ke liye sahi samajh aur analysis zaroori hai.

Ikhtitami Alfaz:

Bearish Flag Pattern ek mahir traders aur investors ke liye ahem hai. Is pattern ko samajh kar, trading decisions ko improve kiya ja sakta hai. Lekin, har trading strategy ki tarah, is pattern ka bhi istemal jaan boojh kar aur sahi tajziya ke saath karna chahiye.

Bearish Flag Pattern ek technical analysis ka concept hai jo ke stock market aur trading me istemal hota hai. Ye ek price action pattern hai jo traders ko market trends ka andaza lagane me madad deta hai. Is pattern ki pehchan aur samajh stock market mein safar karne walon ke liye zaroori hai takay woh trading decisions sahi tarah se le sakein.

Bearish Flag Pattern Ki Tareef:

Bearish Flag Pattern ek chart pattern hai jo trading charts par dekha ja sakta hai. Ye pattern aksar downtrend ya bearish market ke doran dekha jata hai. Is pattern mein market price mein ek neeche ki taraf giraavat (downtrend) hoti hai, phir ek choti si rukawat (consolidation) ati hai, aur phir price mein mazeed giraavat hoti hai.

Mukhtalif Hissay:

Bearish Flag Pattern mein do mukhtalif hissay hote hain:

- Flag Pole: Flag pole wo hissa hota hai jo downtrend ke doran banega. Is mein price mein tezi se giravat hoti hai.

- Flag: Flag ek choti si rectangle ya parallel channel ki shakal mein hota hai jo flag pole ke baad ati hai. Is phase mein price mein thori si stability ati hai.

Bearish Flag Pattern Ki Mukhtasar Tafseelat:

Bearish Flag Pattern ke dekhne walon ke liye kuch zaroori tafseelat hain:

- Flag Pole Ki Lambai: Flag pole ki lambai ko measure karke traders ye determine kar sakte hain ke future mein kitni giravat ka intezar hai.

- Flag Ki Lambai: Flag ki lambai bhi ahem hoti hai. Lambai ke mutabiq traders ko samajhna chahiye ke kitna waqt lag sakta hai flag pattern complete hone mein.

- Volume Analysis: Volume analysis bhi zaroori hai takay traders ko confirm ho ke pattern ke doran market mein kitni activity ho rahi hai.

Bearish Flag Pattern Ka Istemal:

Bearish Flag Pattern ka istemal trading decisions ke liye hota hai. Ye pattern traders ko market ke trend aur possible price movements ke bare mein aik idea deta hai. Is pattern ko samajh kar traders apne trades ko manage kar sakte hain aur potential profits hasil kar sakte hain.

Nateeja:

Bearish Flag Pattern ek ahem tool hai jo traders ko market ka andaza lagane mein madad deta hai. Is pattern ko samajhna aur istemal karna trading ke liye zaroori hai. Lekin, har pattern ki tarah, is pattern ki bhi kamyabi ke liye sahi samajh aur analysis zaroori hai.

Ikhtitami Alfaz:

Bearish Flag Pattern ek mahir traders aur investors ke liye ahem hai. Is pattern ko samajh kar, trading decisions ko improve kiya ja sakta hai. Lekin, har trading strategy ki tarah, is pattern ka bhi istemal jaan boojh kar aur sahi tajziya ke saath karna chahiye.

تبصرہ

Расширенный режим Обычный режим