WOLF WAVE CANDLESTICK PATTERN

WOLF WAVE DEFINITION

Wolf Wave ek technical analysis pattern hai jo forex market mein istemal hota hai. Ye pattern market ke direction ko identify karne aur price movement ko predict karne mein madad karta hai.

CANDLESTICK PATTERNS

Candlestick patterns market ke price movement ko represent karte hain. Har candlestick ek specific time period ko darust karta hai aur price ke open, high, low, aur close ko darust karta hai.

WOLF WAVE CANDLESTICK PATTERN

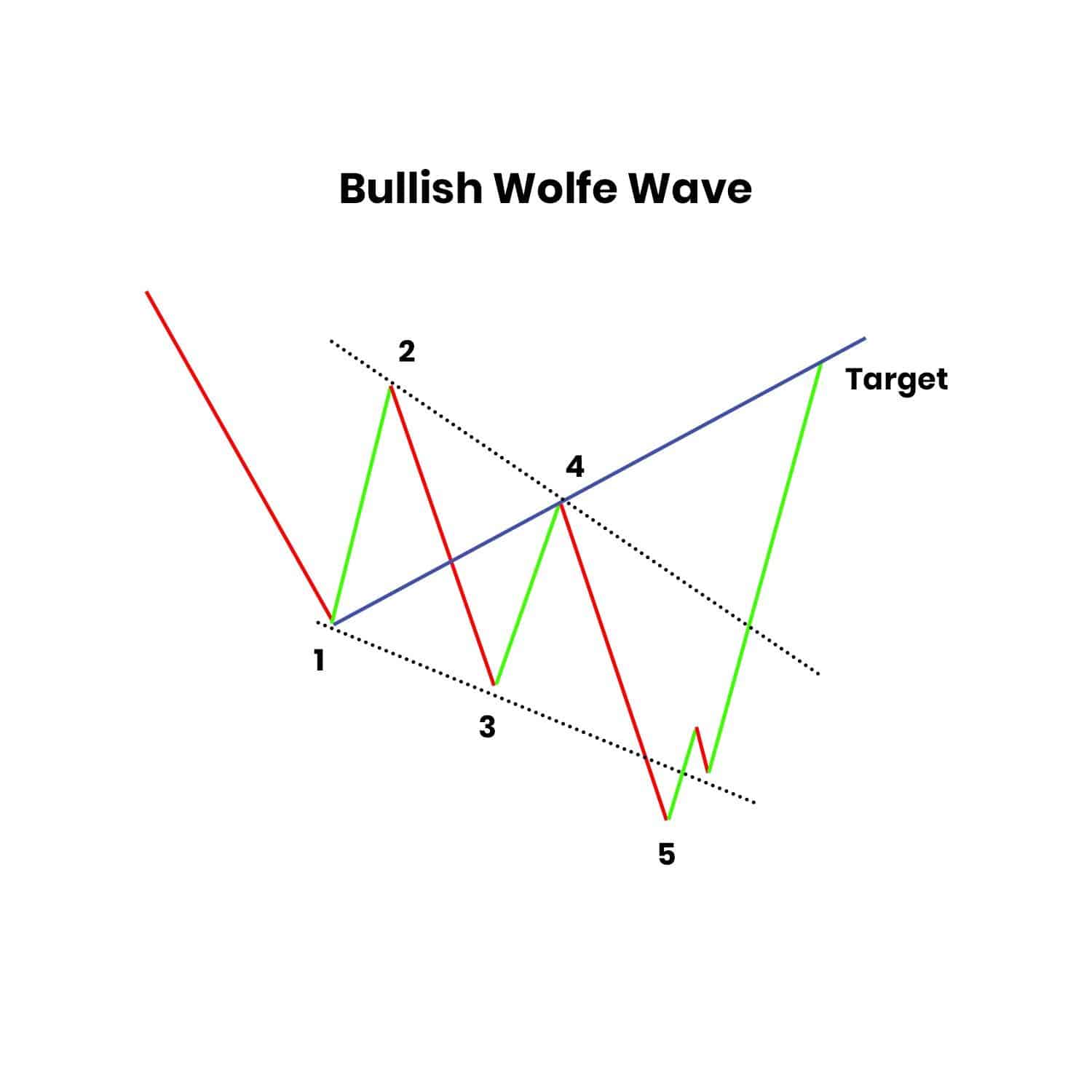

Wolf Wave pattern mein, 5 candlesticks ka combination hota hai jo market mein ek specific pattern create karta hai.

STEPS TO IDENTIFY WOLF WAVE CANDLESTICK PATTERN

POINT 1

Sab se pehle, market mein ek high point (Point 1) ko identify karna hota hai.

POINT 2

Phir, ek low point (Point 2) ko point 1 ke baad identify karna hota hai jo higher hona chahiye.

POINT 3

Point 2 ke baad, market mein ek aur high point (Point 3) ko identify karna hota hai jo point 1 se lower hona chahiye.

POINT 4

Phir, point 3 ke baad ek low point (Point 4) ko identify karna hota hai jo point 2 se higher hona chahiye.

POINT 5

Point 4 ke baad, ek aur high point (Point 5) ko identify karna hota hai jo point 3 se lower hona chahiye.

CHARACTERISTICS OF WOLF WAVE CANDLESTICK PATTERN

- Ye pattern ek symmetrical triangle shape mein hota hai.

- Is pattern mein points 1 aur 4 ke darmiyan ek trend line draw ki jaati hai.

- Points 2 aur 3 is trend line ke upper aur lower sides mein hote hain.

- Ye pattern market ke reversal ya continuation ko indicate karta hai.

WOLF WAVE CANDLESTICK PRICE MOVEMENTS

Wolf Wave Candlestick Pattern ka istemal kar ke traders market ke price movement ko analyze kar sakte hain aur trading decisions lene mein madad le sakte hain. Lekin, yeh pattern sirf ek tool hai aur iski successful trading ke liye proper risk management aur aur technical analysis ki zarurat hoti hai.

WOLF WAVE DEFINITION

Wolf Wave ek technical analysis pattern hai jo forex market mein istemal hota hai. Ye pattern market ke direction ko identify karne aur price movement ko predict karne mein madad karta hai.

CANDLESTICK PATTERNS

Candlestick patterns market ke price movement ko represent karte hain. Har candlestick ek specific time period ko darust karta hai aur price ke open, high, low, aur close ko darust karta hai.

WOLF WAVE CANDLESTICK PATTERN

Wolf Wave pattern mein, 5 candlesticks ka combination hota hai jo market mein ek specific pattern create karta hai.

STEPS TO IDENTIFY WOLF WAVE CANDLESTICK PATTERN

POINT 1

Sab se pehle, market mein ek high point (Point 1) ko identify karna hota hai.

POINT 2

Phir, ek low point (Point 2) ko point 1 ke baad identify karna hota hai jo higher hona chahiye.

POINT 3

Point 2 ke baad, market mein ek aur high point (Point 3) ko identify karna hota hai jo point 1 se lower hona chahiye.

POINT 4

Phir, point 3 ke baad ek low point (Point 4) ko identify karna hota hai jo point 2 se higher hona chahiye.

POINT 5

Point 4 ke baad, ek aur high point (Point 5) ko identify karna hota hai jo point 3 se lower hona chahiye.

CHARACTERISTICS OF WOLF WAVE CANDLESTICK PATTERN

- Ye pattern ek symmetrical triangle shape mein hota hai.

- Is pattern mein points 1 aur 4 ke darmiyan ek trend line draw ki jaati hai.

- Points 2 aur 3 is trend line ke upper aur lower sides mein hote hain.

- Ye pattern market ke reversal ya continuation ko indicate karta hai.

WOLF WAVE CANDLESTICK PRICE MOVEMENTS

Wolf Wave Candlestick Pattern ka istemal kar ke traders market ke price movement ko analyze kar sakte hain aur trading decisions lene mein madad le sakte hain. Lekin, yeh pattern sirf ek tool hai aur iski successful trading ke liye proper risk management aur aur technical analysis ki zarurat hoti hai.

تبصرہ

Расширенный режим Обычный режим