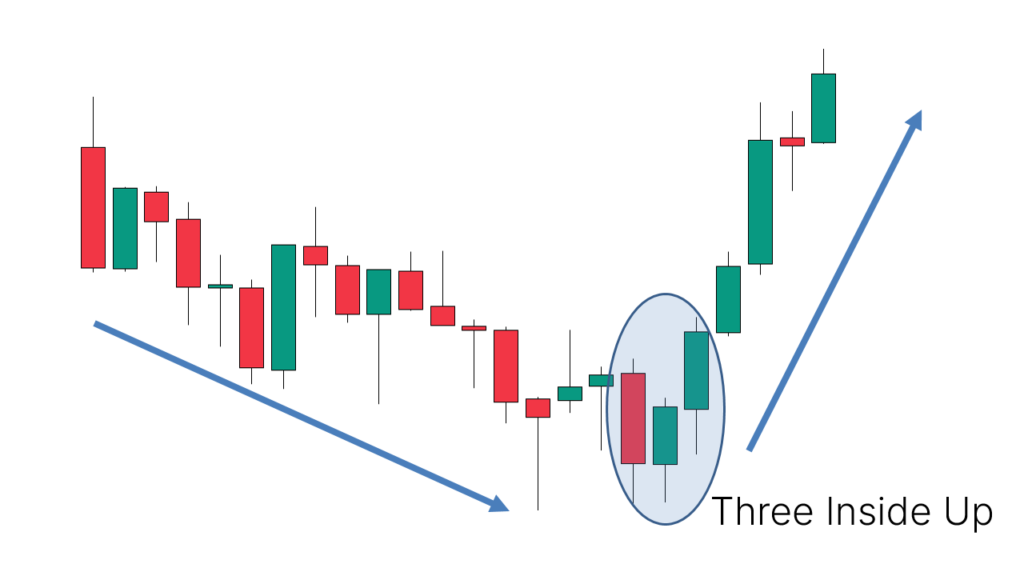

Three Inside Up Candlestick Pattern, forex trading mein ek aham chart pattern hai jo bullish trend ki aghaaz ki nishani hai. Is pattern ko samajhna traders ke liye zaroori hai taaki wo market ki movement ko predict kar sakein aur profitable trades kar sakein.

Mission

Three Inside Up Candlestick Pattern, 3 candlesticks se bana hota hai aur bullish trend ki shuruwat ki indication deta hai. Is pattern mein 3 consecutive candlesticks hote hain, jinmein pehla candlestick bearish hota hai, doosra candlestick doosre ki taraf se jata hai aur teesra candlestick pehle ki taraf se jata hai. Is tarah se, teesri candlestick pehle ki candlestick ki body ko cover kar leti hai aur is tarah se bullish trend ki shuruwat hoti hai.

Three Inside Up Candlestick Pattern Identificaton

Three Inside Up Candlestick Pattern ko identify karna trading mein bahut zaroori hai. Is pattern ki identification ke liye traders ko in 3 candlesticks ki body aur wicks ko dekhna hota hai. Pehle candlestick ki body bearish hoti hai aur doosre aur teesre candlesticks ki bodies bullish hoti hain. Teesri candlestick pehli ki body ko cover karti hai aur is tarah se bullish trend ki shuruwat hoti hai.

Three Inside Up Candlestick Pattern Ka Istemaal

Three Inside Up Candlestick Pattern ko trading mein istemaal karne ke liye traders ko is pattern ki identification karni hoti hai. Jab traders is pattern ko identify kar lete hain, to wo long position lete hain aur stop loss ko pehli candlestick ki low ke neeche rakhte hain. Is tarah se, traders ko profitable trades karne mein madad milti hai.

Conclusion

Three Inside Up Candlestick Pattern forex trading mein ek aham pattern hai jo bullish trend ki shuruwat ki indication deta hai. Is pattern ko samajhna traders ke liye zaroori hai taaki wo market ki movement ko predict kar sakein aur profitable trades kar sakein.

تبصرہ

Расширенный режим Обычный режим