SPIKE CANDLESTICK PATTERN IN FOREX

DEFINITION

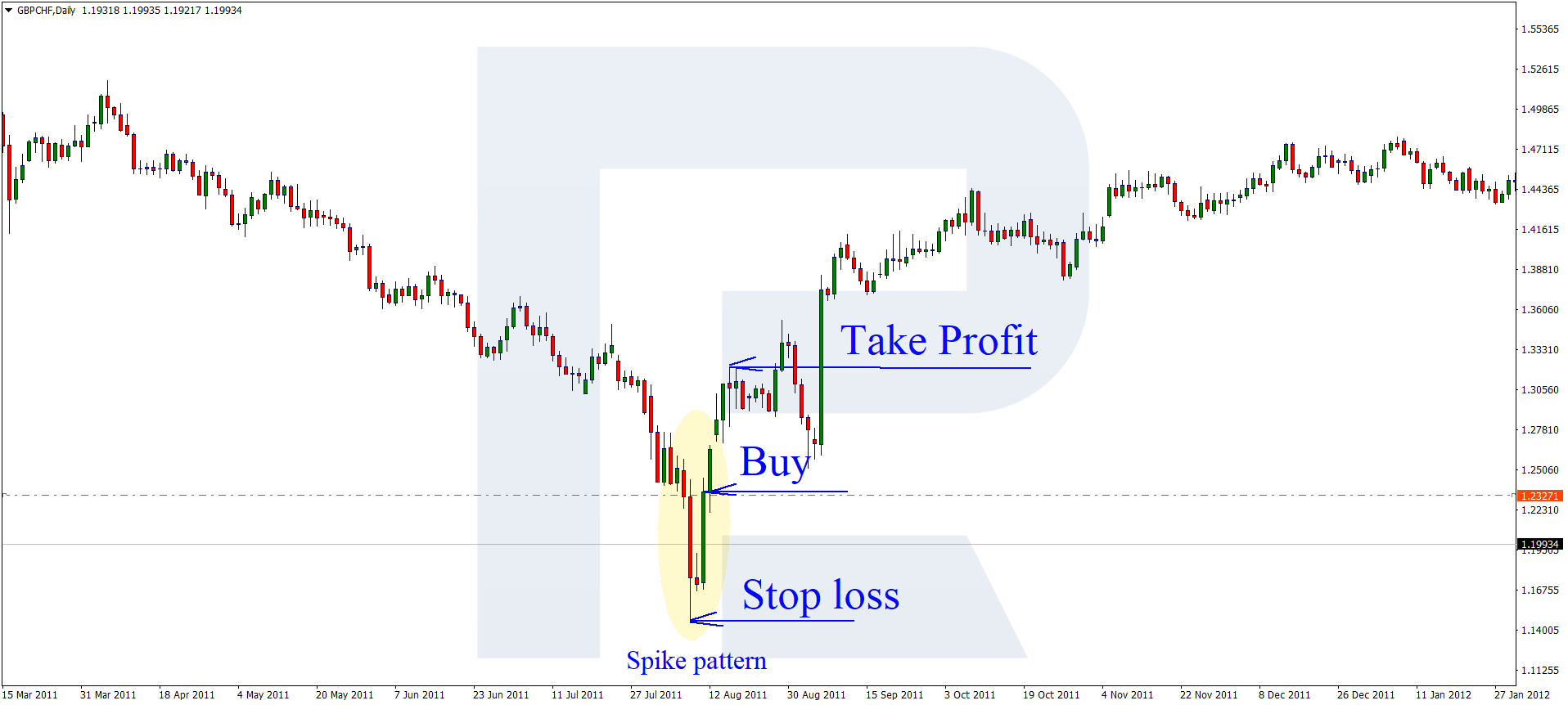

Spike candlestick pattern forex trading mein ek mukhtalif aur ahem pattern hai jo keemat ke tabdeeliyon ko darust karne mein madadgar hota hai. Spike candlestick pattern ki tajziya traders ko market ke short-term trends aur momentum ke baray mein maloomat faraham karta hai. Is pattern ko dekhte hue traders apni trading strategies banate hain. Spike candlestick pattern ek specific candlestick hai jo ek ya zyada lambi shadows ke sath hota hai, jo keemat mein tezi se izafa ya kami ko darust karta hai.

PERFORMANCE OF SPIKE CANDLESTICK PATTERN

Jab market mein sudden tezi ya kami aati hai aur price ek dam se upar ya neeche chali jati hai, to spike candlestick pattern paida hota hai. Is pattern mein candle ki body chhoti hoti hai jabke uski upper aur lower shadows lambi hoti hain, jo keemat ke sudden change ko darust karti hain. Spike candlestick pattern ki tajziya traders ko market ke short-term trends aur momentum ke baray mein maloomat faraham karta hai. Is pattern ko dekhte hue traders apni trading strategies banate hain.

TECHNICAL ANALYSIS OF SPIKE CANDLESTICK PATTERN

Traders is pattern ko technical analysis ke doran istemal karte hain taake market ke tezi ya kami ko samajh sakein aur trading ke faislay le sakein.Spike candlestick pattern ki tajziya traders ko market ke short-term trends aur momentum ke baray mein maloomat faraham karta hai. Is pattern ko dekhte hue traders apni trading strategies banate hain.

Spike candlestick pattern forex trading mein keemat ke tabdeeliyon ko samajhne aur short-term trends ko pehchanne mein ahem kirdar ada karta hai.

DEFINITION

Spike candlestick pattern forex trading mein ek mukhtalif aur ahem pattern hai jo keemat ke tabdeeliyon ko darust karne mein madadgar hota hai. Spike candlestick pattern ki tajziya traders ko market ke short-term trends aur momentum ke baray mein maloomat faraham karta hai. Is pattern ko dekhte hue traders apni trading strategies banate hain. Spike candlestick pattern ek specific candlestick hai jo ek ya zyada lambi shadows ke sath hota hai, jo keemat mein tezi se izafa ya kami ko darust karta hai.

PERFORMANCE OF SPIKE CANDLESTICK PATTERN

Jab market mein sudden tezi ya kami aati hai aur price ek dam se upar ya neeche chali jati hai, to spike candlestick pattern paida hota hai. Is pattern mein candle ki body chhoti hoti hai jabke uski upper aur lower shadows lambi hoti hain, jo keemat ke sudden change ko darust karti hain. Spike candlestick pattern ki tajziya traders ko market ke short-term trends aur momentum ke baray mein maloomat faraham karta hai. Is pattern ko dekhte hue traders apni trading strategies banate hain.

TECHNICAL ANALYSIS OF SPIKE CANDLESTICK PATTERN

Traders is pattern ko technical analysis ke doran istemal karte hain taake market ke tezi ya kami ko samajh sakein aur trading ke faislay le sakein.Spike candlestick pattern ki tajziya traders ko market ke short-term trends aur momentum ke baray mein maloomat faraham karta hai. Is pattern ko dekhte hue traders apni trading strategies banate hain.

Spike candlestick pattern forex trading mein keemat ke tabdeeliyon ko samajhne aur short-term trends ko pehchanne mein ahem kirdar ada karta hai.

تبصرہ

Расширенный режим Обычный режим