VOLUME DEPENDENT EXCHANGE IN FOREX

INTRODUCTION

Forex mein volume-dependent exchange ka tareeqa samajhne ke liye, pehle forex aur exchange ka tareeqa samajhna zaroori hai. Forex mein volume-dependent exchange ka tareeqa samajhna zaroori hai taake traders apni trading decisions ko samajh sakein aur market trends ko predict kar sakein.

FOREIGN EXCHANGE IN FOREX

Forex mein currencies ka exchange hota hai. Yeh global market hai jahan currencies trade hoti hain. Agar ek specific currency ka demand barh raha hai, jaise ke USD, to iska matlab hai ke is currency ki trading volume bhi barh rahi hai. Is situation mein, USD ka exchange rate bhi barh sakta hai.

VOLUME DEPENDENT EXCHANGE TREND REVERSAL

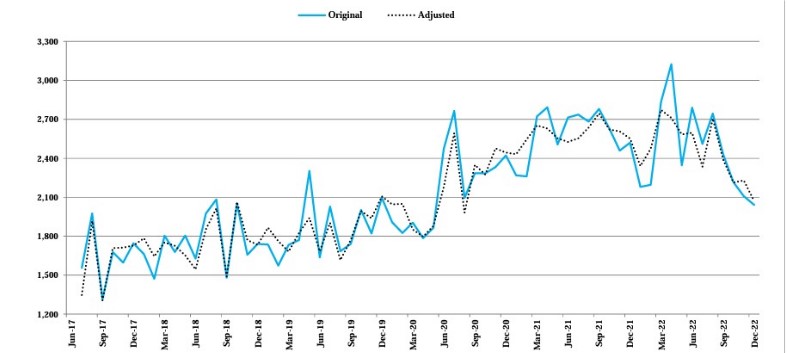

Volume-dependent exchange ka matlab hai ke currency ka exchange rate transaction ke volume par depend karta hai. Is tareeqe mein, jab trading volume barh jati hai, exchange rate mein tabdeeliyan aati hain. Agar volume zyada hai to exchange rate mein izafa hota hai aur agar volume kam hai to exchange rate mein girawat hoti hai.

VOLUME DEPENDENT EXCHANGE TECHNICALLY ASPECTS

Forex mein volume-dependent exchange ka tareeqa samajhna zaroori hai taake traders apni trading decisions ko samajh sakein aur market trends ko predict kar sakein.

exchange analysis forex mein ek tajziya hai jismein tijarat ke volumes ka taqabul kiya jata hai. Is tajziye mein, currency ke exchange rate ko trading volumes ke istemal se samjha jata hai, jis se traders ko market ke dynamics ka behtar andaza hota hai. Ye samajhne mein madad karta hai ke market mein kis tarah ke transactions ho rahe hain aur future ke trends ko predict karne mein madad deta hai.

INTRODUCTION

Forex mein volume-dependent exchange ka tareeqa samajhne ke liye, pehle forex aur exchange ka tareeqa samajhna zaroori hai. Forex mein volume-dependent exchange ka tareeqa samajhna zaroori hai taake traders apni trading decisions ko samajh sakein aur market trends ko predict kar sakein.

FOREIGN EXCHANGE IN FOREX

Forex mein currencies ka exchange hota hai. Yeh global market hai jahan currencies trade hoti hain. Agar ek specific currency ka demand barh raha hai, jaise ke USD, to iska matlab hai ke is currency ki trading volume bhi barh rahi hai. Is situation mein, USD ka exchange rate bhi barh sakta hai.

VOLUME DEPENDENT EXCHANGE TREND REVERSAL

Volume-dependent exchange ka matlab hai ke currency ka exchange rate transaction ke volume par depend karta hai. Is tareeqe mein, jab trading volume barh jati hai, exchange rate mein tabdeeliyan aati hain. Agar volume zyada hai to exchange rate mein izafa hota hai aur agar volume kam hai to exchange rate mein girawat hoti hai.

VOLUME DEPENDENT EXCHANGE TECHNICALLY ASPECTS

Forex mein volume-dependent exchange ka tareeqa samajhna zaroori hai taake traders apni trading decisions ko samajh sakein aur market trends ko predict kar sakein.

exchange analysis forex mein ek tajziya hai jismein tijarat ke volumes ka taqabul kiya jata hai. Is tajziye mein, currency ke exchange rate ko trading volumes ke istemal se samjha jata hai, jis se traders ko market ke dynamics ka behtar andaza hota hai. Ye samajhne mein madad karta hai ke market mein kis tarah ke transactions ho rahe hain aur future ke trends ko predict karne mein madad deta hai.

تبصرہ

Расширенный режим Обычный режим