Introduction.

Trading charts pe flag lagana ek important part hai jo traders ke liye market trends aur patterns ko samajhne mein madad karta hai. Flag lagana trading analysis ka ek crucial aspect hai jis se traders apne trading decisions ko improve kar sakte hain.

Selecting the Trading Chart.

Sab se pehle, aapko apne trading platform par ek suitable chart select karna hoga. Aam taur par, traders candlestick, bar, ya line charts ka istemal karte hain. Candlestick charts zyada popular hain kyunki woh price movements ko achay taur par dikhate hain.

Identifying the Trend.

Flag lagane se pehle, aapko market trend ka pata lagana zaroori hai. Trend ko samajhne ke liye, aap price action aur technical indicators ka istemal kar sakte hain jaise ki moving averages aur trend lines.

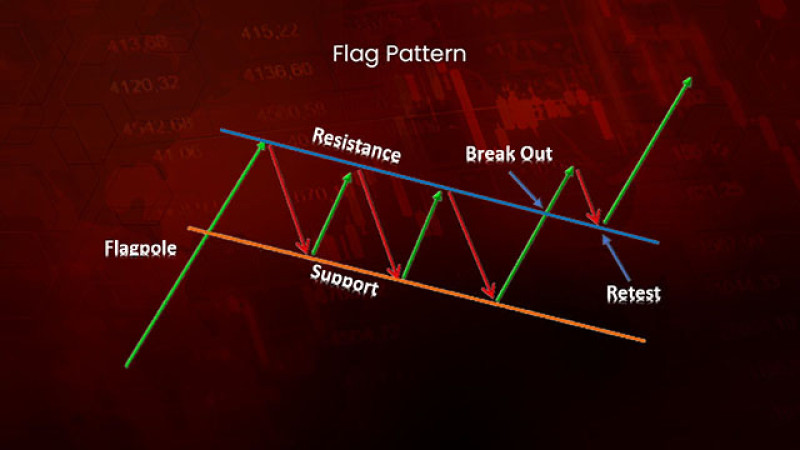

Selecting the Flag Pattern.

Jab trend identify ho jaye, toh aapko flag pattern select karna hoga. Flag patterns trading charts par common hote hain. Bullish flag uptrend ke doran aur bearish flag downtrend ke doran dikhai dete hain.

Placing the Flag.

Flag ko lagane ke liye, aapko ek high aur ek low point ko connect karke flag ka shape draw karna hoga. Bullish flag mein, ek ascending trend line ko high points se connect kiya jata hai aur phir ek parallel line ko low points se draw kiya jata hai. Bearish flag mein, ek descending trend line ko low points se connect kiya jata hai aur phir ek parallel line ko high points se draw kiya jata hai.

Pattern ko tasdeeq karne ke liye, aapko volume aur price action ko dekhna hoga. Agar flag pattern ke doran volume decrease hota hai aur price range narrow hoti hai, toh yeh pattern strong hota hai. Agar volume aur price action mein inconsistency hai, toh pattern weak ho sakta hai.

Setting Entry, Stop Loss, and Target Levels.

Pattern confirm hone ke baad, aapko entry, stop loss, aur target levels set karna hoga. Entry level ko flag breakout ke baad confirm kiya jata hai. Stop loss level ko risk management ke liye set kiya jata hai aur target level ko potential profit ke hisab se set kiya jata hai.

Trading mein risk management kaafi zaroori hai. Stop loss levels ko set karna zaroori hai taake agar trade opposite direction mein chala gaya toh nuksan kam ho sake. Risk reward ratio ko bhi dhyan mein rakhte hue trade karna zaroori hai taake potential profit potential loss se zyada ho.

Trading charts pe flag lagana ek important part hai jo traders ke liye market trends aur patterns ko samajhne mein madad karta hai. Flag lagana trading analysis ka ek crucial aspect hai jis se traders apne trading decisions ko improve kar sakte hain.

Selecting the Trading Chart.

Sab se pehle, aapko apne trading platform par ek suitable chart select karna hoga. Aam taur par, traders candlestick, bar, ya line charts ka istemal karte hain. Candlestick charts zyada popular hain kyunki woh price movements ko achay taur par dikhate hain.

Identifying the Trend.

Flag lagane se pehle, aapko market trend ka pata lagana zaroori hai. Trend ko samajhne ke liye, aap price action aur technical indicators ka istemal kar sakte hain jaise ki moving averages aur trend lines.

Selecting the Flag Pattern.

Jab trend identify ho jaye, toh aapko flag pattern select karna hoga. Flag patterns trading charts par common hote hain. Bullish flag uptrend ke doran aur bearish flag downtrend ke doran dikhai dete hain.

Placing the Flag.

Flag ko lagane ke liye, aapko ek high aur ek low point ko connect karke flag ka shape draw karna hoga. Bullish flag mein, ek ascending trend line ko high points se connect kiya jata hai aur phir ek parallel line ko low points se draw kiya jata hai. Bearish flag mein, ek descending trend line ko low points se connect kiya jata hai aur phir ek parallel line ko high points se draw kiya jata hai.

Pattern ko tasdeeq karne ke liye, aapko volume aur price action ko dekhna hoga. Agar flag pattern ke doran volume decrease hota hai aur price range narrow hoti hai, toh yeh pattern strong hota hai. Agar volume aur price action mein inconsistency hai, toh pattern weak ho sakta hai.

Setting Entry, Stop Loss, and Target Levels.

Pattern confirm hone ke baad, aapko entry, stop loss, aur target levels set karna hoga. Entry level ko flag breakout ke baad confirm kiya jata hai. Stop loss level ko risk management ke liye set kiya jata hai aur target level ko potential profit ke hisab se set kiya jata hai.

Trading mein risk management kaafi zaroori hai. Stop loss levels ko set karna zaroori hai taake agar trade opposite direction mein chala gaya toh nuksan kam ho sake. Risk reward ratio ko bhi dhyan mein rakhte hue trade karna zaroori hai taake potential profit potential loss se zyada ho.

تبصرہ

Расширенный режим Обычный режим