Descending Triangle: Forex Chart Pattern

Introduction.

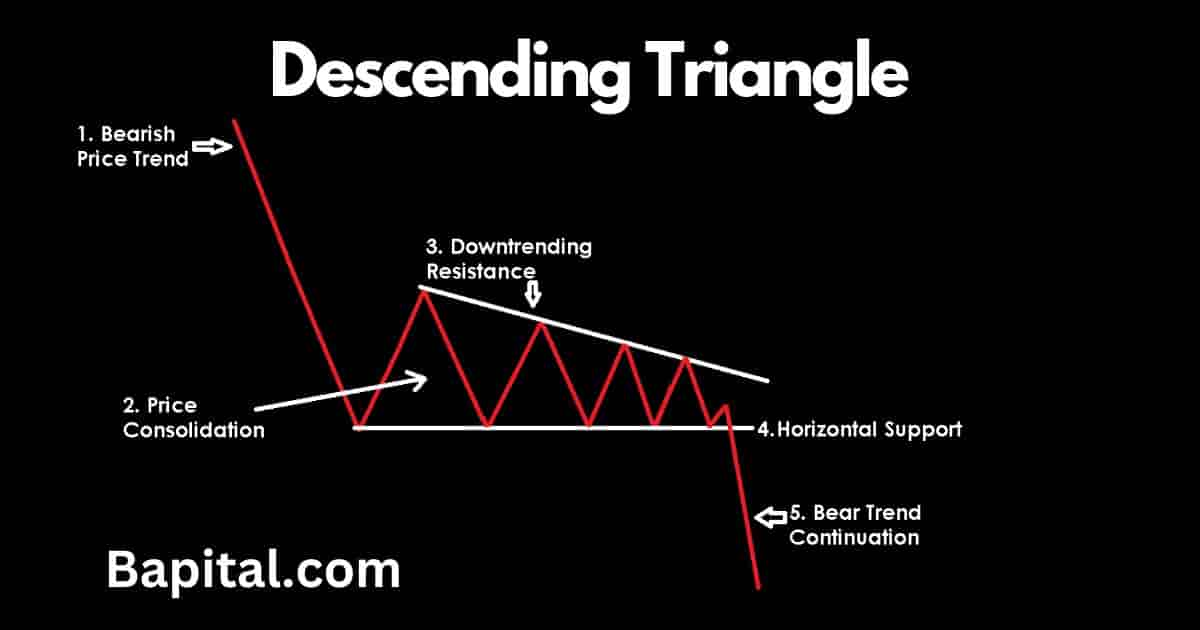

Descending triangle ek popular forex chart pattern hai jo bearish trend ko indicate karta hai. Is pattern mein price ek downward trend mein hoti hai aur support level horizontal hota hai jabke resistance level lower highs banata hai.Descending triangle chart pattern ek continuation pattern hai jo bearish trend mein hota hai. Is pattern mein price ek symmetrical triangle banata hai lekin ye pattern bearish breakout ke sath complete hota hai.Is pattern ko dekhte hue, price ek horizontal support level aur descending resistance level ke darmiyan ek triangle pattern banata hai. Resistance level lower highs banata hai jabke support level constant rehta hai.Descending triangle pattern banane ke liye, price ko kam se kam do lower highs aur ek horizontal support level par connect karna hota hai. Lower highs resistance level ko define karte hain aur support level horizontal hota hai.

Bearish Trend Ko Confirm Karna.

Descending triangle pattern bearish trend ko confirm karta hai. Jab price horizontal support level ko break kar ke neeche jaata hai, ye bearish continuation signal deta hai.

Volume Ki Ahmiyat.

Volume bhi descending triangle pattern ke liye ahmiyat rakhta hai. Agar volume decrease hota hai jab price triangle ke andar move karta hai, to ye pattern strong hota hai. Lekin agar volume breakout ke waqt increase hota hai, to ye pattern aur bhi reliable hota hai.

Breakout Point.

Descending triangle pattern ka breakout point support level ke neeche hota hai. Jab price support level ko break karta hai, to ye bearish breakout signal deta hai. Breakout ke baad, traders bearish positions enter kar sakte hain.

Stop Loss Aur Target.

Stop loss ko usually breakout ke upar rakha jata hai, jabke target ko triangle ke height se calculate kiya ja sakta hai. Lekin har trader ka apna risk tolerance aur trading strategy hota hai, is liye stop loss aur target levels ko adjust kiya ja sakta hai.

Trading Strategies.

Trading Mein Precautions.

Introduction.

Descending triangle ek popular forex chart pattern hai jo bearish trend ko indicate karta hai. Is pattern mein price ek downward trend mein hoti hai aur support level horizontal hota hai jabke resistance level lower highs banata hai.Descending triangle chart pattern ek continuation pattern hai jo bearish trend mein hota hai. Is pattern mein price ek symmetrical triangle banata hai lekin ye pattern bearish breakout ke sath complete hota hai.Is pattern ko dekhte hue, price ek horizontal support level aur descending resistance level ke darmiyan ek triangle pattern banata hai. Resistance level lower highs banata hai jabke support level constant rehta hai.Descending triangle pattern banane ke liye, price ko kam se kam do lower highs aur ek horizontal support level par connect karna hota hai. Lower highs resistance level ko define karte hain aur support level horizontal hota hai.

Bearish Trend Ko Confirm Karna.

Descending triangle pattern bearish trend ko confirm karta hai. Jab price horizontal support level ko break kar ke neeche jaata hai, ye bearish continuation signal deta hai.

Volume Ki Ahmiyat.

Volume bhi descending triangle pattern ke liye ahmiyat rakhta hai. Agar volume decrease hota hai jab price triangle ke andar move karta hai, to ye pattern strong hota hai. Lekin agar volume breakout ke waqt increase hota hai, to ye pattern aur bhi reliable hota hai.

Breakout Point.

Descending triangle pattern ka breakout point support level ke neeche hota hai. Jab price support level ko break karta hai, to ye bearish breakout signal deta hai. Breakout ke baad, traders bearish positions enter kar sakte hain.

Stop Loss Aur Target.

Stop loss ko usually breakout ke upar rakha jata hai, jabke target ko triangle ke height se calculate kiya ja sakta hai. Lekin har trader ka apna risk tolerance aur trading strategy hota hai, is liye stop loss aur target levels ko adjust kiya ja sakta hai.

Trading Strategies.

- Breakout Trading: Jab price support level ko break karta hai, traders bearish positions enter karte hain. Stop loss ko breakout ke upar rakha jata hai aur target ko triangle ke height se calculate kiya jata hai.

- False Breakout Trading: Agar price support level ko briefly break karta hai lekin phir se wapas triangle ke andar aa jata hai, to ye false breakout ho sakta hai. Traders false breakout ke baad positions enter kar sakte hain, stop loss ko high ko set karke aur target ko triangle ke opposite side par rakhte hue.

- Pullback Trading: Agar price breakout ke baad pullback karta hai aur phir se neeche jaata hai, to traders pullback ke baad positions enter kar sakte hain. Stop loss ko pullback ke high ke upar rakha jata hai aur target ko triangle ke opposite side par set kiya jata hai.

Trading Mein Precautions.

- False Breakouts: Kabhi kabhi price breakout ke baad phir se wapas triangle ke andar aa jata hai, is liye traders ko false breakouts se bachne ke liye cautious rehna chahiye.

- Volume Confirmation: Breakout ke samay volume ki confirmation ko dhyan mein rakhein. Agar volume breakout ke waqt increase hota hai, to ye pattern aur bhi reliable hota hai.

تبصرہ

Расширенный режим Обычный режим