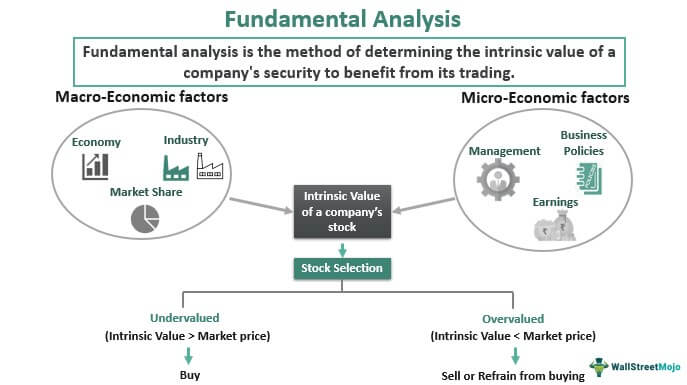

Fundamental analysis ek tarika hai jis se companies ki financial performance aur future growth potential ka pata lagaya ja sakta hai. Is analysis ko karne ke liye kuch important steps hote hain:

1. Company ki financial statements ka analysis:

Isme company ke financial statements like balance sheet, income statement aur cash flow statement ko analyze kiya jata hai. In statements se company ke assets, liabilities, revenue, expenses aur cash flow ka pata chalta hai.

2. Industry analysis:

Isme company ke industry ke competitors, market share, growth rate aur future prospects ka analysis kiya jata hai. Is se pata chalta hai ki company apne industry mein kitni strong hai aur future mein kya potential hai.

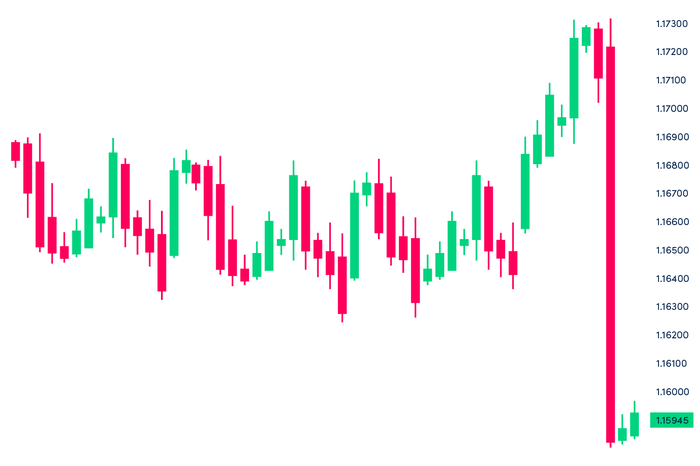

3. Macroeconomic analysis:

Isme economy ke overall indicators jaise ki GDP growth rate, inflation rate aur interest rate ka analysis kiya jata hai. Is se pata chalta hai ki economy kis direction mein ja rahi hai aur company ko kya impact padega.ye economy market k mutabiq chlta rehta h.

4. Management analysis:

Isme company ke management aur leadership ke quality, experience aur decisions ka analysis kiya jata hai. Is se pata chalta hai ki company ke management kaun hai aur unka past performance kya hai.is me ap k pass ks b item ki quality achi hni chaye aur experience b hna chaye.

Conclusion

In sabhi factors ko analyze karke fundamental analysts ek company ke future performance aur growth potential ka estimate karte hain. Ye estimates investors ke liye helpful hote hain, jinhe company ke stock ko buy, hold ya sell karne ka decision lena hota hai.is ki growth sath sath up hti rehti h.

تبصرہ

Расширенный режим Обычный режим