Introduction:

Forex trading mein margin level ek ahem concept hai jo traders ke liye zaroori hai samajhna. Margin level aapke account ki safety aur trading performance ko measure karta hai.

Margin Level Kya Hai:

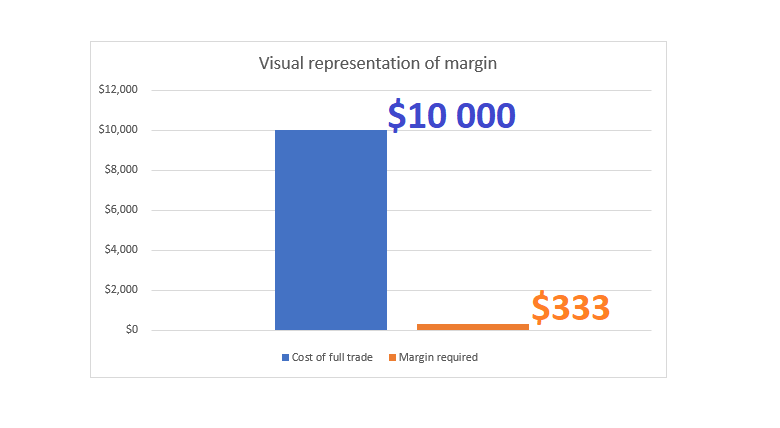

Margin level, aapke trading account mein available margin ko aapke open trades ke required margin se compare karta hai. Ye aapko ye batata hai ke aapke account mein kitna paisa bacha hua hai trades ke liye.

Margin Level Ka Formula:

Margin level ko calculate karne ka formula ye hai:

Margin Level = (Equity / Used Margin) * 100

Margin Level Ki Importance:

Margin level, aapko ye batata hai ke aapke account mein kitni safety hai. Agar margin level kam hai, toh aapko risk hai ke aapke trades ko close kiya ja sake ya margin call receive kiya ja sake.

Margin Call Aur Stop Out:

Agar aapka margin level bohot kam hojata hai, to broker aapko margin call kar sakta hai, ya phir aapke trades ko automatically close kar dega, jo ke stop out kehlata hai.

Margin Level Ki Monitoring:

Traders ko regular basis pe apne margin level ko monitor karna chahiye taake wo apne account ko safe rakhein. Agar margin level kam hojata hai, toh trader ko apne positions ko adjust karna chahiye.

Margin Level Aur Risk Management:

Margin level ko samajh kar, traders apni risk management strategy ko improve kar sakte hain. Kam margin level wale situations mein, traders ko aggressive trading se bachna chahiye.

Conclusion:

Margin level forex trading mein ek critical factor hai jo traders ke liye important hai. Isko samajh kar, traders apne account ki safety ko maintain kar sakte hain aur apni trading performance ko optimize kar sakte hain.

Forex trading mein margin level ek ahem concept hai jo traders ke liye zaroori hai samajhna. Margin level aapke account ki safety aur trading performance ko measure karta hai.

Margin Level Kya Hai:

Margin level, aapke trading account mein available margin ko aapke open trades ke required margin se compare karta hai. Ye aapko ye batata hai ke aapke account mein kitna paisa bacha hua hai trades ke liye.

Margin Level Ka Formula:

Margin level ko calculate karne ka formula ye hai:

Margin Level = (Equity / Used Margin) * 100

Margin Level Ki Importance:

Margin level, aapko ye batata hai ke aapke account mein kitni safety hai. Agar margin level kam hai, toh aapko risk hai ke aapke trades ko close kiya ja sake ya margin call receive kiya ja sake.

Margin Call Aur Stop Out:

Agar aapka margin level bohot kam hojata hai, to broker aapko margin call kar sakta hai, ya phir aapke trades ko automatically close kar dega, jo ke stop out kehlata hai.

Margin Level Ki Monitoring:

Traders ko regular basis pe apne margin level ko monitor karna chahiye taake wo apne account ko safe rakhein. Agar margin level kam hojata hai, toh trader ko apne positions ko adjust karna chahiye.

Margin Level Aur Risk Management:

Margin level ko samajh kar, traders apni risk management strategy ko improve kar sakte hain. Kam margin level wale situations mein, traders ko aggressive trading se bachna chahiye.

Conclusion:

Margin level forex trading mein ek critical factor hai jo traders ke liye important hai. Isko samajh kar, traders apne account ki safety ko maintain kar sakte hain aur apni trading performance ko optimize kar sakte hain.

تبصرہ

Расширенный режим Обычный режим