Breakout trading strategy.

Breakout Trading Strategies mein trader ek particular price level ya zone ko dekhta hai, jahan se asset ka price breakout karke new high ya low bana sakta hai. Agar price us level ya zone se bahar nikal jaata hai, toh trader uss direction mein trade karta hai, hoping for continued momentum. Ye strategy volatile markets mein kaam karti hai jab price suddenly move karta hai. Lekin, ye risky bhi ho sakti hai, kyun ki false breakouts bhi hote hain.

Breakout Trading Strategies ki tafseel yeh hoti hai:

1.Identifying Breakout Levels.

Trader ko pehle hi identify karna hota hai ki kis price level ya zone ko dekhna hai. Ye level ya zone typically previous highs ya lows, support ya resistance levels, ya phir chart patterns jaise triangles, rectangles, ya flags mein hota hai.

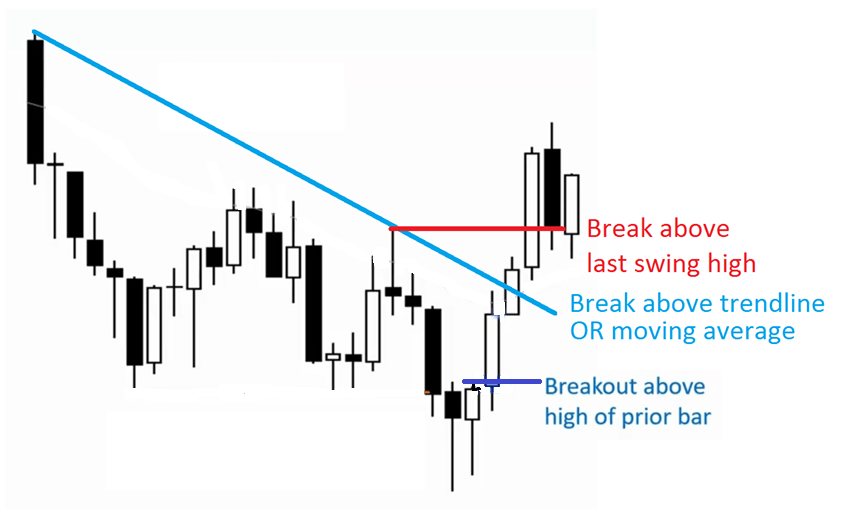

2. Confirming Breakouts.

Jab price breakout level ya zone se bahar nikalta hai, trader ko confirm karna hota hai ki breakout genuine hai aur false signal nahi hai. Iske liye, volume analysis, price action confirmation, aur technical indicators jaise ki moving averages, RSI, aur MACD ka istemal kiya jata hai.

3. Entry Points.

Breakout ke confirm hone ke baad, trader entry point decide karta hai. Kuch traders immediate entry karte hain jab breakout hota hai, jabki doosre wait karte hain ki price pehle breakout level se thoda door chali jaye aur phir entry karte hain.

4. Stop Loss aur Take Profit Levels.

Har trade mein stop loss aur take profit levels ko set karna zaroori hota hai. Stop loss level breakout ke opposite side par set kiya jata hai, taaki losses minimize kiya ja sake. Take profit level ko price ke movement ke hisaab se decide kiya jata hai, jisse trader apne profits lock kar sake.

5. Risk Management.

Breakout trading mein risk management bahut zaroori hai. Trader ko apne risk tolerance ke hisaab se position size ko adjust karna chahiye, aur overleveraging se bachna chahiye.

6. Monitoring and Exiting Trades.

Trades ko monitor karna aur exit points ko adjust karna bhi important hai. Agar breakout confirm nahi hota ya phir trend reverse hota hai, toh trader ko jaldi se apni position ko close karna chahiye.

Breakout Trading Strategies mein trader ek particular price level ya zone ko dekhta hai, jahan se asset ka price breakout karke new high ya low bana sakta hai. Agar price us level ya zone se bahar nikal jaata hai, toh trader uss direction mein trade karta hai, hoping for continued momentum. Ye strategy volatile markets mein kaam karti hai jab price suddenly move karta hai. Lekin, ye risky bhi ho sakti hai, kyun ki false breakouts bhi hote hain.

Breakout Trading Strategies ki tafseel yeh hoti hai:

1.Identifying Breakout Levels.

Trader ko pehle hi identify karna hota hai ki kis price level ya zone ko dekhna hai. Ye level ya zone typically previous highs ya lows, support ya resistance levels, ya phir chart patterns jaise triangles, rectangles, ya flags mein hota hai.

2. Confirming Breakouts.

Jab price breakout level ya zone se bahar nikalta hai, trader ko confirm karna hota hai ki breakout genuine hai aur false signal nahi hai. Iske liye, volume analysis, price action confirmation, aur technical indicators jaise ki moving averages, RSI, aur MACD ka istemal kiya jata hai.

3. Entry Points.

Breakout ke confirm hone ke baad, trader entry point decide karta hai. Kuch traders immediate entry karte hain jab breakout hota hai, jabki doosre wait karte hain ki price pehle breakout level se thoda door chali jaye aur phir entry karte hain.

4. Stop Loss aur Take Profit Levels.

Har trade mein stop loss aur take profit levels ko set karna zaroori hota hai. Stop loss level breakout ke opposite side par set kiya jata hai, taaki losses minimize kiya ja sake. Take profit level ko price ke movement ke hisaab se decide kiya jata hai, jisse trader apne profits lock kar sake.

5. Risk Management.

Breakout trading mein risk management bahut zaroori hai. Trader ko apne risk tolerance ke hisaab se position size ko adjust karna chahiye, aur overleveraging se bachna chahiye.

6. Monitoring and Exiting Trades.

Trades ko monitor karna aur exit points ko adjust karna bhi important hai. Agar breakout confirm nahi hota ya phir trend reverse hota hai, toh trader ko jaldi se apni position ko close karna chahiye.

Summary.

Breakout Trading Strategies ka istemal karte waqt, traders ko market ke volatility aur false breakouts ka dhyan rakhna chahiye.

تبصرہ

Расширенный режим Обычный режим