Bearish Evening Star ek important bearish reversal candlestick pattern hai jo traders ke liye market trends ko identify karne mein madad karta hai. Ye pattern typically uptrend ke baad dekha jata hai aur indicate karta hai ke market ka momentum change hone wala hai aur downward trend shuru hone wala hai. Bearish Evening Star pattern, Japanese candlestick analysis ka hissa hai aur traders ke liye valuable signal provide karta hai.

Bearish Evening Star ka Concept:

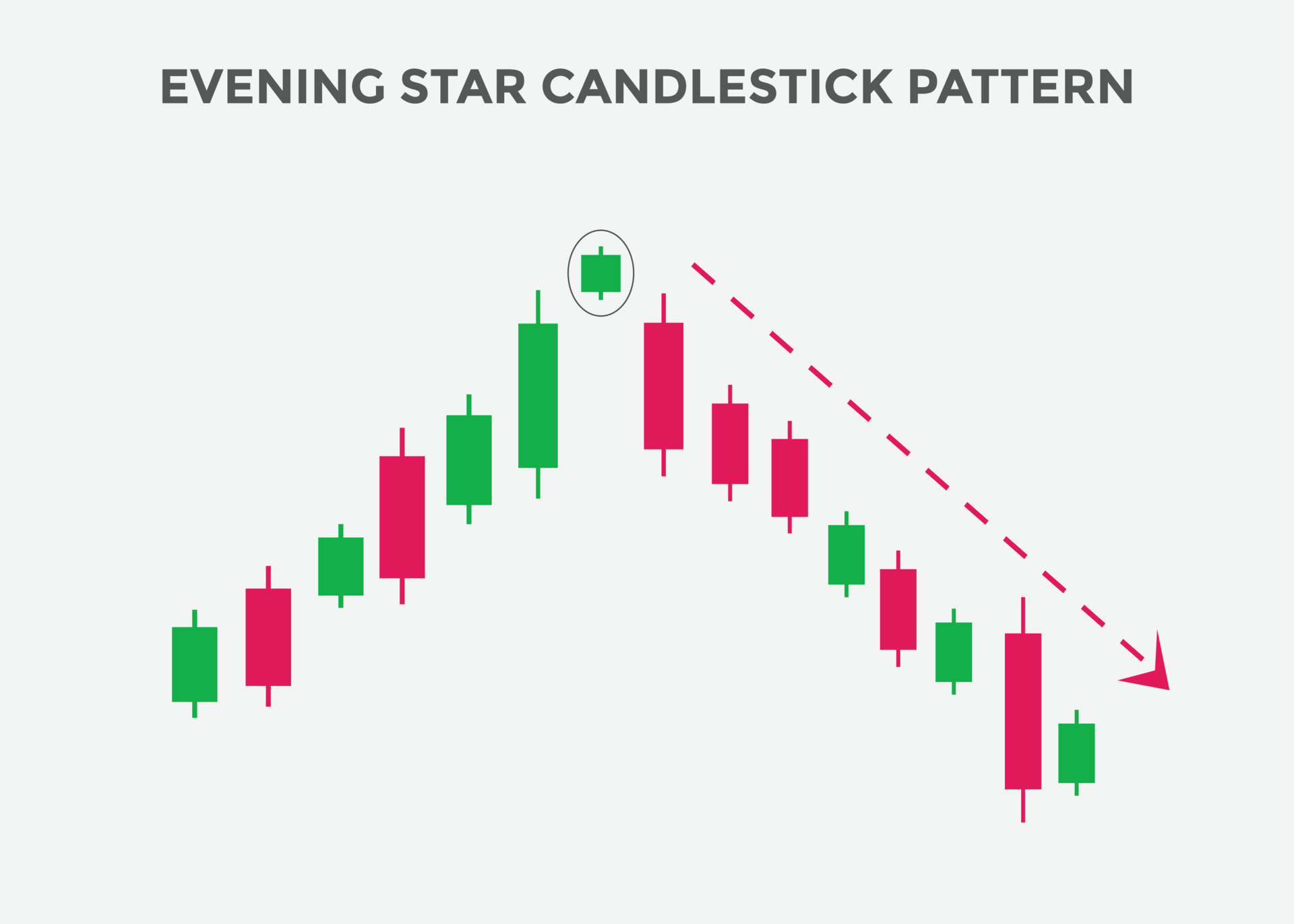

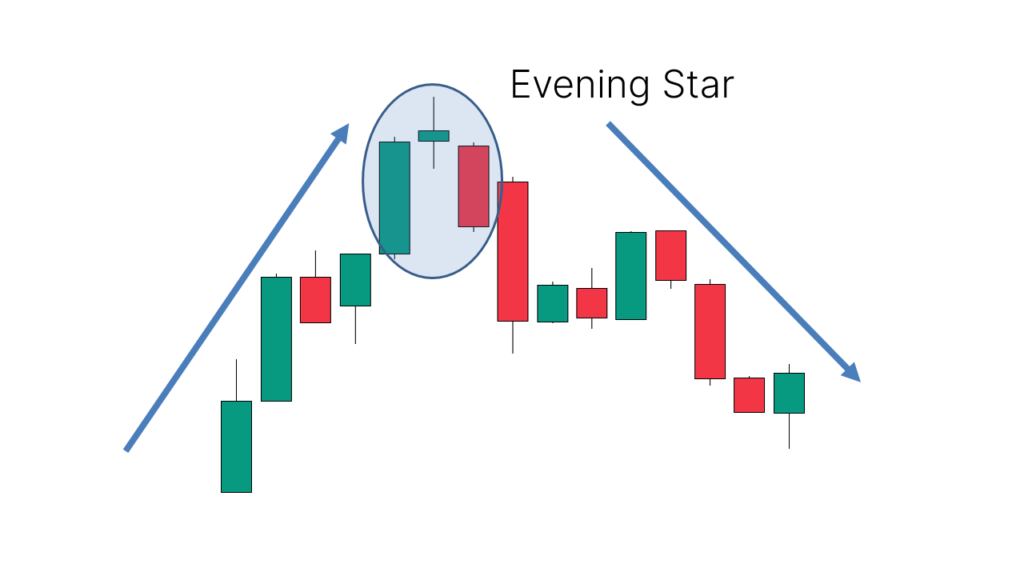

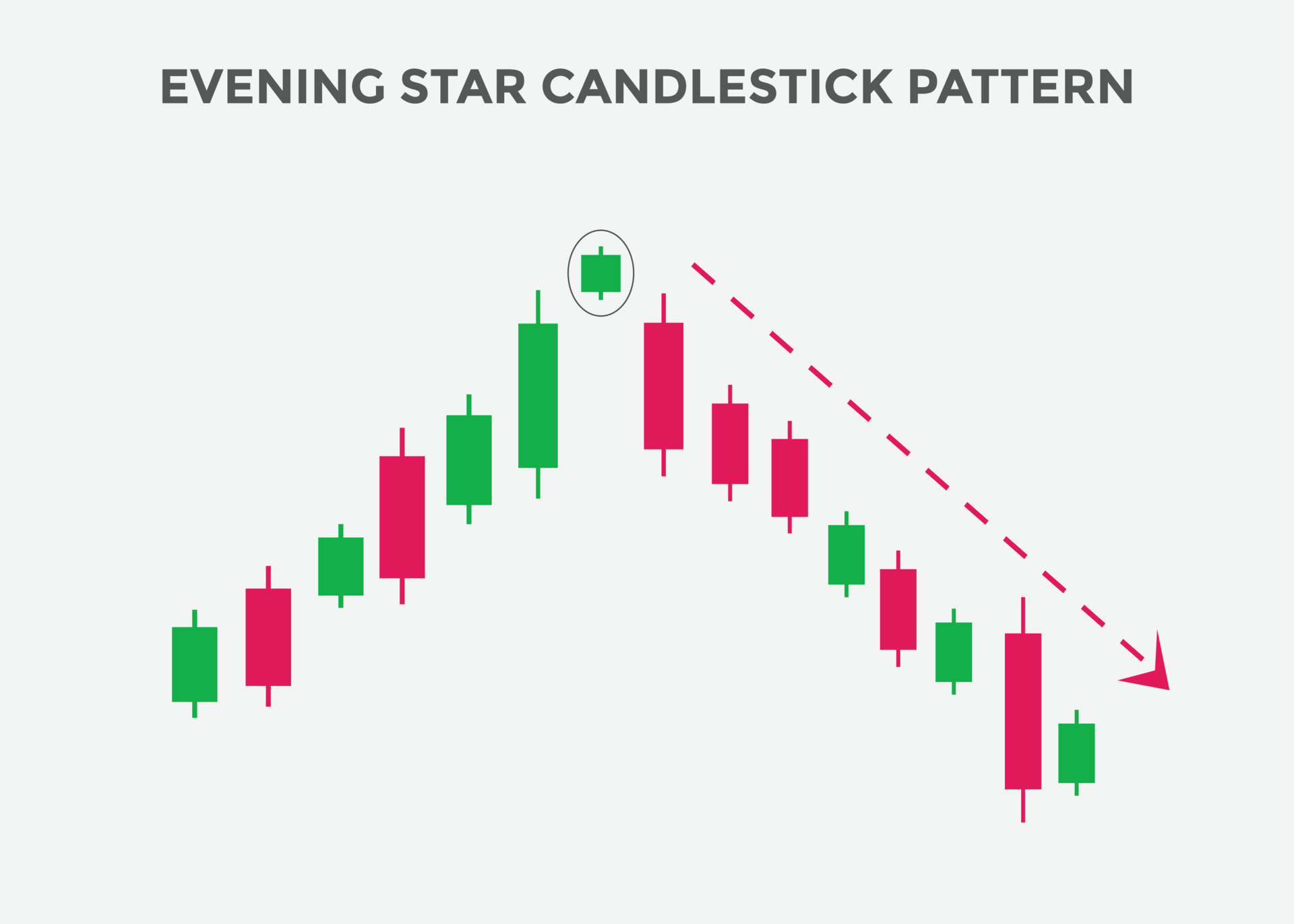

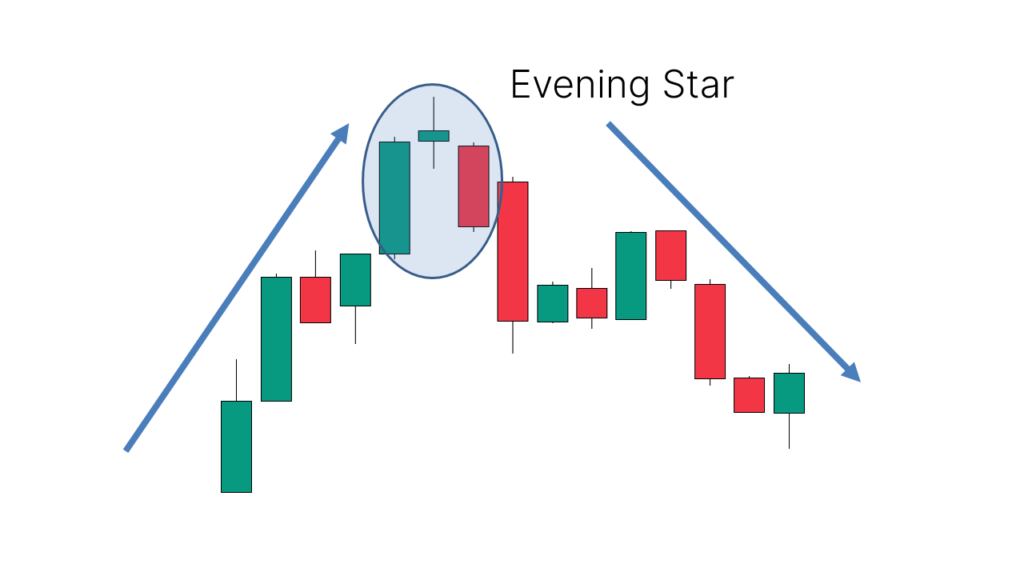

Bearish Evening Star pattern ek bearish reversal pattern hai jo typically uptrend ke baad dekha jata hai. Is pattern mein, pehle ek large bullish candlestick hota hai jo upward trend ko represent karta hai. Fir, ek small-bodied candlestick hota hai jiska close pehle ke bullish candle ke upper range ke andar hota hai. Finally, ek large bearish candlestick hota hai jo pehle ke bullish candlestick ke close ke neeche open hota hai, indicating ke market sentiment change ho raha hai aur bearish reversal ka chance hai.

Evening Star ke Characteristics

Bearish Evening Star pattern ko identify karne ke liye kuch key characteristics hote hain:

Bearish Evening Star ka Identification:

Bearish Evening Star pattern ko identify karne ke liye, traders ko kuch steps follow karne chahiye:

Trading Strategies

Kuch common trading strategies Bearish Evening Star pattern ke liye niche diye gaye hain:

Limitations

Kuch limitations Bearish Evening Star pattern ke bhi hain jo traders ko dhyan mein rakhna chahiye:

Bearish Evening Star pattern ek valuable bearish reversal pattern hai jo traders ko market trends ke reversal ko identify karne mein madad karta hai. Lekin, iska istemal karne se pehle thorough analysis aur practice zaroori hai.

Bearish Evening Star ka Concept:

Bearish Evening Star pattern ek bearish reversal pattern hai jo typically uptrend ke baad dekha jata hai. Is pattern mein, pehle ek large bullish candlestick hota hai jo upward trend ko represent karta hai. Fir, ek small-bodied candlestick hota hai jiska close pehle ke bullish candle ke upper range ke andar hota hai. Finally, ek large bearish candlestick hota hai jo pehle ke bullish candlestick ke close ke neeche open hota hai, indicating ke market sentiment change ho raha hai aur bearish reversal ka chance hai.

Evening Star ke Characteristics

Bearish Evening Star pattern ko identify karne ke liye kuch key characteristics hote hain:

- Large Bullish Candlestick: Pattern ka shuru hota hai ek large bullish candlestick ke saath jo upward trend ko represent karta hai. Is candle ka size significant hota hai indicating strong buying pressure.

- Small-bodied Candlestick: Iske baad, ek small-bodied candlestick aata hai jiska close pehle ke bullish candlestick ke upper range ke andar hota hai. Ye candlestick doji ya spinning top ki tarah hota hai indicating market indecision.

- Large Bearish Candlestick: Pattern ka completion ek large bearish candlestick ke saath hota hai jo pehle ke bullish candlestick ke close ke neeche open hota hai. Is candle ka size bada hota hai indicating strong selling pressure aur bearish reversal ka confirmation.

Bearish Evening Star ka Identification:

Bearish Evening Star pattern ko identify karne ke liye, traders ko kuch steps follow karne chahiye:

- Chart Analysis: Pehle, traders ko candlestick charts ko analyze karna chahiye aur uptrend ki presence ko identify karna chahiye.

- Candlestick Sequence: Traders ko ek large bullish candlestick, ek small-bodied candlestick, aur fir ek large bearish candlestick ki sequence ko dekhna chahiye.

- Confirmation: Pattern ko confirm karne ke liye, traders ko large bearish candlestick ke close ke neeche ek support level break hone ka wait karna chahiye.

Trading Strategies

Kuch common trading strategies Bearish Evening Star pattern ke liye niche diye gaye hain:

- Short Position Entry: Jab Bearish Evening Star pattern confirm ho jata hai, traders short position lete hain expecting ke market ka bearish reversal hoga. Entry point typically large bearish candlestick ke neeche set kiya jata hai.

- Stop Loss Placement: Traders ko apne short positions ke liye stop loss set karna zaroori hai taake wo apne risk ko manage kar sakein. Stop loss typically large bearish candlestick ke high ke just upar set kiya jata hai.

- Profit Target: Profit target ko identify karne ke liye, traders support levels ya previous swing lows ka istemal karte hain. Yeh levels potential price targets provide karte hain.

- Risk-Reward Ratio: Har trade mein risk-reward ratio ka dhyan rakhna zaroori hai. Traders ko apne stop loss aur profit targets ke beech ka ratio set karna chahiye jo unhein comfortable ho.

- Confirmation with Other Indicators: Bearish Evening Star pattern ko confirm karne ke liye, traders aur bhi technical indicators ka istemal kar sakte hain jaise ki volume analysis ya trend indicators.

Limitations

Kuch limitations Bearish Evening Star pattern ke bhi hain jo traders ko dhyan mein rakhna chahiye:

- False Signals: Jaise ki har technical analysis tool, Bearish Evening Star pattern bhi false signals generate kar sakta hai especially choppy market conditions mein.

- Subjectivity: Pattern identification subjective hoti hai aur traders ke interpretation par depend karta hai, isliye confirmatory indicators ka istemal zaroori hai.

- Market Conditions: Is pattern ki effectiveness market conditions par bhi depend karta hai. Choppy ya range-bound markets mein, iska istemal karna challenging ho sakta hai.

- Risk Management: Har trading strategy ki tarah, Bearish Evening Star pattern ka istemal karte waqt bhi risk management ka dhyan rakhna zaroori hai. Apne stop loss aur profit targets ko set karna important hai.

Bearish Evening Star pattern ek valuable bearish reversal pattern hai jo traders ko market trends ke reversal ko identify karne mein madad karta hai. Lekin, iska istemal karne se pehle thorough analysis aur practice zaroori hai.

تبصرہ

Расширенный режим Обычный режим