BEARISH RAILWAY CANDLESTICK PATTERN IN FOREX

COMPREHENSION

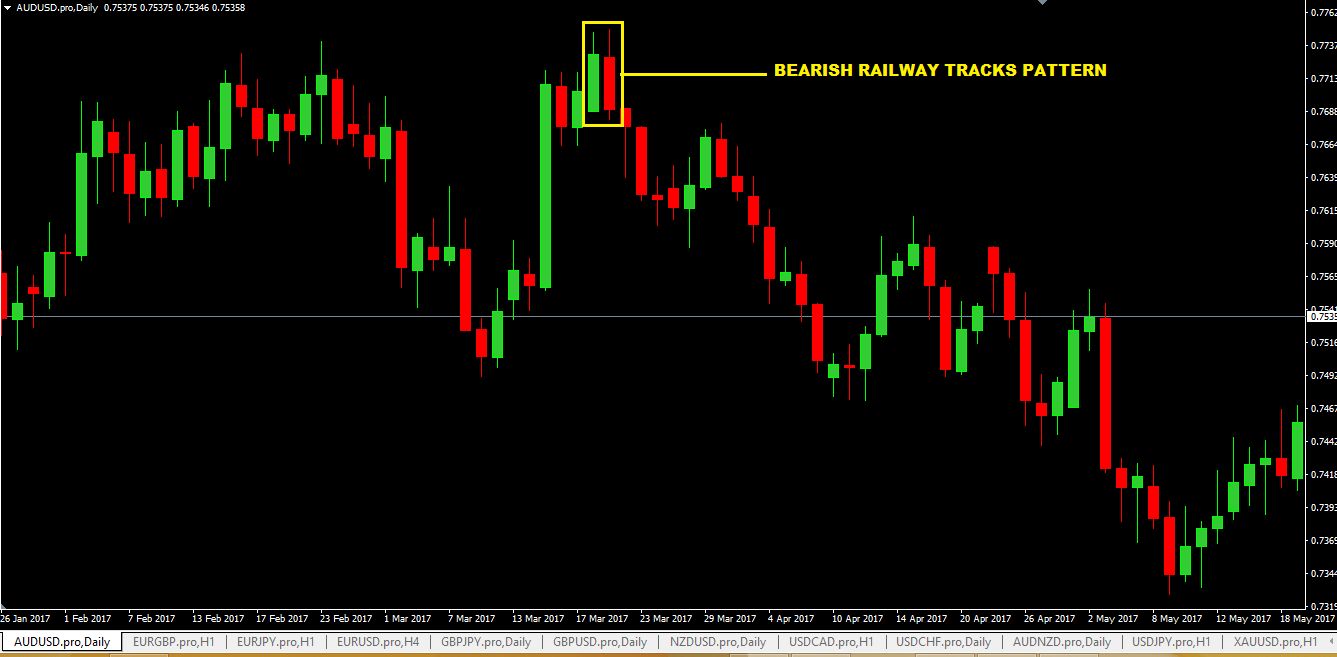

Bearish Railway Candlestick ek bearish reversal pattern hai jo traders ko ek potential selling signal deta hai. Is pattern mein do consecutive candlesticks shamil hote hain. Bearish Railway Candlestick pattern mein pehla candlestick ek uptrend ko represent karta hai aur doosra candlestick ise follow karta hai. Doosra candlestick ka opening price pehle candlestick ke opening price ke near ya us se upar hota hai.

TRADING STRATEGIES

Bearish Railway Candlestick pattern ko confirm karne ke liye, traders ko doosri indicators aur chart patterns ka bhi istemal karna chahiye. Jaise ke volume analysis aur other bearish reversal patterns.

Jab doosra candlestick pehle candlestick ke lower half mein close hota hai, to yeh ek strong selling signal provide karta hai. Is situation mein, market sentiment negative ho jata hai aur traders ko downtrend ki shuruat hone ki ummeed hoti hai.Doosra candle stick ka opening price pehle candlestick ke opening price ke near ya us se upar hota hai.

LIMITATIONS AND TECHNICAL FACTS

Traders ko Bearish Railway Candlestick pattern ke identification ke baad stop loss aur target levels set karna chahiye taake unka trade properly managed ho sake. Bearish Railway Candlestick pattern ko bhi limitations hote hain aur yeh har waqt accurate nahi hota. Isliye, dusre technical analysis tools ka bhi istemal zaroori hota hai trading decisions ke liye.

Doosra candle stick ka opening price pehle candlestick ke opening price ke near ya us se upar hota hai. Bearish Railway Candlestick pattern, jab sahi tareeqe se identified kiya jata hai, ek powerful bearish reversal signal provide karta hai jo traders ko profitable selling opportunities ke liye guide karta hai.

COMPREHENSION

Bearish Railway Candlestick ek bearish reversal pattern hai jo traders ko ek potential selling signal deta hai. Is pattern mein do consecutive candlesticks shamil hote hain. Bearish Railway Candlestick pattern mein pehla candlestick ek uptrend ko represent karta hai aur doosra candlestick ise follow karta hai. Doosra candlestick ka opening price pehle candlestick ke opening price ke near ya us se upar hota hai.

TRADING STRATEGIES

Bearish Railway Candlestick pattern ko confirm karne ke liye, traders ko doosri indicators aur chart patterns ka bhi istemal karna chahiye. Jaise ke volume analysis aur other bearish reversal patterns.

Jab doosra candlestick pehle candlestick ke lower half mein close hota hai, to yeh ek strong selling signal provide karta hai. Is situation mein, market sentiment negative ho jata hai aur traders ko downtrend ki shuruat hone ki ummeed hoti hai.Doosra candle stick ka opening price pehle candlestick ke opening price ke near ya us se upar hota hai.

LIMITATIONS AND TECHNICAL FACTS

Traders ko Bearish Railway Candlestick pattern ke identification ke baad stop loss aur target levels set karna chahiye taake unka trade properly managed ho sake. Bearish Railway Candlestick pattern ko bhi limitations hote hain aur yeh har waqt accurate nahi hota. Isliye, dusre technical analysis tools ka bhi istemal zaroori hota hai trading decisions ke liye.

Doosra candle stick ka opening price pehle candlestick ke opening price ke near ya us se upar hota hai. Bearish Railway Candlestick pattern, jab sahi tareeqe se identified kiya jata hai, ek powerful bearish reversal signal provide karta hai jo traders ko profitable selling opportunities ke liye guide karta hai.

تبصرہ

Расширенный режим Обычный режим