WHAT IS AN INSIDE BAR?

bar kay andr aek mshhor alta / tslsl kay shalay ke nshoonma hay js ko apna taarf kranay kay leay srf do mom btean drkar hote hen۔ yh msal lmhh bh lmhh market kay ahsas pr aek fore dramh hay js men 'brre chalon' say phlay dakhl honay ke amed hay jo tlash men ho skte hay۔ bar kay andr sabqh roshne aonche aor km market ke gher yqene sorthal ko zahr krnay kay leay aopr/nechay qemton men hchkchaht zahr krta hay۔

HOW TO IDENTIFY AN INSIDE BAR ON FOREX CHARTS

fareks daeagram pr bar dezae'n kay andr frq krtay hoe'ay sath ke peshrft ka astamal kea jata hay:

lagt ke srgrme/khsose asharay ka astamal krtay hoe'ay aek sabqh petrn ko phchanen۔

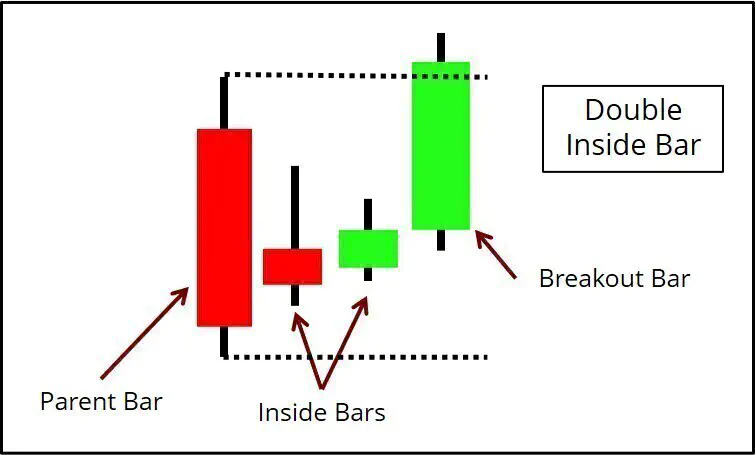

bar dezae'n kay andr oaqa hay js kay zreaay bar kay andr pchhle mom bte aonche aor neche say mkml tor pr dob jate hay۔

TRADING WITH THE INSIDE BAR CANDLESTICK PATTERN: TOP TIPS AND STRATEGIES

kchh brokrz asay aek tslsl kay dezae'n kay tor pr sochtay hen tahm dosray treqay say brek aaؤt bhe qabl fhm hay۔ aek mqrrh mdt kay leay lagt kay aopr (ea nechay) janay kay bad، lagt ke trqe men takher (bar kay andr say khtab) petrn kay alt janay say phlay jate hay۔ as trh، bar kay andr aarze tbadlay (ea soe'ng aekschenj) kay leay kaؤntr petrn men 10 bar say km kay leay aekschenj rkhnay ka mkml aradh rkhta hay۔

kse bhe sort men، slakhon kay andr tbadlh krnay ka aek aor treqh hay aor yh sedha as bat say qae'm hota hay js say shalh dezae'n bay nqab nhen hota hay۔ as mqam pr jb delrz bar kay andr dezae'n ka dhanchh dekhtay hen، as ke ozaht hote hay keonkh karobare shabay qdr ko trteb denay men hchkchatay hen۔ yh kchh ojohat ke bna' pr ho skta hay:

bht mnasb rport jld de ja rhe hay، ya

market nay abhe astratasferk chhlang lgae'e hay aor tajr kafe hd tk lagt ke peshksh kay baray men gngna rhay hen۔

koe'e bhe chez js ke ozaht، aqlet kchh bht mlte jlte hay: fae'day men azafay kay aakhre mqsd kay sath mmknh gher mtoqa slahet ke tlash۔ as moqa pr jb ohan kea ho rha hay js men delr lagt ke trteb denay say grezan hen، asay gher mtoqa tor pr mstqbl men tosea kay leay aek mtoqa sorthal kay tor pr dekha jata hay۔ bar flem dezae'n kay andr brokrz ko yh nhen btanay dea jata hay kh market qemt trteb oar pesh kr rhe hay blkh yh kh market osae'l men drj zel brre karroae'e krnay say phlay brqrar hay۔ as ka mtlb delrz kay leay mmknh khlay droazay hen۔

andr bar brek aaؤt hkmt amle

jesa kh phlay hoalh dea gea hay، bar kay andr aek mthrk karobare shabay kay andr km gher mtoqa honay kay sath aek lmhate amtzaj kay oqt ka pth deta hay۔ as oqt، tajron ko amed hay kh aek aor aonch nech ke shkl akhtear krnay kay bad brek aaؤt ka tbadlh kren gay۔

nechay EUR/GBP daeagram men، pchhlay petrn ko bdtr km poae'nts aor bdtr hae'e poae'nts say dekha jata hay۔ brek aaؤt 'phle bar' kay nchlay hsay kay nechay hota hay as trh market men aek mkhtsr sekshn qae'm krta hay۔ agr yh brek aaؤt 'phle bar' ke aonchae'e pr hoa hay to yh aek toel (khredare) sekshn ko nshan zd krskta hay jo petrn men mtoqa alt ka mzahrh krta hay۔ petrn kay khlaf tbadlay say zeadh joa hota hay jo tajr ke trf say athae'ay janay oalay zeadh qabl tojh chokse ka asharh krta hay۔

stap leolz ko maze kay jholay hae'e/nechay (petrn pr mnhsr) say lea ja skta hay jesa kh ahm lagt ke srgrme ke sthon ke trf say hdaet ke ge'e hay۔ stap ko bench mark kay tor pr shaml krtay hoe'ay، delrz as stap faslay ko do kay mtgher say brrhnay kay leay astamal kr sktay hen takh tek beneft (hd) ke sth ko smjh sken۔ yh qabl aatmad joa bord kay mtabq 1:2 joa anaam ka tnasb bnata hay۔ fboneke toseaat ko bhe kt aaf fgr kay tor pr astamal kea ja skta hay۔

HOW RELIABLE IS THE INSIDE BAR CANDLE?

andr ke slakhen tslsl ya alt janay ka asharh dete hen، jo as tbadlay kay dezae'n ko mzed preshan kr dete hay۔ bogs brek aaؤts ho sktay hen jo aek mnqta msal kay tor pr bar kay andr ke anhsar ko km kr deta hay js ke ojh say tajr aam tor pr bolay janay oalay gher mlke krnse kay tbadlay kay treqh kar ke khsoset kay tor pr bar kay andr shaml honay ke trf jhk jatay hen۔ yane، treqh kar asteblshmnt hay js kay andr bar ko aor bhe mkhtsr smjha jata hay

bar kay andr aek mshhor alta / tslsl kay shalay ke nshoonma hay js ko apna taarf kranay kay leay srf do mom btean drkar hote hen۔ yh msal lmhh bh lmhh market kay ahsas pr aek fore dramh hay js men 'brre chalon' say phlay dakhl honay ke amed hay jo tlash men ho skte hay۔ bar kay andr sabqh roshne aonche aor km market ke gher yqene sorthal ko zahr krnay kay leay aopr/nechay qemton men hchkchaht zahr krta hay۔

HOW TO IDENTIFY AN INSIDE BAR ON FOREX CHARTS

fareks daeagram pr bar dezae'n kay andr frq krtay hoe'ay sath ke peshrft ka astamal kea jata hay:

lagt ke srgrme/khsose asharay ka astamal krtay hoe'ay aek sabqh petrn ko phchanen۔

bar dezae'n kay andr oaqa hay js kay zreaay bar kay andr pchhle mom bte aonche aor neche say mkml tor pr dob jate hay۔

TRADING WITH THE INSIDE BAR CANDLESTICK PATTERN: TOP TIPS AND STRATEGIES

kchh brokrz asay aek tslsl kay dezae'n kay tor pr sochtay hen tahm dosray treqay say brek aaؤt bhe qabl fhm hay۔ aek mqrrh mdt kay leay lagt kay aopr (ea nechay) janay kay bad، lagt ke trqe men takher (bar kay andr say khtab) petrn kay alt janay say phlay jate hay۔ as trh، bar kay andr aarze tbadlay (ea soe'ng aekschenj) kay leay kaؤntr petrn men 10 bar say km kay leay aekschenj rkhnay ka mkml aradh rkhta hay۔

kse bhe sort men، slakhon kay andr tbadlh krnay ka aek aor treqh hay aor yh sedha as bat say qae'm hota hay js say shalh dezae'n bay nqab nhen hota hay۔ as mqam pr jb delrz bar kay andr dezae'n ka dhanchh dekhtay hen، as ke ozaht hote hay keonkh karobare shabay qdr ko trteb denay men hchkchatay hen۔ yh kchh ojohat ke bna' pr ho skta hay:

bht mnasb rport jld de ja rhe hay، ya

market nay abhe astratasferk chhlang lgae'e hay aor tajr kafe hd tk lagt ke peshksh kay baray men gngna rhay hen۔

koe'e bhe chez js ke ozaht، aqlet kchh bht mlte jlte hay: fae'day men azafay kay aakhre mqsd kay sath mmknh gher mtoqa slahet ke tlash۔ as moqa pr jb ohan kea ho rha hay js men delr lagt ke trteb denay say grezan hen، asay gher mtoqa tor pr mstqbl men tosea kay leay aek mtoqa sorthal kay tor pr dekha jata hay۔ bar flem dezae'n kay andr brokrz ko yh nhen btanay dea jata hay kh market qemt trteb oar pesh kr rhe hay blkh yh kh market osae'l men drj zel brre karroae'e krnay say phlay brqrar hay۔ as ka mtlb delrz kay leay mmknh khlay droazay hen۔

andr bar brek aaؤt hkmt amle

jesa kh phlay hoalh dea gea hay، bar kay andr aek mthrk karobare shabay kay andr km gher mtoqa honay kay sath aek lmhate amtzaj kay oqt ka pth deta hay۔ as oqt، tajron ko amed hay kh aek aor aonch nech ke shkl akhtear krnay kay bad brek aaؤt ka tbadlh kren gay۔

nechay EUR/GBP daeagram men، pchhlay petrn ko bdtr km poae'nts aor bdtr hae'e poae'nts say dekha jata hay۔ brek aaؤt 'phle bar' kay nchlay hsay kay nechay hota hay as trh market men aek mkhtsr sekshn qae'm krta hay۔ agr yh brek aaؤt 'phle bar' ke aonchae'e pr hoa hay to yh aek toel (khredare) sekshn ko nshan zd krskta hay jo petrn men mtoqa alt ka mzahrh krta hay۔ petrn kay khlaf tbadlay say zeadh joa hota hay jo tajr ke trf say athae'ay janay oalay zeadh qabl tojh chokse ka asharh krta hay۔

stap leolz ko maze kay jholay hae'e/nechay (petrn pr mnhsr) say lea ja skta hay jesa kh ahm lagt ke srgrme ke sthon ke trf say hdaet ke ge'e hay۔ stap ko bench mark kay tor pr shaml krtay hoe'ay، delrz as stap faslay ko do kay mtgher say brrhnay kay leay astamal kr sktay hen takh tek beneft (hd) ke sth ko smjh sken۔ yh qabl aatmad joa bord kay mtabq 1:2 joa anaam ka tnasb bnata hay۔ fboneke toseaat ko bhe kt aaf fgr kay tor pr astamal kea ja skta hay۔

HOW RELIABLE IS THE INSIDE BAR CANDLE?

andr ke slakhen tslsl ya alt janay ka asharh dete hen، jo as tbadlay kay dezae'n ko mzed preshan kr dete hay۔ bogs brek aaؤts ho sktay hen jo aek mnqta msal kay tor pr bar kay andr ke anhsar ko km kr deta hay js ke ojh say tajr aam tor pr bolay janay oalay gher mlke krnse kay tbadlay kay treqh kar ke khsoset kay tor pr bar kay andr shaml honay ke trf jhk jatay hen۔ yane، treqh kar asteblshmnt hay js kay andr bar ko aor bhe mkhtsr smjha jata hay

تبصرہ

Расширенный режим Обычный режим