DOW THEORY BASIC PRINCIPLES IN FOREX TRADING

Dow Theory ek technical analysis theory hai jo Charles Dow ne develop ki thi. Ye theory market trends aur trading signals ko samajhne ke liye istemal hoti hai.

DOW THEORY BASIC PRINCIPLES

Market Action Reflects Everything

Dow Theory ke mutabiq, market ki harkat mein mojood sab kuch, jaise ki news, events, aur emotions, already reflected hota hai.

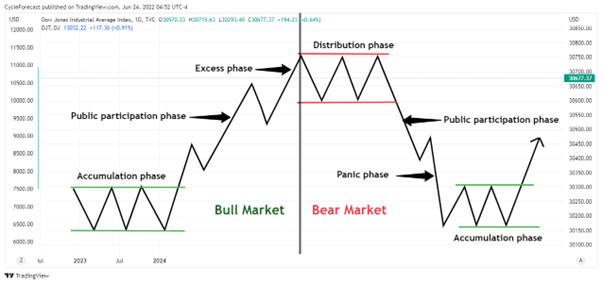

THREE TRENDS

Dow Theory teen alag alag trends ke baare mein batata hai: primary trend, secondary trend, aur minor trend.

TREND CONFIRMATION

Dow Theory ke mutabiq, ek trend tabhi confirm hota hai jab doosre indices bhi uss direction mein move karte hain.

FOREX TRADING MEIN DOW THEORY

TREND ANALYSIS

Dow Theory ki madad se traders market ke trends ko analyze karke trading decisions le sakte hain.

ENTRY AND EXIT POINTS

Dow Theory ke principles ko follow karke traders entry aur exit points ka faisla kar sakte hain.

RISK MANAGEMENT

Dow Theory ki roshni mein traders apni trades ko manage kar sakte hain aur risk ko kam kar sakte hain.Dow Theory ki principles ko samajh kar aur uss par amal karke traders forex market mein speculation kar sakte hain aur trading strategies banasakte hain.

FOREX TRADING MEIN SPECULATION

Forex trading mein speculation ka matlab hai future price movements ko predict karna aur uss par trades karna. Dow Theory ki principles ko samajh kar aur uss par amal karke traders forex market mein speculation kar sakte hain aur trading strategies banasakte hain. Dow Theory ke principles ki madad se traders market trends ko samajh kar better trading decisions le sakte hain.

Dow Theory ek technical analysis theory hai jo Charles Dow ne develop ki thi. Ye theory market trends aur trading signals ko samajhne ke liye istemal hoti hai.

DOW THEORY BASIC PRINCIPLES

Market Action Reflects Everything

Dow Theory ke mutabiq, market ki harkat mein mojood sab kuch, jaise ki news, events, aur emotions, already reflected hota hai.

THREE TRENDS

Dow Theory teen alag alag trends ke baare mein batata hai: primary trend, secondary trend, aur minor trend.

TREND CONFIRMATION

Dow Theory ke mutabiq, ek trend tabhi confirm hota hai jab doosre indices bhi uss direction mein move karte hain.

FOREX TRADING MEIN DOW THEORY

TREND ANALYSIS

Dow Theory ki madad se traders market ke trends ko analyze karke trading decisions le sakte hain.

ENTRY AND EXIT POINTS

Dow Theory ke principles ko follow karke traders entry aur exit points ka faisla kar sakte hain.

RISK MANAGEMENT

Dow Theory ki roshni mein traders apni trades ko manage kar sakte hain aur risk ko kam kar sakte hain.Dow Theory ki principles ko samajh kar aur uss par amal karke traders forex market mein speculation kar sakte hain aur trading strategies banasakte hain.

FOREX TRADING MEIN SPECULATION

Forex trading mein speculation ka matlab hai future price movements ko predict karna aur uss par trades karna. Dow Theory ki principles ko samajh kar aur uss par amal karke traders forex market mein speculation kar sakte hain aur trading strategies banasakte hain. Dow Theory ke principles ki madad se traders market trends ko samajh kar better trading decisions le sakte hain.

تبصرہ

Расширенный режим Обычный режим