Inverse Head and Shoulders Candlestick Patterns Trading.

Inverse Head and Shoulders hai ek candlestick pattern hai jo market analysis mein istemal hota hai. Inverse Head and Shoulders pattern ek powerful tool hai jo traders ko market trends aur reversals ko samajhne mein madad karta hai. Is pattern ko samajh kar, traders apne trading strategies ko improve kar sakte hain aur better entry aur exit points identify kar sakte hain. Magar, pattern ke istemal se pehle, thorough analysis aur risk management zaroori hai.

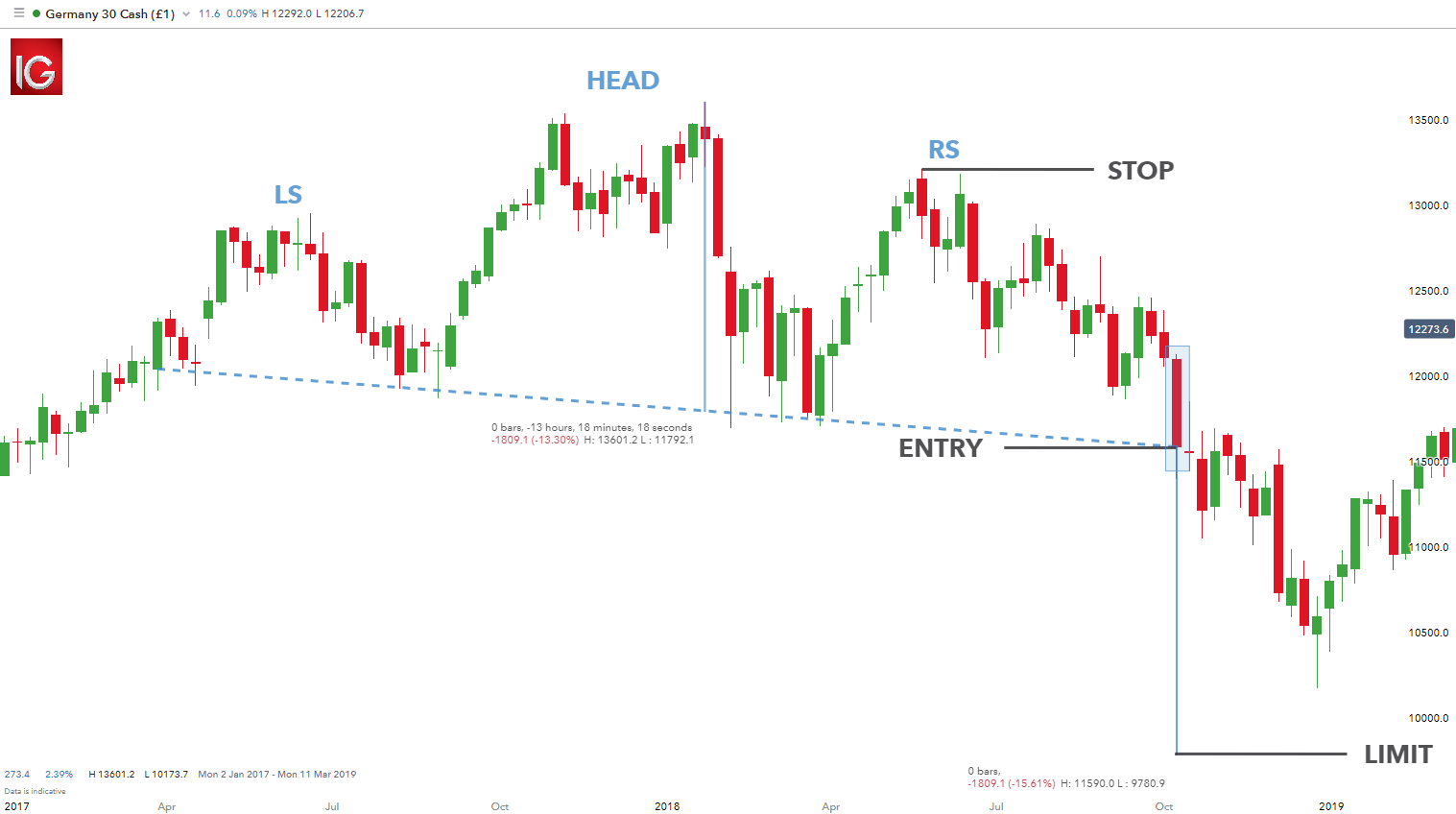

Inverse Head and Shoulders, ek bullish reversal pattern hai jo normal head and shoulders pattern ka ulta hota hai. Ye typically bearish trend ke baad dekha jata hai aur indicate karta hai ke market ka trend change hone wala hai.

Components of Inverse Head and Shoulders.

Head.Yeh pattern ka sabse prominent part hota hai, jo typically market ke low points ko represent karta hai. Head usually shoulders ke darmiyan hota hai aur ye market ki weakest phase ko indicate karta hai.

Shoulders. Inverse Head and Shoulders pattern mein do shoulders hote hain, jo head ke dono taraf hote hain. Ye market mein trend reversal ko suggest karte hain. Right shoulder usually left shoulder se kam bada hota hai, indicating ke bearish momentum kamzor ho raha hai.

Neckline.Neckline, left shoulder aur right shoulder ke darmiyan ek line hoti hai jo support ya resistance ke tor par kaam karti hai. Agar price is line ko break kar ke upar jaata hai, to ye bullish signal hota hai.

Trading Strategies using Inverse Head and Shoulders.

Inverse Head and Shoulders pattern ko identify karna pehla qadam hai. Iske liye, traders ko market ke price action ko closely monitor karna hota hai aur potential Inverse Head and Shoulders pattern ki talaash karni hoti hai.

Pattern ko confirm karne ke liye, traders ko price ke movements ko aur technical indicators ko dekhna hota hai. Agar price neckline ko break kar ke upar jaata hai aur volume bhi increase hota hai, to ye pattern confirm hota hai.

Trade mein dakhil hone se pehle, traders ko apne risk aur reward ko calculate karna chahiye. Agar pattern confirm hota hai, traders long position le sakte hain, ideally neckline break ke upar.Stop loss set karna trading ka zaroori hissa hai. Agar price opposite direction mein chala gaya, to stop loss trader ki protection provide karta hai.aur aap ko btata chaloon kay Target set karna bhi important hai. Traders ko pata hona chahiye ke unka expected profit kitna hai aur jab price us level tak pahunchta hai, to wo trade close kar den.

Maan lo ke ek stock ka price downtrend mein hai aur phir ek Inverse Head and Shoulders pattern form hota hai. Agar price neckline ko break kar ke upar jaata hai, to ye ek entry point ho sakta hai. Stop loss set kiya ja sakta hai neeche left shoulder ke niche aur target set kiya ja sakta hai pattern ke height ke hisaab se.

Inverse Head and Shoulders Pattern ki Limitations.

Kabhi kabhi Inverse Head and Shoulders pattern false signals bhi de sakta hai, isliye confirmatory indicators ka istemal zaroori hai.Pattern ko validate karne ke liye volume ki confirmation bhi zaroori hoti hai. Agar volume pattern ke sath nahi hai, to pattern ka asar kam ho sakta hai.Market conditions bhi pattern ke effectiveness ko influence karte hain. Strong trends mein, ye pattern kam effective ho sakta hai.

Inverse Head and Shoulders hai ek candlestick pattern hai jo market analysis mein istemal hota hai. Inverse Head and Shoulders pattern ek powerful tool hai jo traders ko market trends aur reversals ko samajhne mein madad karta hai. Is pattern ko samajh kar, traders apne trading strategies ko improve kar sakte hain aur better entry aur exit points identify kar sakte hain. Magar, pattern ke istemal se pehle, thorough analysis aur risk management zaroori hai.

Inverse Head and Shoulders, ek bullish reversal pattern hai jo normal head and shoulders pattern ka ulta hota hai. Ye typically bearish trend ke baad dekha jata hai aur indicate karta hai ke market ka trend change hone wala hai.

Components of Inverse Head and Shoulders.

Head.Yeh pattern ka sabse prominent part hota hai, jo typically market ke low points ko represent karta hai. Head usually shoulders ke darmiyan hota hai aur ye market ki weakest phase ko indicate karta hai.

Shoulders. Inverse Head and Shoulders pattern mein do shoulders hote hain, jo head ke dono taraf hote hain. Ye market mein trend reversal ko suggest karte hain. Right shoulder usually left shoulder se kam bada hota hai, indicating ke bearish momentum kamzor ho raha hai.

Neckline.Neckline, left shoulder aur right shoulder ke darmiyan ek line hoti hai jo support ya resistance ke tor par kaam karti hai. Agar price is line ko break kar ke upar jaata hai, to ye bullish signal hota hai.

Trading Strategies using Inverse Head and Shoulders.

Inverse Head and Shoulders pattern ko identify karna pehla qadam hai. Iske liye, traders ko market ke price action ko closely monitor karna hota hai aur potential Inverse Head and Shoulders pattern ki talaash karni hoti hai.

Pattern ko confirm karne ke liye, traders ko price ke movements ko aur technical indicators ko dekhna hota hai. Agar price neckline ko break kar ke upar jaata hai aur volume bhi increase hota hai, to ye pattern confirm hota hai.

Trade mein dakhil hone se pehle, traders ko apne risk aur reward ko calculate karna chahiye. Agar pattern confirm hota hai, traders long position le sakte hain, ideally neckline break ke upar.Stop loss set karna trading ka zaroori hissa hai. Agar price opposite direction mein chala gaya, to stop loss trader ki protection provide karta hai.aur aap ko btata chaloon kay Target set karna bhi important hai. Traders ko pata hona chahiye ke unka expected profit kitna hai aur jab price us level tak pahunchta hai, to wo trade close kar den.

Maan lo ke ek stock ka price downtrend mein hai aur phir ek Inverse Head and Shoulders pattern form hota hai. Agar price neckline ko break kar ke upar jaata hai, to ye ek entry point ho sakta hai. Stop loss set kiya ja sakta hai neeche left shoulder ke niche aur target set kiya ja sakta hai pattern ke height ke hisaab se.

Inverse Head and Shoulders Pattern ki Limitations.

Kabhi kabhi Inverse Head and Shoulders pattern false signals bhi de sakta hai, isliye confirmatory indicators ka istemal zaroori hai.Pattern ko validate karne ke liye volume ki confirmation bhi zaroori hoti hai. Agar volume pattern ke sath nahi hai, to pattern ka asar kam ho sakta hai.Market conditions bhi pattern ke effectiveness ko influence karte hain. Strong trends mein, ye pattern kam effective ho sakta hai.

تبصرہ

Расширенный режим Обычный режим