Assalamu Alaikum Dosto!

Cross Hedging Strategy

Financial aur Invest mein, jahan tension aur risk am taur par top par rehtay hain, expert traders aise strategies dhundhtay hain jo potenital nuksan ko kam karne aur hasilat ko ziada karnay mein madad karti hain. In techniques mein se, "Cross Hedging" aik taqatwar tool ke tor par ubharta hai, jo investors ko volatil markets mein taqat aur soch samajh kar chalne mein madad karti hai.

Cross Hedging ka bunyadi tareeqa yeh hai ke maliyat asbaab ko bachane ke liye maali asbaab ka istemal kiya jata hai jo ke shayad mojooda hedge mojood na ho. Aam taur par hedging mein, hedging instrument aur bachai jane wali aset ke darmiyan aik mukammal mawafiqat talaash ki jati hai, jabke Cross Hedging mein, mawafiqat na mumkin hone par bhi, mawafiq assets ka istemal kiya jata hai taake aik maqbul hedge banaya ja sake, chahe wo asal aset se bilkul mukhtalif bhi ho.

Zero Cross Hedging ki kamyabi asay assets ko pehchan mein hai jo bachai jane wali aset ke sath mazboot taalluqat dikhati hain. Ye taalluqat mukammal na ho sakti hai, lekin isko kuch darja eftetah milne ke liye kafi zaroori hai. Is taalluqat ka faida utha kar, traders nuksan se bach saktay hain jo paishgi market harkatun se aata hai.

Cross Hedging ka amali namuna aik gehray se samaji mein la sakta hai, jismein aik gandum paida karne wale ne apni crop ke daam girne ke khilaf hifazati tadabeer dhondni ho. Agar usay seedha apni position ko gandum futures istemal karke hedge karna ho to wo dekhega ke makai futures gandum ke daamon ke sath mazboot taalluqat rakhta hai. Is soorat mein, producer makai futures mein position le kar Cross Hedge kar sakta hai takay gandum market mein hone wale mumkinayatun ko khatam kar sake.

Cross Hedging aur Hedging Mein Difference

Hedging aur Cross Hedging dono trading aur invest mein istemal hone wale risk management techniques hain jo potential nuksan se bachne ke liye istemal hoti hain, lekin inki tajaweez aur maqsad mein farq hai. Chaliye in dono strategies ke darmiyan kuch key farqat ko explore karte hain:

- Definition And Purpose:

- Hedging: Hedging maali asbaab ka istemal karta hai taake mojooda invest ki position ko sath le jane wale khatray se bachaye ya kam kare. Hedging ka asal maqsad hai ek perfect hedge banane ka, jismein hedging instrument aur bachai jane wali aset ke darmiyan mukammal mawafiqat ho takay khatra poora tarah se khatam ho sake.

- Cross Hedging: Cross Hedging ne dosri taraf, mawafiq assets ka istemal karta hai taake mojooda aset ki khatrat ko bachaye, jab aik specific asset ke liye mukammal mawafiqat mojood na ho. Ye wo assets hain jo bachai jane wali aset ke sath mazboot taalluqat rakhti hain, chahe wo bilkul mukhtalif bhi ho. Cross Hedging ka asal maqsad hai khatrat ko manage karna jab kisi specific asset ke liye mukammal hedge na mumkin ho.

- Aset ki Correlation:

- Hedging: Traditional hedging mein, bachai jane wali aset aur hedging instrument ke darmiyan mazboot taalluqat honi chahiye, chahay wo positive ho ya negative, ye us hedge ki qisam par depend karta hai jo istemal hoti hai. Misal ke liye, agar aik trader stocks ka portfolio hold kar raha hai to wo isay stock index futures contract ki short position le kar hedge kar sakta hai kyunki stock prices aur index prices aksar milte julte hain.

- Cross Hedging: Jaisa ke pehle zikar hua, Cross Hedging mawafiq assets par mabni hai jo bachai jane wali aset ke sath mazboot taalluqat rakhti hain. Taalluqat mukammal na ho sakti hai, lekin ye kafi mazboot hoti hai ke kisi had tak bachao faraham kar sake. Misal ke liye, gandum ke daamon ke khilaf bachao hasil karne ke liye makai futures ka istemal karna, kyun ke ye dono agricultural commodities historically observable taalluqat rakhti hain.

- Hedge ki Durustagi:

- Hedging: Traditional hedging mukammal hedge banane ki taraf israr karta hai, ye iska matlab hai ke hedging instrument asal aset ke khatre ko puri tarah se khatam kar de. Agar isay sahi taur par amal kiya jaye to hedge se hasil hone wale munafa ya nuksan ko asal invest se bilkul khatam kar dega.

- Cross Hedging: Cross Hedging mein, aik kam durust tareeqa hota hai, kyun ke wo aset jo hedging ke liye istemal hota hai, wo asal aset se mukhtalif hota hai lekin usse mazboot taalluqat rakhta hai. Darmiyan mein dono assets ke darmiyan taalluqat waqt ke saath tabdeel ho sakti hain, jiski wajah se Cross Hedge ki asar mein izafah hone ki mumkinat hai.

- Hedging: Riwayati hedging strategies amooman seedhi aur asaan ho sakti hain kyun ke traders wohi ya mazeed mawafiq assets ke sath kaam kar rahe hote hain. Markaz yahan par woh direct hedge dhundhna hota hai jo asal invest mein nazdeek aata ho.

- Cross Hedging: Cross Hedging ziada mushkil ho sakti hai kyun ke is mein woh assets talashni parti hain jo mawafiq taalluqat ke sath hon aur inke talluqat ko waqtan-fa-waqtan qareeb se nigrani karna parta hai. Is mein ziada lachak hoti hai jab direct hedging instruments dastiyab nahi hote, jo traders ko market ke halat mein kreativ taur par nisar karne ki ijaazat deta hai.

Mukhtasaran, jab dono hedging aur Cross Hedging nuksan ka nigranayi karnay ka maqsad rakhte hain, to hedging direct aur mawafiq asset ke sath seedha aur durust hedge banane mein mabni hoti hai, jabke Cross Hedging mawafiq taalluqat rakhtay hue mawafiq assets ka istemaal karti hai jab ek durust hedge mumkin nahi hota. Traders ko har strategy ke faide aur mehdoodiyon ko madde nazar rakhte hue apne risk nigrani maqasid aur market ki soorat-e-haal ke mutabiq behtar taur par intikhab karna chahiye.[/LIST]

Cross Hedging Formula

Cross Hedging Formula ek hissi daleel hai jo istemal hoti hai hedge ratio ya hedging instrument ki tadad ka hisaab lagane ke liye, jo ek diye gaye position ko asal aset se bachane ke liye zaroori hai. Formula ka maqsad ye hai ke asal aset ki keemat ke hareef hone aur chunay gaye hedging instrument ki keemat ke darmiyan taaluqat ko qaim kare.

Cross Hedging Formula hasil karne ke liye, hamein hedge ratio ke tajziya ka tawajjuh rakhna zaroori hai. Hedge ratio wo units hain jo asal aset ko moqami taur par bachane ke liye hedging instrument ki zaroorat hoti hai. Ye do aset ke darmiyan taaluqat par mabni hota hai.

Hedge ratio (HR) ka aam formula is tarah hai:

HR = Covariance between the asset being protected and the hedging instrument / Variance of the hedging instrument

Where: Covariance = Dono aset ke darmiyan correction ka istatistiati miqdaar hai, jo yeh darust karta hai ke wo saath mein ya ulte raaste mein kaise harkat karte hain. Positive covariance ishara karta hai ke wo saath mein harkat karte hain, jabke negative covariance ye darust karta hai ke wo ulte raaste mein harkat karte hain.

Variance = Hedging instrument ke wapis ka istatistiati miqdaar hai. Ye instrument ki harkat aur khatra ko shumari mein laata hai.

Jab hedge ratio tay kiya jata hai, to Cross Hedge ke liye zaroorat hai ke asal aset ki quantity ko hedge ratio se mukammal kia jaye.

Example:

Chaliye ek manfi samaji mein sochein jahan ek soybean producer soybean ke daamon mein mumkinayat hone ke khilaaf Cross Hedge karna chahta hai. Usne mabni hone wale soybean prices ke mazboot tareen taluqat ki buniad par corn futures ko hedging instrument ke tor par istemal karne ka faisla kiya hai.

Hedge ratio calculate karein: Maan lijiye ke soybean aur corn futures prices ke darmiyan covariance 0.80 hai, aur corn futures prices ki variance 0.64 hai.

Faraz karein ke producer 10,000 bushels soybeans ko bachana chahta hai. Chahiye honge corn futures contracts ki tadad = HR * Quantity of soybeans

Chahiye honge corn futures contracts

Calculate the hedge ratio: Suppose the covariance between soybean and corn futures prices is 0.80, and the variance of corn futures prices is 0.64.

HR = 0.80 / 0.64 HR ≈ 1.25

Is misal mein, producer ko 12,500 corn futures contracts khareedne ki zaroorat hogi taake wo soybean prices mein hosla afzai ke khilaaf mumkin nuksan ko bacha sake.

Yaad rakhna zaroori hai ke Cross Hedge ka asar asal aset aur hedging instrument ke darmiyan correlation ki mazbooti par mabni hai. Traders ko chahiye ke wo is correlation ko musalsal nazar rakhein aur apne positions ko market ke tabdiliyon ke mutabiq adjust karte rahein taake optimal hedge qaim rahe.

Cross Hedging Kab Use Karein?

Cross Hedging kuch khaas market conditions aur surat-e-haal mein aik qeemati risk management strategy ban sakti hai. Traders aur investors ko Cross Hedging ko in halat aur sooraton mein istemal karne ka soch sakte hain:

- Direct Hedging Instruments Ki Kami: Jab asal aset ke liye market mein seedha aur perfect hedging instrument mojood na ho. Iss soorat mein, asal aset se taalluqat rakhnay wale kisi doosre related aset ko daryaft karna ek alternative risk management approach ko darust karta hai.

- Zyada Correlated Asetain: Jab asal aset aur koi doosra aset aapas mein mazboot taalluqat rakhte hain, to Cross Hedging ke zariye harkat ko asar andaz karna mumkin hota hai. Asetain aapas mein taalluqat ka degree Cross Hedge ki darusti aur asar ko mutasir karegi.

- Mutasil Portfolio: Cross Hedging ko woh portfolios ke liye faida mand hai jo limited hedging options ke sath asetain shamil karte hain. Related instruments ka istemal karke, traders apni portfolios ki overall risk management ko behtar bana sakte hain.

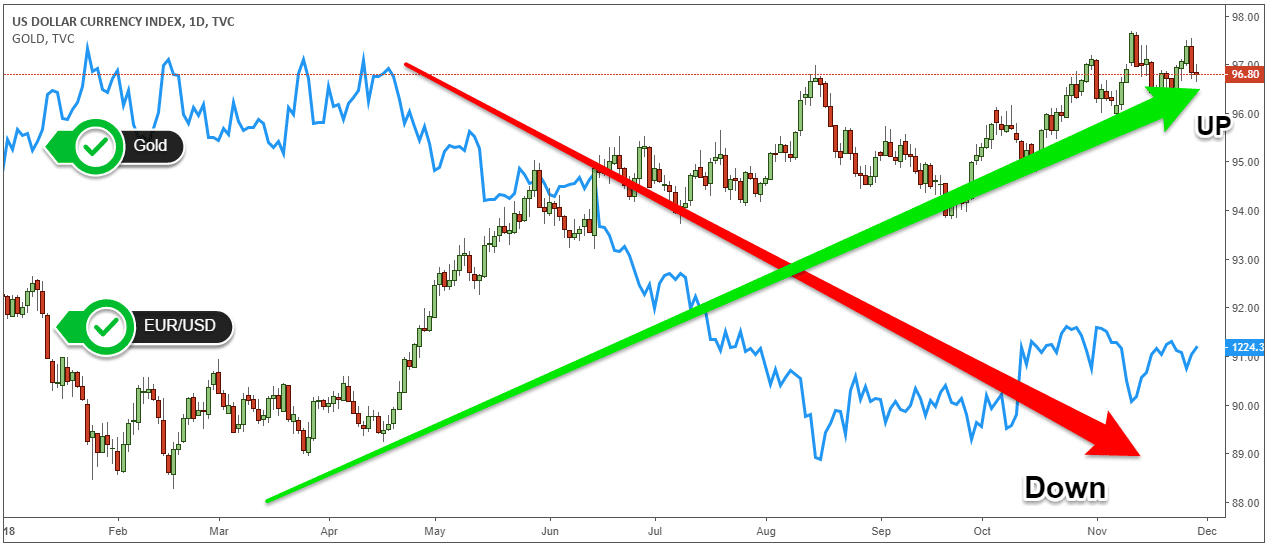

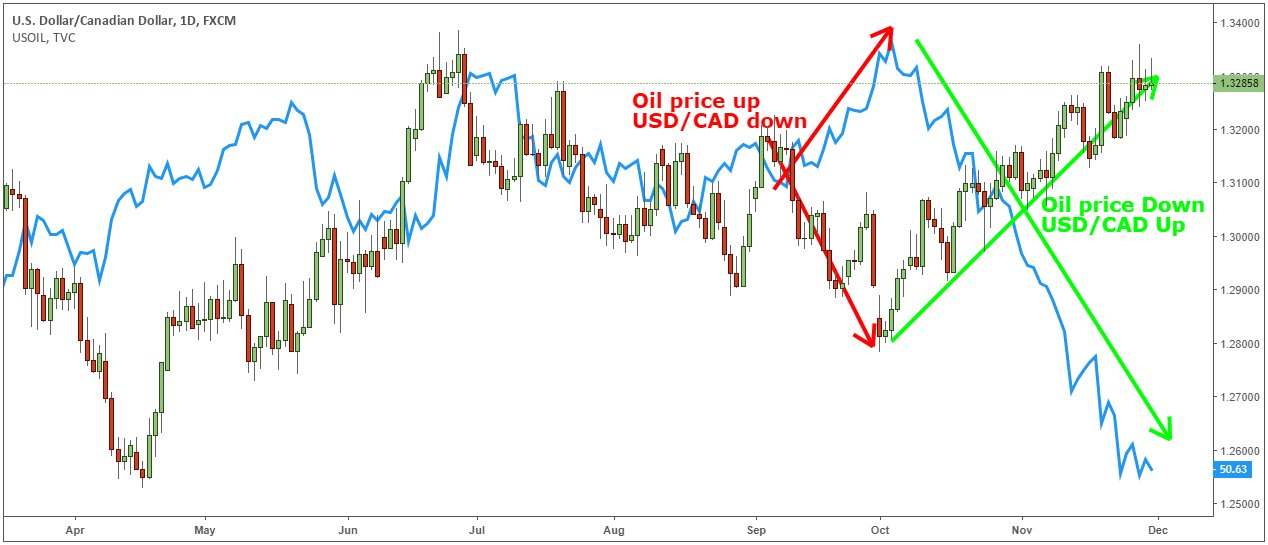

- Commodity Markets: Cross Hedging aam taur par commodity markets mein istemal hoti hai jahan ek hi sector ke mukhtalif aset aksar mazboot taalluqat dikhate hain. Misal ke liye, crude oil futures ka istemal gasoline ke prices ke fluctuations ke khilaaf hedge karne ke liye.

- Cross-Border Investments: Foreign markets mein maqami hone wale investors exchange rate risks ko manage karne ke liye Cross Hedging ka istemal kar sakte hain. Apni positions ko apni home currency mein denominate hone wale related aset ka istemal karke wo mohlik currency harkaton se bacha sakte hain.

- Temporary Hedging Needs: Cross Hedging chhoti muddat ke hedging needs ke liye faida mand ho sakti hai jab seedha hedging amal na mumkin ho sake taake contract muddatein ya liquidation ki muddat se mutalliq. Ye transitional doran mein risk management ke liye ek lazzat janib deta hai.

- Ijtanaab aur Takhayyul: Cross Hedging traders ko unki creativity aur adaptability ka istemal karne aur risk management strategies banane mein madad karta hai. Ye traditional hedging methods ke kaam na aane par bhi risk kam karne ke liye aur options faraham karne ke liye zyada imkanat deta hai.

- Short-Term Hedging Needs: Cross Hedging chhoti muddat ke hedging needs ke liye khaas kar faida mand ho sakti hai, khaas kar jab direct hedges muddat khatam hone ya liquidity constraints ki wajah se na mumkin ho. Ye transitional doran mein risk management ke liye ek qawi approach faraham karta hai.

- Risk Mitigation in Diversified Portfolios: Un portfolios ke liye jo limited hedging options wale asetain shamil karte hain, Cross Hedging risk ko different asset classes mein manage karne ke liye ek qeemati tool ban sakta hai. Ye traditional hedging strategies ko mukammal karta hai aur risk management capabilities ko behtar bana deta hai.

- Cost-Efficiency: Kuch cases mein, Cross Hedging direct hedging methods ke muqablay mein zyada moassar ho sakta hai, kyun ke related aset ke transaction costs ya margin requirements kam ho sakte hain.

Cross Hedging ke Nuksanat:

Lekin, Cross Hedging ke sath jude challenges aur risks ko jan'na zaroori hai:

- Imperfect Correlation: Cross Hedge ki asar us correlation par mabni hai jo asal aset aur hedging instrument ke darmiyan hai. Ye correlation waqt ke saath tabdeel ho sakta hai ya toot sakta hai, jo hedge ki kifayatiyat ko asar andaz kar sakta hai.

- Market Liquidity: Chunay gaye hedging instrument ki theek se dastiyabiyat aur liquidation ka khayal rakhna chahiye. Jo aset dastiyab nahi hai, wahaan mushkilat honay ke imkanat hain.

- Basis Risk: Basis risk woh risk hai jo asal aset aur hedging instrument ke darmiyan taalluqat ki historical correlation se alag ho jaaye. Basis risk hedge ki performance ko mutasir kar sakta hai.

- Complexity: Cross Hedging direct hedging methods ke muqablay mein zyada mushkil ho sakta hai. Traders ko correlations ko carefuly tajziya karna padta hai aur kifayatiyat ke liye mawafiq decisions lene padte hain.

تبصرہ

Расширенный режим Обычный режим