ATR Introduction.

Average True Range (A.T.R) ek ahem tool hai jo traders ko market ki volatility ka andaza lagane mein madad karta hai. Iska istemal karke traders apne trading strategies ko refine kar sakte hain aur market ke mukhtalif conditions mein apne positions ko adjust kar sakte hain, jo unhein zyada consistent aur successful trading results deta hai.Average True Range (A.T.R) ek zaroori tool hai jo traders ko market ki volatility ka andaza lagane mein madad karta hai. Yeh average range of price movements ko calculate karta hai, jo ek maqami currency pair, stocks ya anya securities kee daily price changes mein hota hai.

Asal Rata.

Average True Range (A.T.R) ka matlab hota hai "Average Haqeeqati Fasla". Yeh ek technical analysis indicator hai jo market volatility ko measure karta hai.

Calculation.

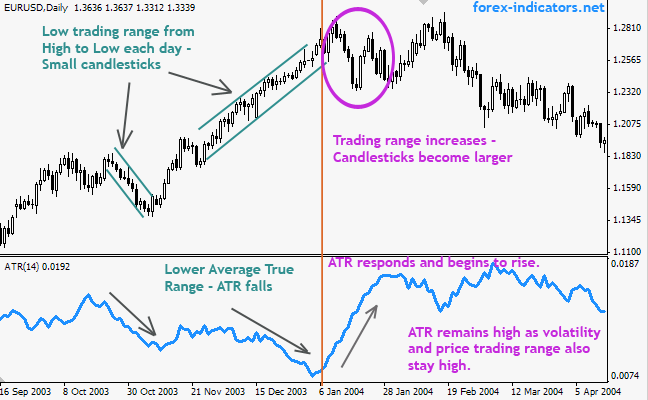

A.T.R ko calculate karne ke liye, pehle har din ka true range calculate kiya jata hai. True range, sab se bara aur sab se chhota out of the following teen cheezen hota hai: aaj ka high minus aaj ka low, aaj ka high minus kal ka close, aur aaj ka low minus kal ka close. Phir, ek nishchit samay ke liye (jaise ke 14 din) true ranges ko add karke aur uska average nikala jata hai, jo A.T.R hota hai.

Istemal aur Ahmiyat.

A.T.R ka istemal traders ko market ki volatality ka andaza lagane mein madad karta hai. Jab A.T.R zyada hota hai, yeh darust karata hai ke market zyada volatile hai aur jab kam hota hai, to yeh darust karata hai ke market kam volatile hai. Traders isko apne trading strategies mein istemal karke stop-loss levels aur profit targets ko set karte hain.

Trading Strategies.

A.T.R ko alag alag trading strategies mein istemal kiya ja sakta hai. For example, kuch traders A.T.R ka istemal karke stop-loss levels ko set karte hain. Agar A.T.R zyada hai, to woh apne stop-loss levels ko zyada rakhenge taake market ki volatility ko accommodate kar sakein. Doosri taraf, kuch traders A.T.R ka istemal karke position sizes ko adjust karte hain. Jab A.T.R zyada hota hai, to woh apne positions ko kam kar dete hain taake zyada risk se bach sakein.

Average True Range (A.T.R) ek ahem tool hai jo traders ko market ki volatility ka andaza lagane mein madad karta hai. Iska istemal karke traders apne trading strategies ko refine kar sakte hain aur market ke mukhtalif conditions mein apne positions ko adjust kar sakte hain, jo unhein zyada consistent aur successful trading results deta hai.Average True Range (A.T.R) ek zaroori tool hai jo traders ko market ki volatility ka andaza lagane mein madad karta hai. Yeh average range of price movements ko calculate karta hai, jo ek maqami currency pair, stocks ya anya securities kee daily price changes mein hota hai.

Asal Rata.

Average True Range (A.T.R) ka matlab hota hai "Average Haqeeqati Fasla". Yeh ek technical analysis indicator hai jo market volatility ko measure karta hai.

Calculation.

A.T.R ko calculate karne ke liye, pehle har din ka true range calculate kiya jata hai. True range, sab se bara aur sab se chhota out of the following teen cheezen hota hai: aaj ka high minus aaj ka low, aaj ka high minus kal ka close, aur aaj ka low minus kal ka close. Phir, ek nishchit samay ke liye (jaise ke 14 din) true ranges ko add karke aur uska average nikala jata hai, jo A.T.R hota hai.

Istemal aur Ahmiyat.

A.T.R ka istemal traders ko market ki volatality ka andaza lagane mein madad karta hai. Jab A.T.R zyada hota hai, yeh darust karata hai ke market zyada volatile hai aur jab kam hota hai, to yeh darust karata hai ke market kam volatile hai. Traders isko apne trading strategies mein istemal karke stop-loss levels aur profit targets ko set karte hain.

Trading Strategies.

A.T.R ko alag alag trading strategies mein istemal kiya ja sakta hai. For example, kuch traders A.T.R ka istemal karke stop-loss levels ko set karte hain. Agar A.T.R zyada hai, to woh apne stop-loss levels ko zyada rakhenge taake market ki volatility ko accommodate kar sakein. Doosri taraf, kuch traders A.T.R ka istemal karke position sizes ko adjust karte hain. Jab A.T.R zyada hota hai, to woh apne positions ko kam kar dete hain taake zyada risk se bach sakein.

تبصرہ

Расширенный режим Обычный режим