Trend following ek mashhoor trading strategy hai jo ke traders mukhtalif financial markets mein istemal karte hain, jaise ke stocks, forex, commodities, aur cryptocurrencies. Trend following ka bunyadi tajurba ye hai ke market trends ko pehchanna aur un se faida uthana, chahe wo upar ki taraf bullish ho ya neeche ki taraf bearish. Ye strategy is aqeede par mabni hai ke ek trend jab qaim ho jata hai, to usay kuch waqt tak jari rehne ki imkan hoti hai, jis se traders prices ke directional movement se faida utha sakte hain.

Key Concepts in Trend Following

Examples of Trend Following Strategies

Trend following ek mukhtalif istemal ki jane wali aur effective trading strategy hai jo market trends ko identify kar ke munafa kamane ka maqsad rakhti hai. Trends ko pehchanne, munafa aur nuqsanat ke liye sahi entry aur exit signals ka istemal, risk management ka tawajjo, aur market conditions mein adaptability ke zariye trend following traders consistent returns hasil karne ki koshish karte hain. Halanke challenges jaise ke whipsaws aur market volatility hote hain, lekin sahi risk management aur strategy optimization se ye risks kam kiye ja sakte hain. Trend following ko kamiyabi hasil karne ke liye discipline, sabar, aur trading ke liye systematic approach zaroori hai financial markets mein.

Key Concepts in Trend Following

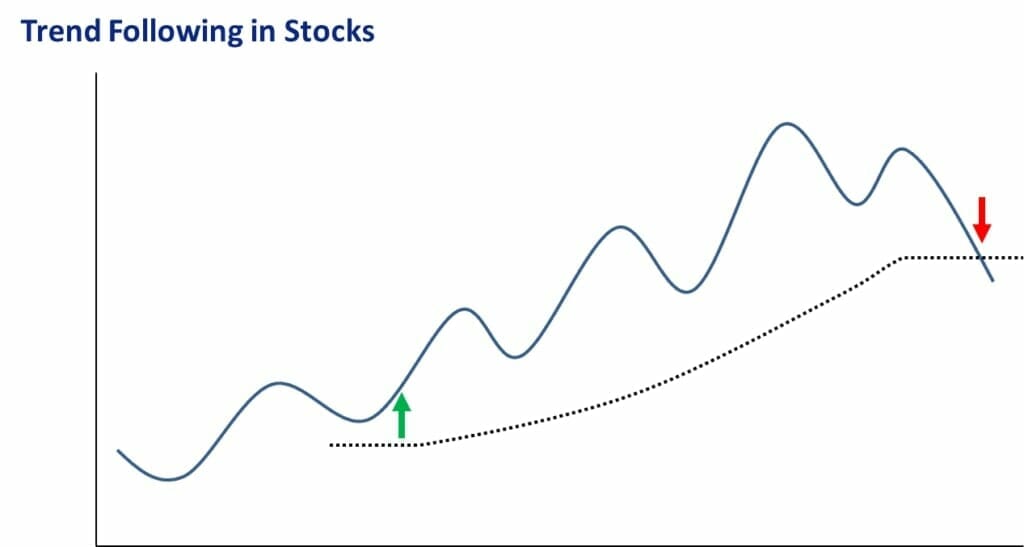

- Trend Identification: Trend following ka pehla qadam ek trend ko pehchanna hai. Ye kaam technical analysis ke tools jaise ke moving averages, trend lines, aur chart patterns ka istemal kar ke kiya jata hai. Ek bullish trend ko zyada highs aur zyada lows se pehchana jata hai, jab ke ek bearish trend mein kam highs aur kam lows hoti hain.

- Entry Signals: Jab ek trend pehchana jata hai, traders entry signals ko talash karte hain taake wo trend ke rukh mein trades shuru kar sakein. Aam entry signals mein breakout ko include kiya jata hai jo ke uptrend mein resistance levels se ooper hone ka signal hota hai ya downtrend mein support levels se neeche hone ka. Traders indicators jaise ke Moving Average Convergence Divergence (MACD) ya Relative Strength Index (RSI) bhi istemal kar sakte hain entry points ko confirm karne ke liye.

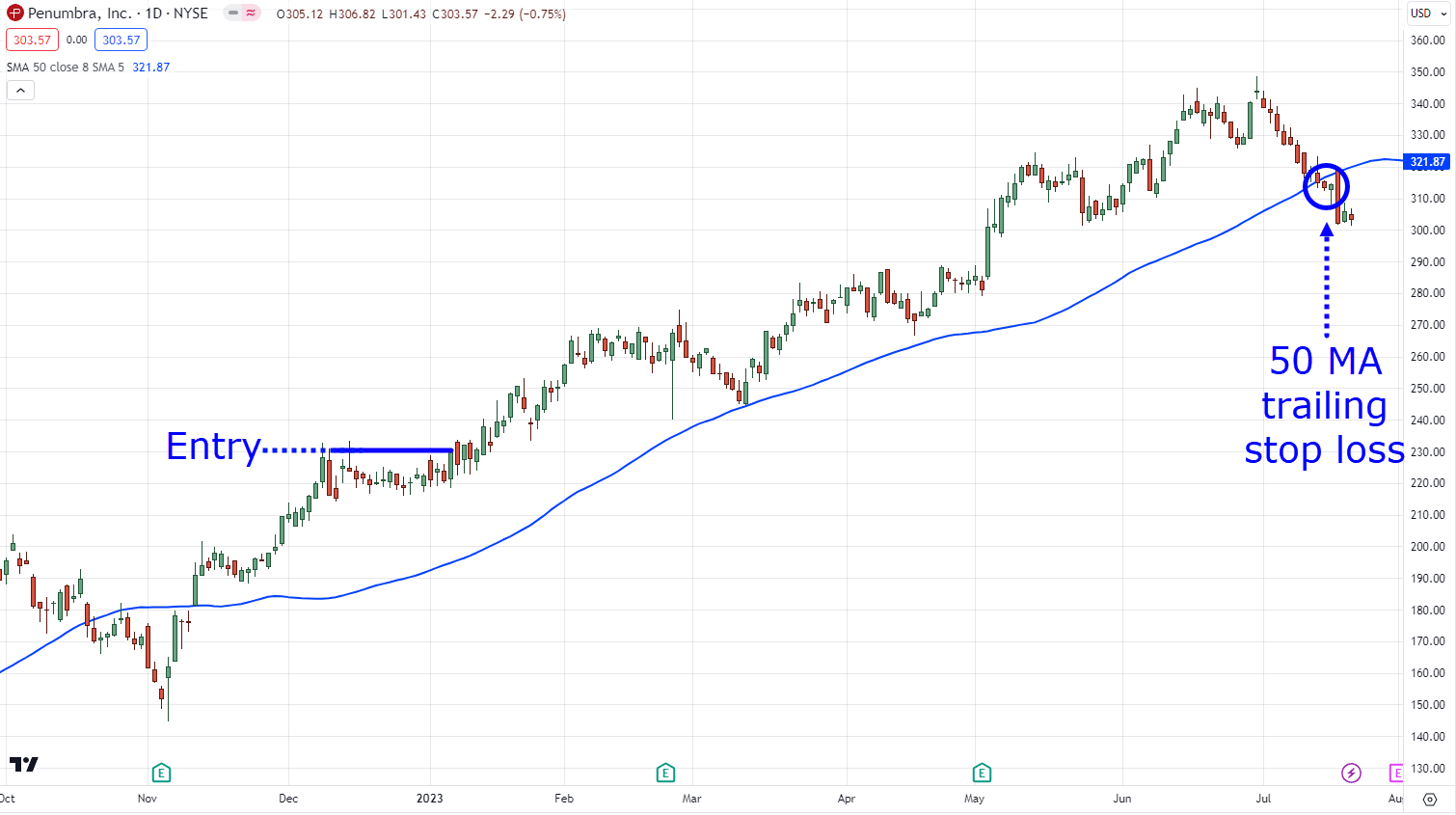

- Risk Management: Risk management trend following strategies mein bohot ahem hai. Traders aam tor par stop-loss orders ka istemal karte hain taake agar trend ulta hojaye to nuqsanat ko mehdood kar sakein. Position sizing bhi ahem hai, jahan traders apne har trade ke liye apne risk tolerance aur trading account ke size ke mutabiq capital ka hissa tay karte hain.

- Exit Strategies: Trend following traders mukhtalif exit strategies ka istemal karte hain taake wo munafa lock kar sakein aur nakami ko rokein. Ye strategies trailing stop-loss orders, technical levels ya indicators ke based profit targets, ya dono ko mila kar bhi ho sakti hain.

- Profit Potential: Trend following strategies ko bohot zyada munafa kamane ka potential hota hai jab markets mein strong aur sustained trends hote hain. Traders trend ko kuch waqt tak follow kar ke apne munafa ko maximize kar sakte hain.

- Adaptability: Trend following ko mukhtalif time frames par apply kiya ja sakta hai, chahay wo short-term intraday trading ho ya long-term position trading. Ye flexibility traders ko mukhtalif market conditions mein trends ko capture karne ki ijazat deta hai.

- Reduced Emotional Bias: Objective rules ke zariye trend identification aur technical indicators ke istemal se trend following strategies emotional decision-making ko kam karte hain, jo ke zyada disciplined aur consistent trading ko janam deti hai.

- Diversification: Trend following ko mukhtalif assets par apply kiya ja sakta hai, jis se traders apne portfolios ko diversify kar ke risk ko kam kar sakte hain aur mukhtalif markets aur instruments ke exposure ke zariye faida utha sakte hain.

- Whipsaws: Trend following ka ek masla whipsaws ka samna karna hota hai, jo ke chand waqt ke liye price movements hote hain jo ke false signals ko trigger kar sakte hain aur nuqsanat ka sabab ban sakte hain. Traders filters ya additional confirmation indicators ka istemal kar sakte hain whipsaws ka asar kam karne ke liye.

- Market Volatility: Trends ko market volatility bhi mutasir kar sakta hai, aur sudden price spikes ya drops trend following strategies ko asar daal sakte hain. Risk management techniques jaise ke position sizes adjust karna aur volatility-based indicators ka istemal karke ye fluctuations ko manage kiya ja sakta hai.

- Drawdowns: Market consolidation ya reversal ke doran, trend following strategies ko drawdowns ka samna karna pad sakta hai, jo temporary declines ko account value mein darust karta hai. Traders ko sabar se kaam lena aur apne trading plan ko follow karna chahiye in doraan.

- Backtesting and Optimization: Successful trend following ke liye thorough backtesting aur trading rules aur parameters ka optimization zaroori hai. Traders ko apne strategies ko historical data par test karna chahiye performance ko assess karne aur zaroori adjustments ko karne ke liye.

Examples of Trend Following Strategies

- Moving Average Crossover: Ek sabse simple trend following strategy moving average crossover hai. Traders short-term masalan 50-day aur long-term(masalan 200-day moving averages ke darmiyan ek crossover ko entry ya exit ka signal samajhte hain.

- Trendline Breakouts: Traders price charts par trendlines draw karte hain trend direction ko pehchane ke liye. Ek bullish trendline ke breakout ya bearish trendline ke breakdown ko ek trend continuation trade ka signal samjha jata hai.

- ADX Indicator: Average Directional Index (ADX) ek technical indicator hai jo trend ki strength ko measure karta hai. Traders ek strong trend ko confirm karne ke liye ADX readings (masalan 25 ke ooper) ko dekhte hain aur us direction mein trades karte hain.

- Parabolic SAR: Parabolic Stop and Reverse (SAR) indicator potential trend reversals ko pehchane ke liye istemal hota hai. Traders jab SAR price ke neeche flip hota hai to long positions enter karte hain aur jab ye price ke ooper flip hota hai to short positions enter karte hain, trend ke sath mila kar.

Trend following ek mukhtalif istemal ki jane wali aur effective trading strategy hai jo market trends ko identify kar ke munafa kamane ka maqsad rakhti hai. Trends ko pehchanne, munafa aur nuqsanat ke liye sahi entry aur exit signals ka istemal, risk management ka tawajjo, aur market conditions mein adaptability ke zariye trend following traders consistent returns hasil karne ki koshish karte hain. Halanke challenges jaise ke whipsaws aur market volatility hote hain, lekin sahi risk management aur strategy optimization se ye risks kam kiye ja sakte hain. Trend following ko kamiyabi hasil karne ke liye discipline, sabar, aur trading ke liye systematic approach zaroori hai financial markets mein.

تبصرہ

Расширенный режим Обычный режим