Explained.

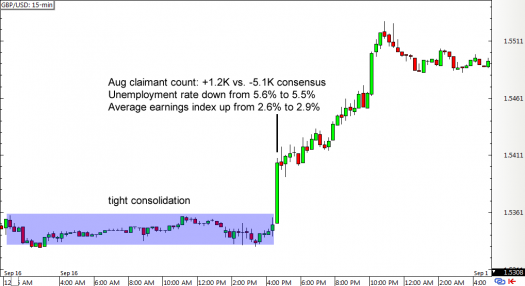

Forex mein, jab kisi currency pair ka price movement aik limit mein rehta hai aur up-down ki jagah sideways move karta hai, to us phase ko Consolidation Phase kehte hain. Is phase ke dauran, traders ko market ki condition ko samajhne ke liye patience ki zarurat hoti hai.

Consolidation Purpose.

Consolidation Phase tab hota hai jab market mein jyada volatility nahi hoti. Iss phase mein traders ki buying aur selling activity kam hoti hai jis ki wajah se price movement limit mein rehta hai aur market range-bound ho jata hai.

Consolidation Phase Duration.

Consolidation Phase ka duration kisi bhi currency pair ke liye different hota hai.

Kuch pairs ke liye yeh phase kuch hours tak chalta hai aur kuch ke liye kuch days tak bhi ho sakta hai.

How to trade in Consolidation Phase.

Consolidation Phase mein traders ko market ki condition ke baare mein samajhna zaruri hota hai. Is phase mein traders ko market ki direction ka analysis karna hota hai aur phir price movement ko predict karne ke liye technical indicators ka use karna hota hai.

Risk management in Consolidation Phase.

Consolidation Phase mein trading karte waqt, traders ko apni positions ke liye tight stop loss rakhna chahiye. Yeh ek risk management strategy hai jis se traders apni losses ko kam kar sakte hain.

Consolidation Phase ek normal market condition hai jis mein price movement limit mein rehta hai. Is phase mein traders ko market ki direction ke baare mein analysis karna hota hai aur technical indicators ka use karna hota hai. Risk management ke liye tight stop loss rakhna zaruri hota hai.

Forex mein, jab kisi currency pair ka price movement aik limit mein rehta hai aur up-down ki jagah sideways move karta hai, to us phase ko Consolidation Phase kehte hain. Is phase ke dauran, traders ko market ki condition ko samajhne ke liye patience ki zarurat hoti hai.

Consolidation Purpose.

Consolidation Phase tab hota hai jab market mein jyada volatility nahi hoti. Iss phase mein traders ki buying aur selling activity kam hoti hai jis ki wajah se price movement limit mein rehta hai aur market range-bound ho jata hai.

Consolidation Phase Duration.

Consolidation Phase ka duration kisi bhi currency pair ke liye different hota hai.

Kuch pairs ke liye yeh phase kuch hours tak chalta hai aur kuch ke liye kuch days tak bhi ho sakta hai.

How to trade in Consolidation Phase.

Consolidation Phase mein traders ko market ki condition ke baare mein samajhna zaruri hota hai. Is phase mein traders ko market ki direction ka analysis karna hota hai aur phir price movement ko predict karne ke liye technical indicators ka use karna hota hai.

Risk management in Consolidation Phase.

Consolidation Phase mein trading karte waqt, traders ko apni positions ke liye tight stop loss rakhna chahiye. Yeh ek risk management strategy hai jis se traders apni losses ko kam kar sakte hain.

Consolidation Phase ek normal market condition hai jis mein price movement limit mein rehta hai. Is phase mein traders ko market ki direction ke baare mein analysis karna hota hai aur technical indicators ka use karna hota hai. Risk management ke liye tight stop loss rakhna zaruri hota hai.

تبصرہ

Расширенный режим Обычный режим