Introduction to Relative Vigor Index

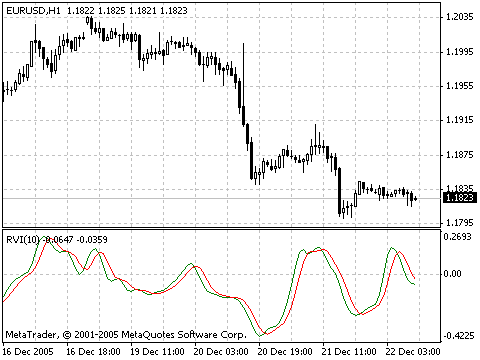

The Relative Vigor Index (RVI) ek technical analysis tool hai jo keematon ke harkaat ki taqat ya zor ko assess karne ke liye banaya gaya hai, khaaskar trading mein. John Ehlers ne isay develop kiya, jo ke momentum aur trend analysis ke elements ko combine karta hai takay market dynamics ka insight mil sake. RVI ka calculation kuch steps mein hota hai. Sab se pehle, Typical Price (TP) ko calculate kiya jata hai, jo ke 14 periods ke liye set hota hai aur high, low, aur closing prices ka average hota hai. Phir ye TP Price Change (PC) ko calculate karne ke liye istemaal hota hai, jo ke current TP aur ek set number of periods pehle ke TP ke darmiyan farq ko darust karta hai, aam tor par ek period hoti hai.

Calculation of RVI

Next, Smoothed Price Change (SPC) ko calculate kiya jata hai, jisme exponential moving average (EMA) ka istemaal kiya jata hai, jiska smoothing factor aam tor par 10 periods ke liye set hota hai, PC pe lagaya jata hai. Ye smoothing noise ko remove karta hai aur price changes ke asal trend ko highlight karta hai. Aakhir mein, RVI ko khud derive kiya jata hai jisme SPC ko SPC aur PC ke absolute values ka average divide kiya jata hai, phir 100 se multiply karke result ko percentage mein express kiya jata hai.

Interpreting RVI Signals

RVI signals ko interpret karna price movements ki relative strength aur unke market trends par hone wale asraat ko samajhna shamil hai. Agar RVI badh raha hai to ye yeh suggest karta hai ke bullish momentum strong ho raha hai, jo ke prices mein uptrend ka potential dikhata hai. Umgeer agar RVI gir raha hai jab prices badh rahe hain, to ye weak bullish momentum ya bearish pressures ki emergence ko indicate kar sakta hai, jo ke ek downtrend ko dikhata hai. Traders aksar dusre technical indicators ya price action se confirmatory signals dhoondte hain takay RVI-based signals ko validate kar sake aur informed trading decisions le sakein.

Combining RVI with Other Indicators

RVI ko effectively use karne ka ek ahem pehlu ye hai ke uske signals ko dusre indicators aur analytical tools ke saath mila kar dekha jaye. Misal ke taur par, traders RVI signals ko trend lines, support aur resistance levels, ya moving averages ke saath combine kar sakte hain takay market conditions ka ek mukammal view hasil kar sakein. Ye holistic approach traders ko noise ko filter karne mein madad karta hai aur multiple factors jo unke favor mein align hote hain unhe identify karne mein madad deta hai.

Using RVI for Trend Confirmation

Iske ilawa RVI ko market mein potential reversal points dhoondne ke liye istemaal kiya ja sakta hai. Jab RVI price action se diverge hota hai, jese ke jab prices continue kar rahi hoti hain magar RVI decline kar raha hai, to ye ek bearish divergence ko signal kar sakta hai aur ek possible trend reversal ko downside mein dikhata hai. Umgeer, bullish divergences, jahan prices gir rahi hoti hain magar RVI rise kar raha hai, ye ek potential bullish reversal ko indicate kar sakti hai. Yad rakhna zaroori hai ke jese ke har technical indicator, RVI bhi foolproof nahi hai aur ise dusri forms of analysis aur risk management strategies ke saath istemaal karna chahiye. Traders ko bhi consider karna chahiye ke wo kis timeframe mein trade kar rahe hain, kyunke RVI ka effectiveness market conditions aur price movements ki duration par depend karta hai jo analyze ki ja rahi hai.

Practical Applications of RVI in Trading

Amli tor par traders RVI ko apni trading decisions ko support karne ke liye mukhtalif tareeqon mein apply kar sakte hain. Ek common strategy hai ke RVI ko trend direction confirm karne ke liye use kiya jaye. Misal ke taur par, agar RVI prices ke saath rise kar raha hai to ye suggest karta hai ke bullish trend strong hai aur continue ho sakta hai. Umgeer, agar RVI decline kar raha hai jab ke prices rise kar rahe hain, to ye weak bullish momentum aur ek potential trend reversal ko dikhata hai. Traders divergences ko bhi dhoondte hain RVI aur price action ke darmiyan takay potential reversals ya market sentiment mein shifts ko anticipate kar sakein.

Ek aur tareeqa ye hai ke RVI ko ek trading system ka hissa banaya jaye jo ke mukhtalif indicators ko combine karta hai. Maslan, ek trader RVI ko moving averages aur volume analysis ke saath combine karke entry aur exit points ko confirm kar sakta hai. Jab multiple indicators align hote hain, ye ek stronger signal provide karta hai aur trade setup mein confidence ko increase karta hai.

Risk Management with RVI

Risk management ka hona zaroori hai jab RVI ya koi bhi technical indicator istemaal kiya jata hai. Traders ko apni risk tolerance ko define karna chahiye, stop-loss orders set karna chahiye, aur account size aur risk-reward preferences ke basis pe position sizing consider karna chahiye. Iske ilawa, wo regularly apne trading strategies ko review aur adjust karna chahiye market conditions aur performance metrics ke basis pe. Ye bhi zaroori hai ke RVI ki limitations ko samajhna. Jese ke har technical indicator, RVI bhi historical price data par based hai aur isliye lagging nature ka hai. Ye hamesha future price movements ko accurately predict nahi kar sakta, khaaskar jab market volatility ya unexpected news events hote hain. Traders ko RVI ko ek tool ke tor par use karna chahiye apne analytical toolkit mein aur changing market conditions ke liye adaptable rehna chahiye.

Relative Vigor Index (RVI) ek valuable technical indicator hai jo ke traders ko price movements ki strength assess karne mein madad karta hai aur financial markets mein potential trend reversals ko identify karne mein. RVI ko calculate karna, uske signals ko interpret karna, aur usay ek comprehensive trading strategy mein integrate karna samajhna traders ko informed decisions lene mein madad karta hai aur unki overall trading performance ko improve karta hai. Magar, zaroori hai ke RVI ko dusre indicators aur risk management techniques ke saath istemaal kiya jaye takay risks ko mitigate kiya ja sake aur trading effectiveness ko long term mein enhance kiya ja sake.

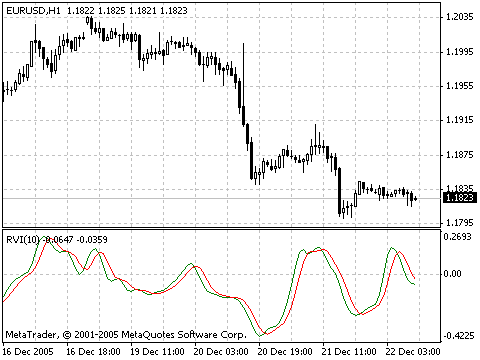

The Relative Vigor Index (RVI) ek technical analysis tool hai jo keematon ke harkaat ki taqat ya zor ko assess karne ke liye banaya gaya hai, khaaskar trading mein. John Ehlers ne isay develop kiya, jo ke momentum aur trend analysis ke elements ko combine karta hai takay market dynamics ka insight mil sake. RVI ka calculation kuch steps mein hota hai. Sab se pehle, Typical Price (TP) ko calculate kiya jata hai, jo ke 14 periods ke liye set hota hai aur high, low, aur closing prices ka average hota hai. Phir ye TP Price Change (PC) ko calculate karne ke liye istemaal hota hai, jo ke current TP aur ek set number of periods pehle ke TP ke darmiyan farq ko darust karta hai, aam tor par ek period hoti hai.

Calculation of RVI

Next, Smoothed Price Change (SPC) ko calculate kiya jata hai, jisme exponential moving average (EMA) ka istemaal kiya jata hai, jiska smoothing factor aam tor par 10 periods ke liye set hota hai, PC pe lagaya jata hai. Ye smoothing noise ko remove karta hai aur price changes ke asal trend ko highlight karta hai. Aakhir mein, RVI ko khud derive kiya jata hai jisme SPC ko SPC aur PC ke absolute values ka average divide kiya jata hai, phir 100 se multiply karke result ko percentage mein express kiya jata hai.

Interpreting RVI Signals

RVI signals ko interpret karna price movements ki relative strength aur unke market trends par hone wale asraat ko samajhna shamil hai. Agar RVI badh raha hai to ye yeh suggest karta hai ke bullish momentum strong ho raha hai, jo ke prices mein uptrend ka potential dikhata hai. Umgeer agar RVI gir raha hai jab prices badh rahe hain, to ye weak bullish momentum ya bearish pressures ki emergence ko indicate kar sakta hai, jo ke ek downtrend ko dikhata hai. Traders aksar dusre technical indicators ya price action se confirmatory signals dhoondte hain takay RVI-based signals ko validate kar sake aur informed trading decisions le sakein.

Combining RVI with Other Indicators

RVI ko effectively use karne ka ek ahem pehlu ye hai ke uske signals ko dusre indicators aur analytical tools ke saath mila kar dekha jaye. Misal ke taur par, traders RVI signals ko trend lines, support aur resistance levels, ya moving averages ke saath combine kar sakte hain takay market conditions ka ek mukammal view hasil kar sakein. Ye holistic approach traders ko noise ko filter karne mein madad karta hai aur multiple factors jo unke favor mein align hote hain unhe identify karne mein madad deta hai.

Using RVI for Trend Confirmation

Iske ilawa RVI ko market mein potential reversal points dhoondne ke liye istemaal kiya ja sakta hai. Jab RVI price action se diverge hota hai, jese ke jab prices continue kar rahi hoti hain magar RVI decline kar raha hai, to ye ek bearish divergence ko signal kar sakta hai aur ek possible trend reversal ko downside mein dikhata hai. Umgeer, bullish divergences, jahan prices gir rahi hoti hain magar RVI rise kar raha hai, ye ek potential bullish reversal ko indicate kar sakti hai. Yad rakhna zaroori hai ke jese ke har technical indicator, RVI bhi foolproof nahi hai aur ise dusri forms of analysis aur risk management strategies ke saath istemaal karna chahiye. Traders ko bhi consider karna chahiye ke wo kis timeframe mein trade kar rahe hain, kyunke RVI ka effectiveness market conditions aur price movements ki duration par depend karta hai jo analyze ki ja rahi hai.

Practical Applications of RVI in Trading

Amli tor par traders RVI ko apni trading decisions ko support karne ke liye mukhtalif tareeqon mein apply kar sakte hain. Ek common strategy hai ke RVI ko trend direction confirm karne ke liye use kiya jaye. Misal ke taur par, agar RVI prices ke saath rise kar raha hai to ye suggest karta hai ke bullish trend strong hai aur continue ho sakta hai. Umgeer, agar RVI decline kar raha hai jab ke prices rise kar rahe hain, to ye weak bullish momentum aur ek potential trend reversal ko dikhata hai. Traders divergences ko bhi dhoondte hain RVI aur price action ke darmiyan takay potential reversals ya market sentiment mein shifts ko anticipate kar sakein.

Ek aur tareeqa ye hai ke RVI ko ek trading system ka hissa banaya jaye jo ke mukhtalif indicators ko combine karta hai. Maslan, ek trader RVI ko moving averages aur volume analysis ke saath combine karke entry aur exit points ko confirm kar sakta hai. Jab multiple indicators align hote hain, ye ek stronger signal provide karta hai aur trade setup mein confidence ko increase karta hai.

Risk Management with RVI

Risk management ka hona zaroori hai jab RVI ya koi bhi technical indicator istemaal kiya jata hai. Traders ko apni risk tolerance ko define karna chahiye, stop-loss orders set karna chahiye, aur account size aur risk-reward preferences ke basis pe position sizing consider karna chahiye. Iske ilawa, wo regularly apne trading strategies ko review aur adjust karna chahiye market conditions aur performance metrics ke basis pe. Ye bhi zaroori hai ke RVI ki limitations ko samajhna. Jese ke har technical indicator, RVI bhi historical price data par based hai aur isliye lagging nature ka hai. Ye hamesha future price movements ko accurately predict nahi kar sakta, khaaskar jab market volatility ya unexpected news events hote hain. Traders ko RVI ko ek tool ke tor par use karna chahiye apne analytical toolkit mein aur changing market conditions ke liye adaptable rehna chahiye.

Relative Vigor Index (RVI) ek valuable technical indicator hai jo ke traders ko price movements ki strength assess karne mein madad karta hai aur financial markets mein potential trend reversals ko identify karne mein. RVI ko calculate karna, uske signals ko interpret karna, aur usay ek comprehensive trading strategy mein integrate karna samajhna traders ko informed decisions lene mein madad karta hai aur unki overall trading performance ko improve karta hai. Magar, zaroori hai ke RVI ko dusre indicators aur risk management techniques ke saath istemaal kiya jaye takay risks ko mitigate kiya ja sake aur trading effectiveness ko long term mein enhance kiya ja sake.

تبصرہ

Расширенный режим Обычный режим