Forex Trading Mein Slippage Ka Tajziya

Introduction:

Forex trading, jo kay dunia bhar mein popular hai, mein traders currencies ka exchange karte hain. Slippage ek common phenomenon hai jo traders ko affect karta hai. Is article mein hum slippage ke mutalliq Roman Urdu mein tajziya karenge.Forex trading mein slippage ek common aur natural phenomenon hai jo traders ko affect karta hai. Traders ko slippage ke nuqsanat se bachne ke liye apni strategies ko adapt karna zaroori hai aur reliable brokers ka chunav karna chahiye.

1. Slippage Kya Hai?

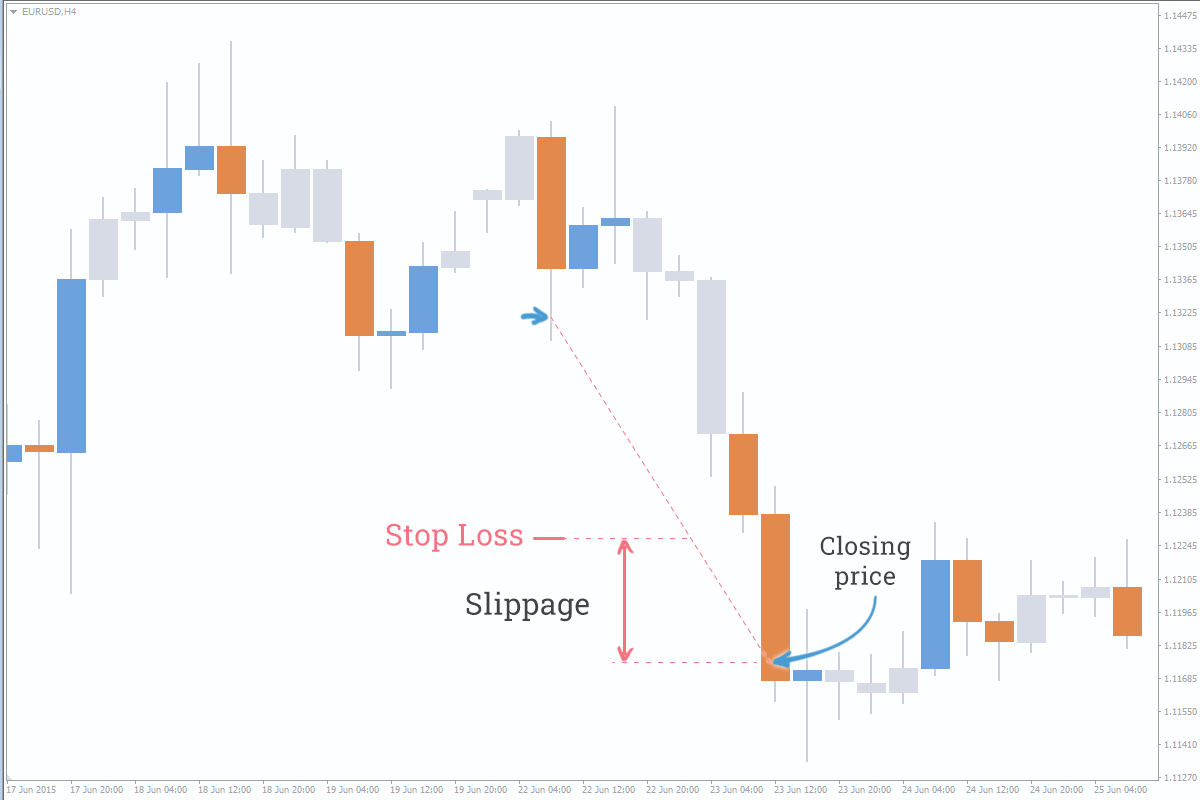

Slippage ek situation hai jab trader ka order execute hone mein expected price se difference hota hai.

Yeh difference usually volatility, market liquidity, aur broker execution speed se mutalliq hota hai.

2. Slippage Ki Wajah:

Jab market mein ziada volatility hoti hai, orders ko execute karne mein delays aur price variations ho sakte hain.

Lack of Liquidity:

Agar market mein kam liquidity hai, to large orders ko fill karne mein mushkil hoti hai, jis se slippage hota hai.

Broker Execution Speed:

Broker ki execution speed bhi slippage ka ek factor hai. Agar broker ki servers slow hain, to orders mein delays ho sakti hain.

Slippage Ke Nuqsanat:

Slippage se traders ko financial loss ho sakta hai, khas tor par jab large orders execute kiye jate hain.

Execution Issues:

Slippage ki wajah se traders ka order expected price se execute nahi ho pata, jis se unka trading strategy effect hoti hai.

Frustration:

Bar bar slippage ka samna karne se traders ka frustration barh jata hai.

Slippage Ko Control Kaise Karein:

Use Limit Orders:

Limit orders ka istemal karke traders slippage ko control kar sakte hain, kyun ke limit orders mein specified price par hi execute hota hai.

Monitoring Market Conditions:

Market ki conditions ko monitor karke, traders slippage ke chances ko kam kar sakte hain.

Choosing Reliable Brokers:

Ache aur reliable brokers ka chunav karke, traders apni slippage risk ko minimize kar sakte hain.

5. Slippage Ka Impact:

Scalping Strategies:

Slippage scalping strategies ko negatively affect karta hai, kyun ke scalping mein orders ki execution speed crucial hoti hai.

Long-Term Trading:

Long-term trading mein slippage ka impact kam hota hai, lekin large orders execute karne par bhi dhyan diya jana chahiye.

Introduction:

Forex trading, jo kay dunia bhar mein popular hai, mein traders currencies ka exchange karte hain. Slippage ek common phenomenon hai jo traders ko affect karta hai. Is article mein hum slippage ke mutalliq Roman Urdu mein tajziya karenge.Forex trading mein slippage ek common aur natural phenomenon hai jo traders ko affect karta hai. Traders ko slippage ke nuqsanat se bachne ke liye apni strategies ko adapt karna zaroori hai aur reliable brokers ka chunav karna chahiye.

1. Slippage Kya Hai?

Slippage ek situation hai jab trader ka order execute hone mein expected price se difference hota hai.

Yeh difference usually volatility, market liquidity, aur broker execution speed se mutalliq hota hai.

2. Slippage Ki Wajah:

Jab market mein ziada volatility hoti hai, orders ko execute karne mein delays aur price variations ho sakte hain.

Lack of Liquidity:

Agar market mein kam liquidity hai, to large orders ko fill karne mein mushkil hoti hai, jis se slippage hota hai.

Broker Execution Speed:

Broker ki execution speed bhi slippage ka ek factor hai. Agar broker ki servers slow hain, to orders mein delays ho sakti hain.

Slippage Ke Nuqsanat:

Slippage se traders ko financial loss ho sakta hai, khas tor par jab large orders execute kiye jate hain.

Execution Issues:

Slippage ki wajah se traders ka order expected price se execute nahi ho pata, jis se unka trading strategy effect hoti hai.

Frustration:

Bar bar slippage ka samna karne se traders ka frustration barh jata hai.

Slippage Ko Control Kaise Karein:

Use Limit Orders:

Limit orders ka istemal karke traders slippage ko control kar sakte hain, kyun ke limit orders mein specified price par hi execute hota hai.

Monitoring Market Conditions:

Market ki conditions ko monitor karke, traders slippage ke chances ko kam kar sakte hain.

Choosing Reliable Brokers:

Ache aur reliable brokers ka chunav karke, traders apni slippage risk ko minimize kar sakte hain.

5. Slippage Ka Impact:

Scalping Strategies:

Slippage scalping strategies ko negatively affect karta hai, kyun ke scalping mein orders ki execution speed crucial hoti hai.

Long-Term Trading:

Long-term trading mein slippage ka impact kam hota hai, lekin large orders execute karne par bhi dhyan diya jana chahiye.

تبصرہ

Расширенный режим Обычный режим