Kya Hai Relative Vigor Index?

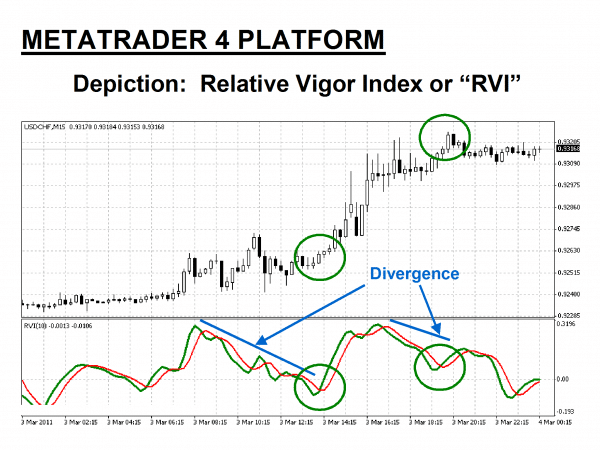

Relative Vigor Index (RVI) ek technical analysis indicator hai jo traders aur investors ko market trends aur momentum ke baray mein maloomat faraham karta hai. Yeh indicator, market ke current price aur uske previous prices ke beech ki taqat ka andaza lagane mein madad karta hai.Relative Vigor Index, market trends aur momentum ke baray mein maloomat faraham karta hai. Yeh indicator, traders aur investors ko trend confirmation aur momentum analysis mein madad karta hai. Relative Vigor Index ki keemat -1 se +1 tak hoti hai aur iska istemal market analysis ke mukhtalif pehluon par kiya ja sakta hai.

Relative Vigor Index Ka Tareeqa-e-Kar.

Relative Vigor Index, market ke current price aur uske previous prices ke darmiyan ka farq nikaalta hai. Yeh indicator, do tareeqon se calculate kiya ja sakta hai.

Relative Vigor Index Ka Istemal.

Relative Vigor Index, traders aur investors ko market ki taqat aur momentum ka andaza lagane mein madad karta hai. Yeh indicator, do tarah se istemal kiya ja sakta hai.

Relative Vigor Index Ki Keemat.

Relative Vigor Index ki keemat -1 se +1 tak hoti hai. Agar RVI ki value +1 ke qareeb hai, to yeh strong bullish trend ko darust karti hai. Agar RVI ki value -1 ke qareeb hai, to yeh strong bearish trend ko darust karti hai.

Relative Vigor Index Ka Istemal Kaise Karein.

Relative Vigor Index ka istemal karne ke liye, traders aur investors ko do asoolon ka khayal rakhna chahiye.

Relative Vigor Index Ka Istemal Karne Se Pehle Dheyan Dene Wale Masail.

Relative Vigor Index ka istemal karne se pehle, traders aur investors ko yeh dheyan mein rakhna chahiye.

Relative Vigor Index Ke Fayde aur Nuksan

Relative Vigor Index ke istemal ke fayde aur nuksan hain.

Relative Vigor Index Ka Istemal Karne Ki Salahiyat .

Relative Vigor Index ka istemal karne ke liye, traders aur investors ko market trends aur momentum ke saath sahih analysis karne ki salahiyat honi chahiye. Iske ilawa, dusre technical indicators aur analysis ke saath iska istemal karke sahih tajziye kiya ja sakta hai.

Relative Vigor Index (RVI) ek technical analysis indicator hai jo traders aur investors ko market trends aur momentum ke baray mein maloomat faraham karta hai. Yeh indicator, market ke current price aur uske previous prices ke beech ki taqat ka andaza lagane mein madad karta hai.Relative Vigor Index, market trends aur momentum ke baray mein maloomat faraham karta hai. Yeh indicator, traders aur investors ko trend confirmation aur momentum analysis mein madad karta hai. Relative Vigor Index ki keemat -1 se +1 tak hoti hai aur iska istemal market analysis ke mukhtalif pehluon par kiya ja sakta hai.

Relative Vigor Index Ka Tareeqa-e-Kar.

Relative Vigor Index, market ke current price aur uske previous prices ke darmiyan ka farq nikaalta hai. Yeh indicator, do tareeqon se calculate kiya ja sakta hai.

- Close-Close Method: Is method mein, RVI ko current price aur previous price ke darmiyan ka farq ke tajziye se calculate kiya jata hai.

- High-Low Method: Is method mein, RVI ko high price aur low price ke darmiyan ka farq ke tajziye se calculate kiya jata hai.

Relative Vigor Index Ka Istemal.

Relative Vigor Index, traders aur investors ko market ki taqat aur momentum ka andaza lagane mein madad karta hai. Yeh indicator, do tarah se istemal kiya ja sakta hai.

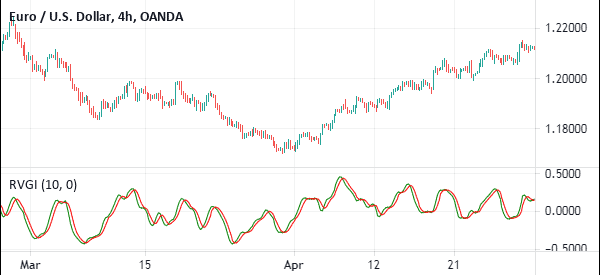

- Trend Confirmation: RVI, trend ka confirmation faraham karta hai. Agar RVI ki value positive hai, to yeh bullish trend ko indicate karta hai. Agar RVI ki value negative hai, to yeh bearish trend ko indicate karta hai.

- Momentum Analysis: RVI, market ki momentum ko measure karne mein madad karta hai. Agar RVI ki value bara hai, to yeh strong buying pressure ko darust karti hai. Agar RVI ki value choti hai, to yeh strong selling pressure ko darust karti hai.

Relative Vigor Index Ki Keemat.

Relative Vigor Index ki keemat -1 se +1 tak hoti hai. Agar RVI ki value +1 ke qareeb hai, to yeh strong bullish trend ko darust karti hai. Agar RVI ki value -1 ke qareeb hai, to yeh strong bearish trend ko darust karti hai.

Relative Vigor Index Ka Istemal Kaise Karein.

Relative Vigor Index ka istemal karne ke liye, traders aur investors ko do asoolon ka khayal rakhna chahiye.

- Trend Analysis: RVI ko trend analysis ke liye istemal kiya ja sakta hai. Agar RVI ki value positive hai, to yeh bullish trend ko confirm karti hai. Agar RVI ki value negative hai, to yeh bearish trend ko confirm karti hai.

- Momentum Confirmation: RVI ko momentum confirmation ke liye istemal kiya ja sakta hai. Agar RVI ki value bara hai aur price bhi bara hai, to yeh strong buying pressure ko darust karta hai. Agar RVI ki value choti hai aur price bhi choti hai, to yeh strong selling pressure ko darust karta hai.

Relative Vigor Index Ka Istemal Karne Se Pehle Dheyan Dene Wale Masail.

Relative Vigor Index ka istemal karne se pehle, traders aur investors ko yeh dheyan mein rakhna chahiye.

- Lagging Indicator: Relative Vigor Index, market ke previous prices ke based par calculate hota hai, is liye yeh lagging indicator hai aur kuch waqt ka intezar karna pad sakta hai.

- Confirmation: RVI ko dusre indicators aur analysis ke saath istemal karke confirm karna chahiye taake sahih tajziye kiya ja sake.

Relative Vigor Index Ke Fayde aur Nuksan

Relative Vigor Index ke istemal ke fayde aur nuksan hain.

- Fayde:

- Trend confirmation aur momentum analysis ke liye mufeed hai.

- Market ki taqat aur weakness ko samajhne mein madad karta hai.

- Nuksan:

- Lagging nature ki wajah se, kabhi kabhi sahih tajziye mein deri ho sakti hai.

- Iska istemal sirf doosre indicators aur analysis ke saath confirm kiya ja sakta hai.

Relative Vigor Index Ka Istemal Karne Ki Salahiyat .

Relative Vigor Index ka istemal karne ke liye, traders aur investors ko market trends aur momentum ke saath sahih analysis karne ki salahiyat honi chahiye. Iske ilawa, dusre technical indicators aur analysis ke saath iska istemal karke sahih tajziye kiya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим