TRADING ANALYSIS OF RENKO CHART PATTERN IN FOREX

Renko chart pattern forex mein ek aham charting technique hai jo traditional candlestick charts se mukhtalif hai. Ismein price movement ko bricks ya blocks ke roop mein darust karte hain, jo ki fixed price increments ya decrements par base hote hain. Renko chart ek unique charting method hai jismein har naye brick ka size pehle se tay hota hai, na ke time ya volume ke basis par. Har brick ko trend ko represent karta hai, jisse traders ko price action ki clear understanding hoti hai.

CREATIONS OF RENKO BRICK

Har naya brick tab banata hai jab price predefined amount move karta hai. Agar price upar jaata hai, toh naya brick upar ki taraf add hota hai, aur agar price neeche jaata hai, toh brick neeche ki taraf add hota hai.

RENKO CHART ADVANTAGES

Renko charts trends ko asani se identify karne mein madad karte hain, kyun ke har brick ek trend ki clear representation hai.

REJECTED FALSE SIGNALS

Traditional charts mein noise ya false signals ka samna hota hai, lekin Renko charts mein yeh kam hota hai, kyun ke sirf significant price movements hi consider kiye jaate hain.

ENTRY AND EXIT POINTS

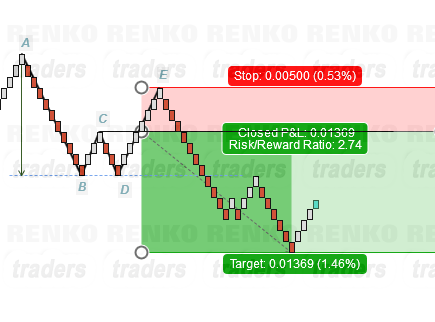

Renko charts traders ko entry aur exit points ka clear pata dete hain, kyun ke trend changes ko asani se dekha ja sakta hai.

UNDERSTANDING OF VOLATILITY

Renko charts volatility ko samajhne mein madad karte hain, kyun ke bricks ke size volatility ko darust darust reflect karte hain.

ANALYSIS TREND OF RENKO CHART

Renko charts ko trend analysis aur price action ke liye istemal kiya jaata hai. Ismein short-term aur long-term trends ko asani se samjha ja sakta hai, aur traders ko clear entry aur exit points milte hain. Renko charts ke istemal se noise kam hoti hai aur price movements ko clearly dekha ja sakta hai, jo ki trading decisions ko improve karta hai.

Renko chart pattern forex mein ek aham charting technique hai jo traditional candlestick charts se mukhtalif hai. Ismein price movement ko bricks ya blocks ke roop mein darust karte hain, jo ki fixed price increments ya decrements par base hote hain. Renko chart ek unique charting method hai jismein har naye brick ka size pehle se tay hota hai, na ke time ya volume ke basis par. Har brick ko trend ko represent karta hai, jisse traders ko price action ki clear understanding hoti hai.

CREATIONS OF RENKO BRICK

Har naya brick tab banata hai jab price predefined amount move karta hai. Agar price upar jaata hai, toh naya brick upar ki taraf add hota hai, aur agar price neeche jaata hai, toh brick neeche ki taraf add hota hai.

RENKO CHART ADVANTAGES

Renko charts trends ko asani se identify karne mein madad karte hain, kyun ke har brick ek trend ki clear representation hai.

REJECTED FALSE SIGNALS

Traditional charts mein noise ya false signals ka samna hota hai, lekin Renko charts mein yeh kam hota hai, kyun ke sirf significant price movements hi consider kiye jaate hain.

ENTRY AND EXIT POINTS

Renko charts traders ko entry aur exit points ka clear pata dete hain, kyun ke trend changes ko asani se dekha ja sakta hai.

UNDERSTANDING OF VOLATILITY

Renko charts volatility ko samajhne mein madad karte hain, kyun ke bricks ke size volatility ko darust darust reflect karte hain.

ANALYSIS TREND OF RENKO CHART

Renko charts ko trend analysis aur price action ke liye istemal kiya jaata hai. Ismein short-term aur long-term trends ko asani se samjha ja sakta hai, aur traders ko clear entry aur exit points milte hain. Renko charts ke istemal se noise kam hoti hai aur price movements ko clearly dekha ja sakta hai, jo ki trading decisions ko improve karta hai.

تبصرہ

Расширенный режим Обычный режим