Bull Trap.

Bull trap mein trading karne se pehle, samajhdaari se qadam uthana zaroori hai. Yeh ek market phenomenon hai jahan investors ko ek jhooti umeed di jati hai ke market mein upar jaane wale hai, lekin asal mein, yeh sirf ek temporary rally hoti hai.

Bull Trap Kya Hai.

Bull trap wo hoti hai jab market mein ek false signal diya jata hai ke prices upar jayenge, lekin baad mein prices neeche gir jaate hain. Yeh typically tab hota hai jab market ke upar trend mein halka sa change aata hai aur investors ko lagta hai ke market upar ja raha hai.

Bull Trap Conditions.

Bull trap conditions mein trading karte waqt, kuch important factors hote hain jo traders ko samajhna zaroori hai:

Overbought Markets

Market overbought ho ya phir bahut zyada high levels par ho, to yeh ek bull trap ke liye fertile ground banata hai. Overbought markets mein, prices ki upar wale movement mein exhaustion hoti hai, jo baad mein ek sharp reversal ke liye jagah banati hai.

Weak Fundamentals.

Agar market ke fundamentals strong nahi hain aur sirf technical indicators par rely kiya ja raha hai, to yeh ek bull trap ke liye aur bhi zyada susceptible ho sakta hai. Weak fundamentals, jaise ke kam earnings growth ya economic instability, ek false bullish signal create kar sakte hain.

Low Volume Trading & False Breakouts.

Kabhi kabhi bull trap conditions mein trading low volume par hoti hai, jo ek indicator ho sakta hai ke actual market sentiment weak hai. Low volume trading mein, ek chhota sa movement bhi prices ko manipulate kar sakta hai,

jisse investors ko trap kiya ja sakta hai.

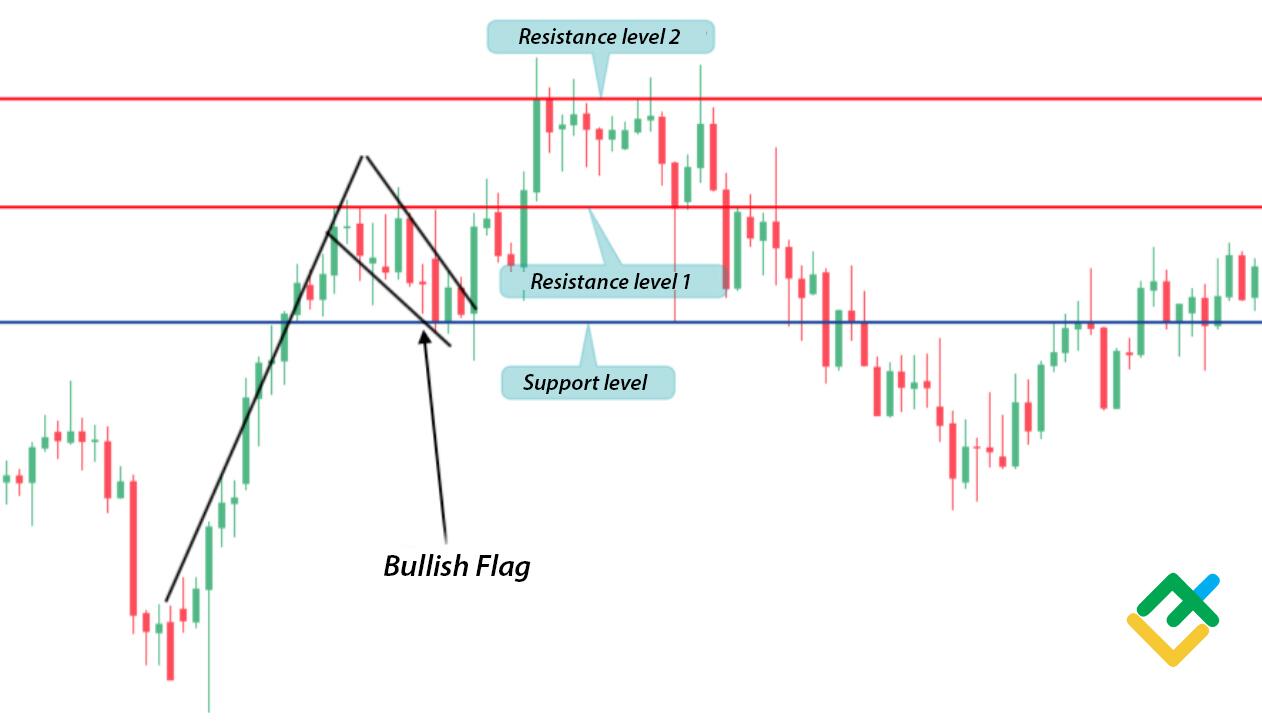

False breakouts, jahan ke price ek resistance level ko breach karta hai lekin phir se neeche aata hai, ek clear indication ho sakte hain ke bull trap ho sakta hai. Traders ko false breakouts par alert rehna chahiye aur confirmatory signals ka wait karna chahiye.

Bull trap mein trading karne se pehle, samajhdaari se qadam uthana zaroori hai. Yeh ek market phenomenon hai jahan investors ko ek jhooti umeed di jati hai ke market mein upar jaane wale hai, lekin asal mein, yeh sirf ek temporary rally hoti hai.

Bull Trap Kya Hai.

Bull trap wo hoti hai jab market mein ek false signal diya jata hai ke prices upar jayenge, lekin baad mein prices neeche gir jaate hain. Yeh typically tab hota hai jab market ke upar trend mein halka sa change aata hai aur investors ko lagta hai ke market upar ja raha hai.

Bull Trap Conditions.

Bull trap conditions mein trading karte waqt, kuch important factors hote hain jo traders ko samajhna zaroori hai:

Overbought Markets

Market overbought ho ya phir bahut zyada high levels par ho, to yeh ek bull trap ke liye fertile ground banata hai. Overbought markets mein, prices ki upar wale movement mein exhaustion hoti hai, jo baad mein ek sharp reversal ke liye jagah banati hai.

Weak Fundamentals.

Agar market ke fundamentals strong nahi hain aur sirf technical indicators par rely kiya ja raha hai, to yeh ek bull trap ke liye aur bhi zyada susceptible ho sakta hai. Weak fundamentals, jaise ke kam earnings growth ya economic instability, ek false bullish signal create kar sakte hain.

Low Volume Trading & False Breakouts.

Kabhi kabhi bull trap conditions mein trading low volume par hoti hai, jo ek indicator ho sakta hai ke actual market sentiment weak hai. Low volume trading mein, ek chhota sa movement bhi prices ko manipulate kar sakta hai,

jisse investors ko trap kiya ja sakta hai.

False breakouts, jahan ke price ek resistance level ko breach karta hai lekin phir se neeche aata hai, ek clear indication ho sakte hain ke bull trap ho sakta hai. Traders ko false breakouts par alert rehna chahiye aur confirmatory signals ka wait karna chahiye.

تبصرہ

Расширенный режим Обычный режим