RSI Trading Strategy in Forex Trading.

Introduction.

Forex trading mein RSI (Relative Strength Index) ek aham tool hai jo market trends aur momentum ko analyze karne mein istemal hota hai. Yeh strategy traders ko market mein mukhtalif entry aur exit points pe guide karta hai. Neeche diye gaye Roman Urdu mein RSI trading strategy ko samjha jaye ga.RSI ek technical indicator hai jo market ke overbought aur oversold conditions ko detect karta hai. Yeh 0 se 100 tak ka range hota hai aur typically 70 se zyada overbought aur 30 se kam oversold conditions ko darust karta hai.

RSI Trading Strategy ki Bunyadi Tassawurat.

RSI trading strategy ka bunyadi concept yeh hai ke jab RSI overbought ya oversold zone mein enter hota hai, to market mein reversal hone ka imkan hota hai. Is strategy mein traders RSI ki readings ko istemal kar ke potential entry aur exit points tay karte hain.

Entry Points in RSI.

Stop Loss aur Take Profit.

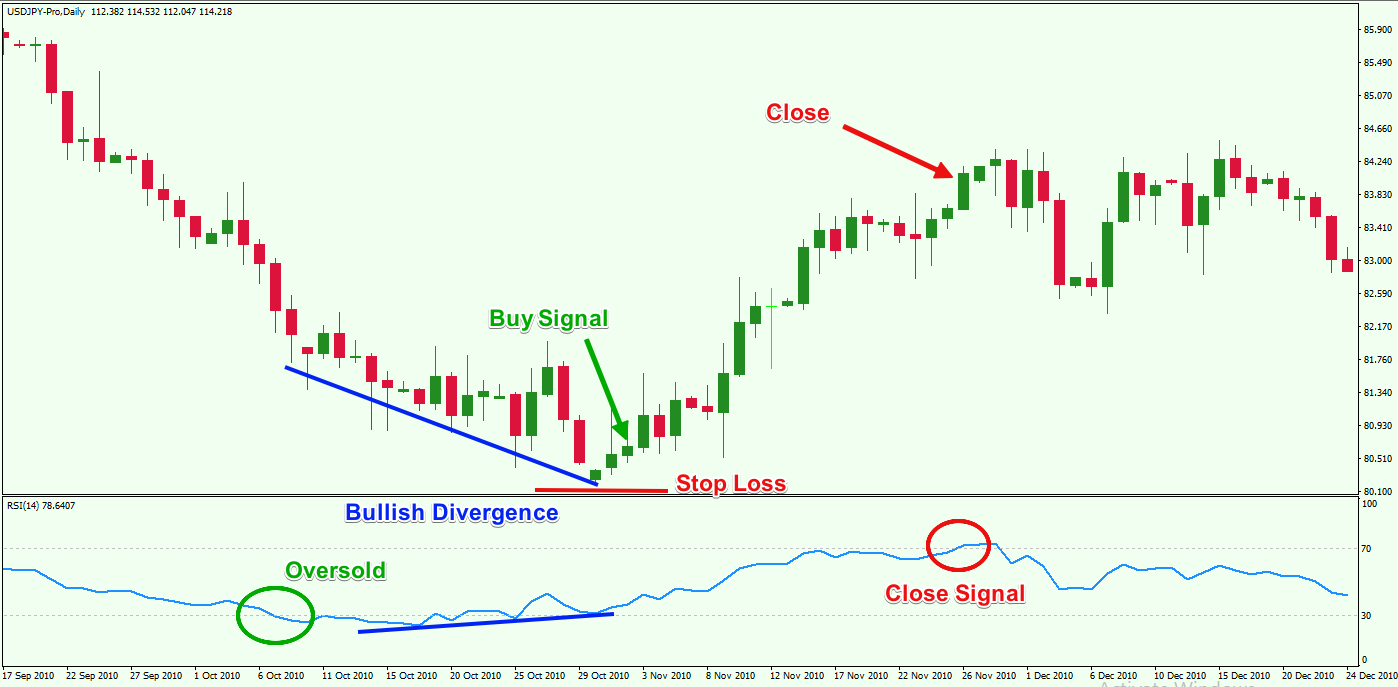

Stop loss aur take profit levels tay karna RSI trading strategy mein zaroori hai taake loss ko minimize kiya ja sake aur profit ko maximize kiya ja sake. Traders ko apne trades ke liye munasib stop loss aur take profit levels tay karna chahiye taake risk ko manage kiya ja sake.

Divergence.

Divergence RSI trading strategy mein bhi ek ahem concept hai. Agar price aur RSI ke darmiyan koi farq hota hai, toh yeh divergence kehte hain aur isay market reversal ka potential signal samjha jata hai.

RSI Trading Strateg.

Ek misaal ke tor par, agar RSI 70 ke upar hai aur price bhi upar ja rahi hai, toh yeh indicate kar sakta hai ke market overbought hai aur downward movement ka imkan hai. Is situation mein, trader sell kar sakta hai aur stop loss aur take profit levels ko tay kar sakta hai.

RSI Trading Strategy ke Faide aur Nuqsanat.

RSI Trading Strategy ki Mehfoozat.

RSI trading strategy ko safar karte waqt mehfooz rakna zaroori hai. Iske liye traders ko apne risk management ke principles ko follow karna chahiye aur sirf RSI ki readings par pura bharosa na karna. Dusre technical indicators aur market analysis tools ko bhi istemal karna zaroori hai.

Introduction.

Forex trading mein RSI (Relative Strength Index) ek aham tool hai jo market trends aur momentum ko analyze karne mein istemal hota hai. Yeh strategy traders ko market mein mukhtalif entry aur exit points pe guide karta hai. Neeche diye gaye Roman Urdu mein RSI trading strategy ko samjha jaye ga.RSI ek technical indicator hai jo market ke overbought aur oversold conditions ko detect karta hai. Yeh 0 se 100 tak ka range hota hai aur typically 70 se zyada overbought aur 30 se kam oversold conditions ko darust karta hai.

RSI Trading Strategy ki Bunyadi Tassawurat.

RSI trading strategy ka bunyadi concept yeh hai ke jab RSI overbought ya oversold zone mein enter hota hai, to market mein reversal hone ka imkan hota hai. Is strategy mein traders RSI ki readings ko istemal kar ke potential entry aur exit points tay karte hain.

Entry Points in RSI.

- Overbought Zone (70 se zyada RSI): Jab RSI 70 se zyada ho jata hai, toh yeh indicate karta hai ke market overbought ho chuki hai aur downward movement ka imkan hai. Traders is situation mein sell karne ki strategy istemal karte hain.

- Oversold Zone (30 se kam RSI): Agar RSI 30 se kam ho jata hai, toh yeh indicate karta hai ke market oversold ho chuki hai aur upward movement ka imkan hai. Traders is situation mein buy karne ki strategy istemal karte hain.

Stop Loss aur Take Profit.

Stop loss aur take profit levels tay karna RSI trading strategy mein zaroori hai taake loss ko minimize kiya ja sake aur profit ko maximize kiya ja sake. Traders ko apne trades ke liye munasib stop loss aur take profit levels tay karna chahiye taake risk ko manage kiya ja sake.

Divergence.

Divergence RSI trading strategy mein bhi ek ahem concept hai. Agar price aur RSI ke darmiyan koi farq hota hai, toh yeh divergence kehte hain aur isay market reversal ka potential signal samjha jata hai.

RSI Trading Strateg.

Ek misaal ke tor par, agar RSI 70 ke upar hai aur price bhi upar ja rahi hai, toh yeh indicate kar sakta hai ke market overbought hai aur downward movement ka imkan hai. Is situation mein, trader sell kar sakta hai aur stop loss aur take profit levels ko tay kar sakta hai.

RSI Trading Strategy ke Faide aur Nuqsanat.

- Faide:

- Asan istemal aur samajhne mein asani.

- Market trends aur momentum ko analyze karne mein madadgar.

- Potential entry aur exit points tay karne mein madadgar.

- Nuqsanat:

- False signals ka samna karna.

- Sirf RSI pe pura bharosa na karna, doosre technical indicators ke saath istemal karna zaroori hai.

- Market conditions ke tabadlaat ka dhuayan dena zaroori hai.

RSI Trading Strategy ki Mehfoozat.

RSI trading strategy ko safar karte waqt mehfooz rakna zaroori hai. Iske liye traders ko apne risk management ke principles ko follow karna chahiye aur sirf RSI ki readings par pura bharosa na karna. Dusre technical indicators aur market analysis tools ko bhi istemal karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим