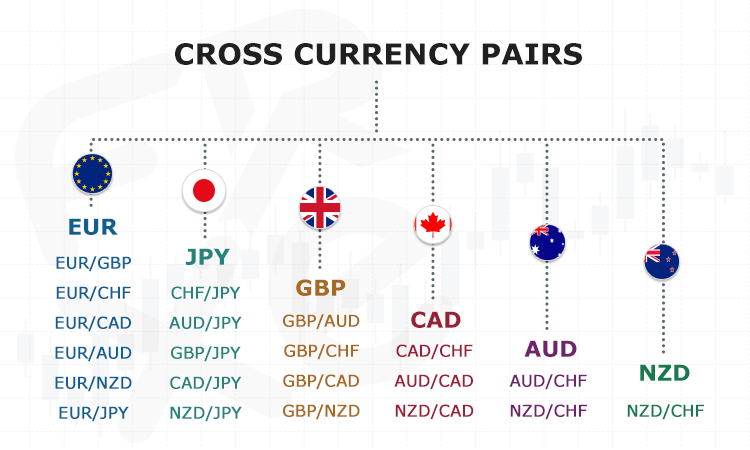

Cross Currency Pairs in Forex .

Forex mein cross currency pair ka matlab hota hai do mukhtalif currency pairs ke beech kaam karna. Ye pairs USD ke bina hotay hain. Cross currency pair mein aam taur par USD ki koi value nahi hoti hai, isliye inhein non-USD pairs bhi kaha jata hai.

Cross currency pair mein do mukhtalif currencies ka pair hota hai jo USD ke bina kaam karta hai. Jaisay ke GBP/JPY, EUR/JPY, EUR/GBP, AUD/CAD, AUD/JPY, CHF/JPY, etc. In pairs mein do mukhtalif currencies hoti hain jin ke beech kaam karna hota hai.

Cross Currency Pair Importance.

Cross currency pair ki importance isliye hoti hai ke in pairs mein trading karne se traders ko USD ki value ka koi effect nahi hota.

Isliye, traders ko currency rates ke fluctuations ko samajhna aur analyze karna hota hai. Cross currency pair mein trading karne se traders ko zyada profit mil sakta hai.

Cross Currency Pair Trading method.

Cross currency pair mein trading ka tareeqa USD pairs ke mutabiq hi hota hai. Traders ko currency rates ki analysis karni hoti hai aur inke trends ko samajhna hota ha

Jaisay hi traders ko pata chalta hai ke kis currency ka rate increase ho raha hai aur kis ka decrease, wo us currency pair mein invest karta hai jis mein usko zyada profit mil sakta hai.

Key Facts of Cross Curriency pairs.

In conclusion, cross currency pair forex mein trading ka ek aham hissa hai. Ye pairs USD ke bina kaam karte hain aur traders ko currency rates ke fluctuations ko samajhna hota hai. Cross currency pair mein trading karne se traders ko zyada profit mil sakta hai.

Forex mein cross currency pair ka matlab hota hai do mukhtalif currency pairs ke beech kaam karna. Ye pairs USD ke bina hotay hain. Cross currency pair mein aam taur par USD ki koi value nahi hoti hai, isliye inhein non-USD pairs bhi kaha jata hai.

Cross currency pair mein do mukhtalif currencies ka pair hota hai jo USD ke bina kaam karta hai. Jaisay ke GBP/JPY, EUR/JPY, EUR/GBP, AUD/CAD, AUD/JPY, CHF/JPY, etc. In pairs mein do mukhtalif currencies hoti hain jin ke beech kaam karna hota hai.

Cross Currency Pair Importance.

Cross currency pair ki importance isliye hoti hai ke in pairs mein trading karne se traders ko USD ki value ka koi effect nahi hota.

Isliye, traders ko currency rates ke fluctuations ko samajhna aur analyze karna hota hai. Cross currency pair mein trading karne se traders ko zyada profit mil sakta hai.

Cross Currency Pair Trading method.

Cross currency pair mein trading ka tareeqa USD pairs ke mutabiq hi hota hai. Traders ko currency rates ki analysis karni hoti hai aur inke trends ko samajhna hota ha

Jaisay hi traders ko pata chalta hai ke kis currency ka rate increase ho raha hai aur kis ka decrease, wo us currency pair mein invest karta hai jis mein usko zyada profit mil sakta hai.

Key Facts of Cross Curriency pairs.

In conclusion, cross currency pair forex mein trading ka ek aham hissa hai. Ye pairs USD ke bina kaam karte hain aur traders ko currency rates ke fluctuations ko samajhna hota hai. Cross currency pair mein trading karne se traders ko zyada profit mil sakta hai.

تبصرہ

Расширенный режим Обычный режим