Average True Range Indicator Introduction.

Average True Range (ATR) ek technical indicator hai jo market volatility ko measure karta hai. Yeh indicator traders ko market ke movement ke potential levels ko samajhne mein madad karta hai. Is article mein hum dekhenge kis tarah se ATR indicator ka istemal karke trading ki strategy ko improve kiya ja sakta hai.

Average True Range (ATR) traders ko market volatility ko samajhne mein madad karta hai. Iska istemal karke traders apne trading strategies ko improve kar sakte hain aur market ke movements ko better analyze kar sakte hain. Lekin, traders ko ATR ki limitations ko bhi samajhna zaroori hai taaki woh sahi decisions le sakein.

Purpose of ATR Indicator.

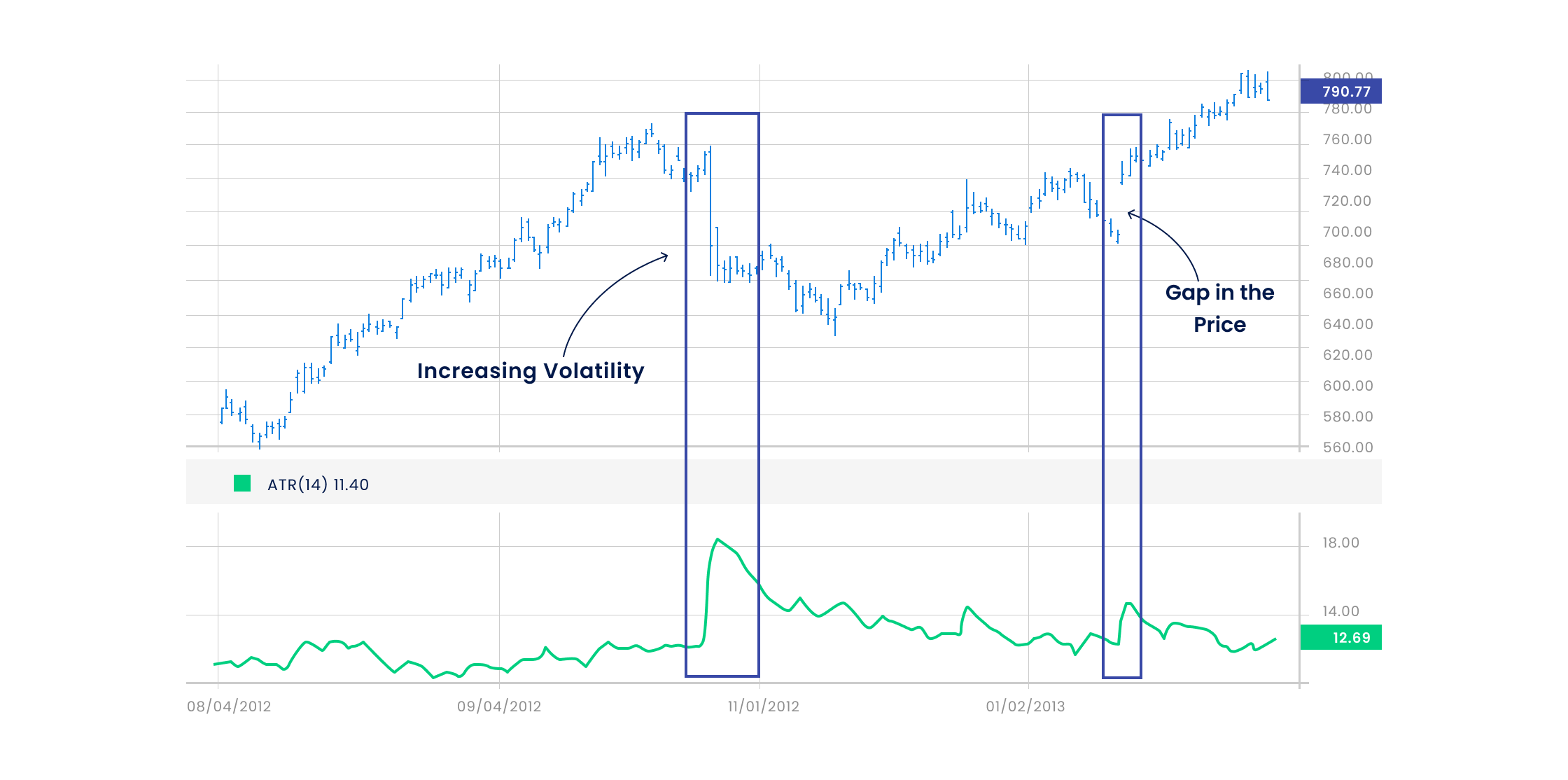

ATR indicator market volatility ko measure karta hai. Iski value price movements ke range ko darust karta hai. Jitni zyada ATR value, utni zyada volatility hoti hai aur vice versa.

Calculations of ATR Indicator.

ATR ka calculation previous periods ki price movements se hota hai. Isme price ke high, low aur close ko consider kiya jata hai. ATR ki value usually pips mein hoti hai.ATR indicator traders ko market ki volatility ko samajhne mein madad karta hai. Iske zariye traders market ke expected range ko estimate kar sakte hain. Isse stop loss levels aur position sizes determine karne mein bhi help milti hai.

ATR Trading Strategy.

ATR indicator ko trading strategy mein integrate karne ke liye kuch steps hain:

Sabse pehle, ATR ki current value ko analyze karein. Agar ATR ki value zyada hai, to market mein zyada volatility hai aur traders ko apne positions ke liye zyada buffer dena chahiye aur aap ko btata chaloon kay yea ATR ki value ko use karke stop loss levels determine karein. ATR ki value se multiply karke, traders apne positions ke liye appropriate stop loss levels set kar sakte hain. Jitni zyada volatility, utna zyada stop loss ka distance hona chahiye.

Entry Points Selection.

ATR ki value ko istemal karke entry points select karein. Jab market volatility zyada ho, tab traders ko entry points ko adjust kar lena chahiye. High volatility mein, entry points ko thoda dur set karna advisable hota hai.

Suppose, ATR ki current value 50 pips hai aur aap EUR/USD pair par trading kar rahe hain. Agar aapne ek long position enter kiya hai, to aap apna stop loss level set karte waqt ATR ki value ko consider karenge. Agar aap chahte hain ke stop loss level market volatility ke according set ho, to aap ATR ki value se multiply karke stop loss level set kar sakte hain. For example, agar aap ATR ki value ko 2 se multiply karte hain, to aapka stop loss level 100 pips distance par hoga.

Average True Range (ATR) ek technical indicator hai jo market volatility ko measure karta hai. Yeh indicator traders ko market ke movement ke potential levels ko samajhne mein madad karta hai. Is article mein hum dekhenge kis tarah se ATR indicator ka istemal karke trading ki strategy ko improve kiya ja sakta hai.

Average True Range (ATR) traders ko market volatility ko samajhne mein madad karta hai. Iska istemal karke traders apne trading strategies ko improve kar sakte hain aur market ke movements ko better analyze kar sakte hain. Lekin, traders ko ATR ki limitations ko bhi samajhna zaroori hai taaki woh sahi decisions le sakein.

Purpose of ATR Indicator.

ATR indicator market volatility ko measure karta hai. Iski value price movements ke range ko darust karta hai. Jitni zyada ATR value, utni zyada volatility hoti hai aur vice versa.

Calculations of ATR Indicator.

ATR ka calculation previous periods ki price movements se hota hai. Isme price ke high, low aur close ko consider kiya jata hai. ATR ki value usually pips mein hoti hai.ATR indicator traders ko market ki volatility ko samajhne mein madad karta hai. Iske zariye traders market ke expected range ko estimate kar sakte hain. Isse stop loss levels aur position sizes determine karne mein bhi help milti hai.

ATR Trading Strategy.

ATR indicator ko trading strategy mein integrate karne ke liye kuch steps hain:

Sabse pehle, ATR ki current value ko analyze karein. Agar ATR ki value zyada hai, to market mein zyada volatility hai aur traders ko apne positions ke liye zyada buffer dena chahiye aur aap ko btata chaloon kay yea ATR ki value ko use karke stop loss levels determine karein. ATR ki value se multiply karke, traders apne positions ke liye appropriate stop loss levels set kar sakte hain. Jitni zyada volatility, utna zyada stop loss ka distance hona chahiye.

Entry Points Selection.

ATR ki value ko istemal karke entry points select karein. Jab market volatility zyada ho, tab traders ko entry points ko adjust kar lena chahiye. High volatility mein, entry points ko thoda dur set karna advisable hota hai.

Suppose, ATR ki current value 50 pips hai aur aap EUR/USD pair par trading kar rahe hain. Agar aapne ek long position enter kiya hai, to aap apna stop loss level set karte waqt ATR ki value ko consider karenge. Agar aap chahte hain ke stop loss level market volatility ke according set ho, to aap ATR ki value se multiply karke stop loss level set kar sakte hain. For example, agar aap ATR ki value ko 2 se multiply karte hain, to aapka stop loss level 100 pips distance par hoga.

تبصرہ

Расширенный режим Обычный режим