Introduction To The Piercing Line Candlestick Pattern:

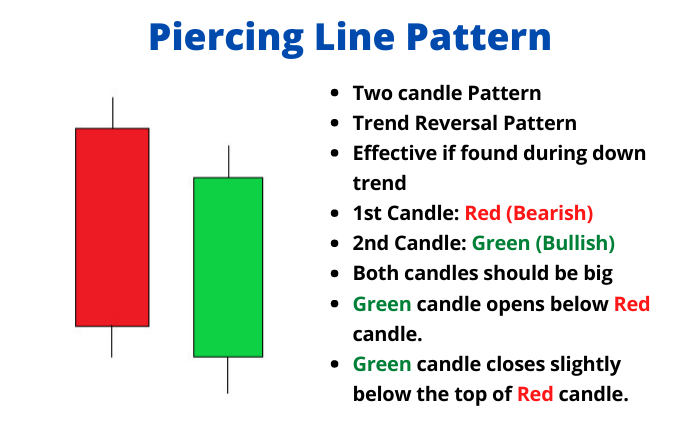

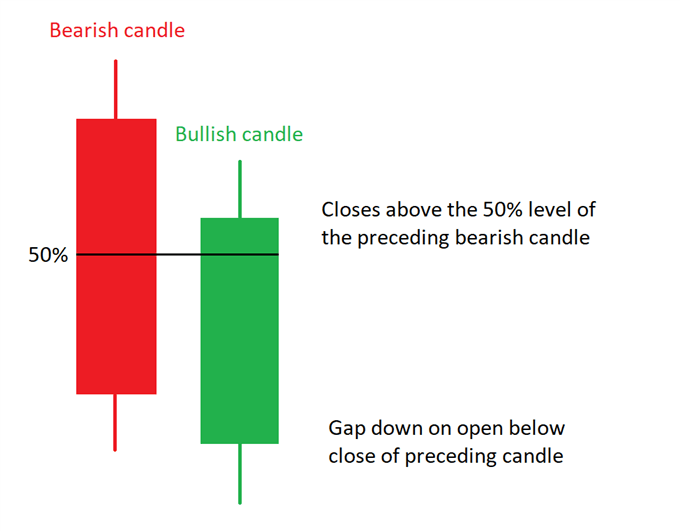

Assalam o Alaikum Dear Friends and Fellows Piercing Line candlestick pattern ek bullish reversal pattern hy jo downtrend ke dauran hota hy. Isme do candlesticks hotey hy, jisme pehla candleek bearish candle hy aur dusra candle bullish hota hy jo pehle candle ki body ke kam se kam adha hissa tak upar close hota hy. Ye pattern significant consider kiya jata hy kyunki isse market sentiment me bearish se bullish ki shift dikhti hy, jisse trend reversal ka potential show hota hy.

Anatomy Of The Piercing Line Candlestick Pattern:

Piercing Line candlestick pattern do alag candlesticks se banta hy. Pehla candlestick bearish hota hy, jo downtrend ki continuation ko darshata hy. Ye candle generally lambi body aur choti ya bilkul nahi upper shadow ke saath hota hy. Dusra candlestick bullish hota hy, jo pehle candle ki close se neeche open hota hy. Fir isme rally hoti hy throughout the session aur ye kam se kam pehle candle ki body ke adhe hisse tak upar close hota hy. Ye pehle candle ki body ko dusre candle ke dwara pierce karne se ye pattern significant hota hy.

Interpretation Of The Piercing Line Candlestick Pattern:

Piercing Line candlestick pattern ko ek bullish reversal signal ke roop me dekha jata hy. Isse ye darshaya jata hy ki downtrend me jo selling pressure hy wo kam ho rahi hy aur buyers phir se control me aa rahe hy. Is pattern me dusre candle ka close pehle candle se kafi high hota hy, jisse ye pata chalta hy ki buyers aa rahe hy aur price ko upar le ja rahe hy. Isse long positions enter karne ya short positions ko close karne ka signal samjha jata hy.

Confirmation And Trade Entry For The Piercing Line Candlestick Pattern:

jabki Piercing Line candlestick pattern akele me hi ek strong reversal signal samjha jata hy, traders aksar trade enter karne se pehle dusre technical indicators ya patterns ki tasdeek dekhne ki koshish karte hy. Is pattern ki tasdeek karne ke kuch common methods include karte hy jaise ki MACD ya RSI indicators par bullish divergence dhundhna ya ek significant resistance level ke upar break ka intezar karna. Jab pattern tasdeek ho jaye, traders agle candle ke open par long positions enter kar sakte hy ya dusre candle ke high se thodi upar buy stop order set kar sakte hy.

Stop Loss And Take Profit Levels For The Piercing Line Candlestick Pattern:

Risk ko manage karne aur potential losses se bachne ke liye traders ko appropriate stop loss levels set karna chiye jab wo Piercing Line candlestick pattern trade karte hy. Ek common approach hoti hy ki stop loss dusre candle ke low se thodi neeche ya passby support level ke neeche set karna. Take profit levels pattern ki size ya security ki price action history par depend karte hy. Traders fixed target par profits le sakte hy jaise ki pattern ki size ka do guna ya trailing stop use kar sakte hy taaki jab market inke favour me move ho to profits ko lock kiya ja sake. Conclusion me, Piercing Line candlestick pattern ek powerful bullish reversal signal hy jo market direction me ek potential change darshata hy. Traders ko is pattern ko pehchanne aur ise dusre technical indicators aur patterns ke saath confirm karne ke liye istemaal karna chiye. Appropriate stop loss aur take profit levels set karke, traders risk ko manage kar sakte hy aur Piercing Line candlestick pattern trade karte waqt potential profits ko maximize kar sakte hy.

Assalam o Alaikum Dear Friends and Fellows Piercing Line candlestick pattern ek bullish reversal pattern hy jo downtrend ke dauran hota hy. Isme do candlesticks hotey hy, jisme pehla candleek bearish candle hy aur dusra candle bullish hota hy jo pehle candle ki body ke kam se kam adha hissa tak upar close hota hy. Ye pattern significant consider kiya jata hy kyunki isse market sentiment me bearish se bullish ki shift dikhti hy, jisse trend reversal ka potential show hota hy.

Anatomy Of The Piercing Line Candlestick Pattern:

Piercing Line candlestick pattern do alag candlesticks se banta hy. Pehla candlestick bearish hota hy, jo downtrend ki continuation ko darshata hy. Ye candle generally lambi body aur choti ya bilkul nahi upper shadow ke saath hota hy. Dusra candlestick bullish hota hy, jo pehle candle ki close se neeche open hota hy. Fir isme rally hoti hy throughout the session aur ye kam se kam pehle candle ki body ke adhe hisse tak upar close hota hy. Ye pehle candle ki body ko dusre candle ke dwara pierce karne se ye pattern significant hota hy.

Interpretation Of The Piercing Line Candlestick Pattern:

Piercing Line candlestick pattern ko ek bullish reversal signal ke roop me dekha jata hy. Isse ye darshaya jata hy ki downtrend me jo selling pressure hy wo kam ho rahi hy aur buyers phir se control me aa rahe hy. Is pattern me dusre candle ka close pehle candle se kafi high hota hy, jisse ye pata chalta hy ki buyers aa rahe hy aur price ko upar le ja rahe hy. Isse long positions enter karne ya short positions ko close karne ka signal samjha jata hy.

Confirmation And Trade Entry For The Piercing Line Candlestick Pattern:

jabki Piercing Line candlestick pattern akele me hi ek strong reversal signal samjha jata hy, traders aksar trade enter karne se pehle dusre technical indicators ya patterns ki tasdeek dekhne ki koshish karte hy. Is pattern ki tasdeek karne ke kuch common methods include karte hy jaise ki MACD ya RSI indicators par bullish divergence dhundhna ya ek significant resistance level ke upar break ka intezar karna. Jab pattern tasdeek ho jaye, traders agle candle ke open par long positions enter kar sakte hy ya dusre candle ke high se thodi upar buy stop order set kar sakte hy.

Stop Loss And Take Profit Levels For The Piercing Line Candlestick Pattern:

Risk ko manage karne aur potential losses se bachne ke liye traders ko appropriate stop loss levels set karna chiye jab wo Piercing Line candlestick pattern trade karte hy. Ek common approach hoti hy ki stop loss dusre candle ke low se thodi neeche ya passby support level ke neeche set karna. Take profit levels pattern ki size ya security ki price action history par depend karte hy. Traders fixed target par profits le sakte hy jaise ki pattern ki size ka do guna ya trailing stop use kar sakte hy taaki jab market inke favour me move ho to profits ko lock kiya ja sake. Conclusion me, Piercing Line candlestick pattern ek powerful bullish reversal signal hy jo market direction me ek potential change darshata hy. Traders ko is pattern ko pehchanne aur ise dusre technical indicators aur patterns ke saath confirm karne ke liye istemaal karna chiye. Appropriate stop loss aur take profit levels set karke, traders risk ko manage kar sakte hy aur Piercing Line candlestick pattern trade karte waqt potential profits ko maximize kar sakte hy.

تبصرہ

Расширенный режим Обычный режим