Bilateral Charts Candlestick Pattern

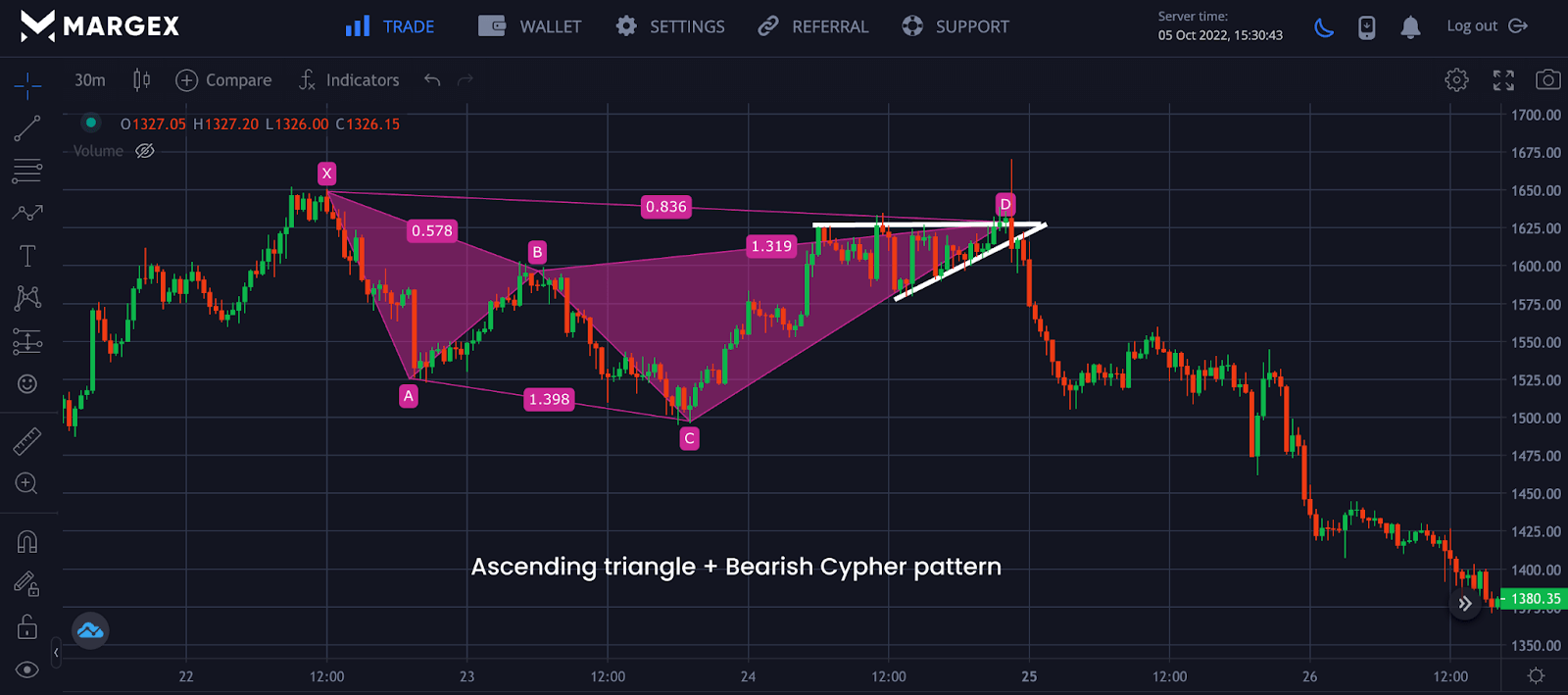

Assalam o Alaikum Dear Friends and Fellows Bilateral chart patterns forex trading me ahem hein, kyun ke ye dono taraf, yaani bullish aur bearish price movements ko indicate kar sakty hein.In patterns ka maqsad market me honey waly potential price moves ko traders ko batana hota hy.Is pattern me price chart par aik triangle ban jata hy, jahan pe price lines doosri taraf se milti hein aur triangle ke darmiyan aik horizontal line hoti hy.Symmetrical triangle bullish ya bearish breakout indicate kar sakti hy, isay confirm karny ke liye traders doosri technical indicators ka bhi istemal karty hein. Rectangle pattern me price chart par aik rectangle ban jata hy jahan pe price horizontal lines ke darmiyan trade hoti hy. Rectangle bullish ya bearish breakout ka indication ho sakta hy.Pennant pattern me price chart par aik flag jaisa pattern ban jata hy, jo triangle ki tarah hota hy.Yeh pattern typically strong price move ke baad aata hy aur breakout ka hint deta hy.Bilateral chart patterns ek important tool hein, lekin trading me hamesha risk hota hy, isliye risk management ka bhi khayal rakhna zaroori hy.

Bilateral Chart Pattern and its Types

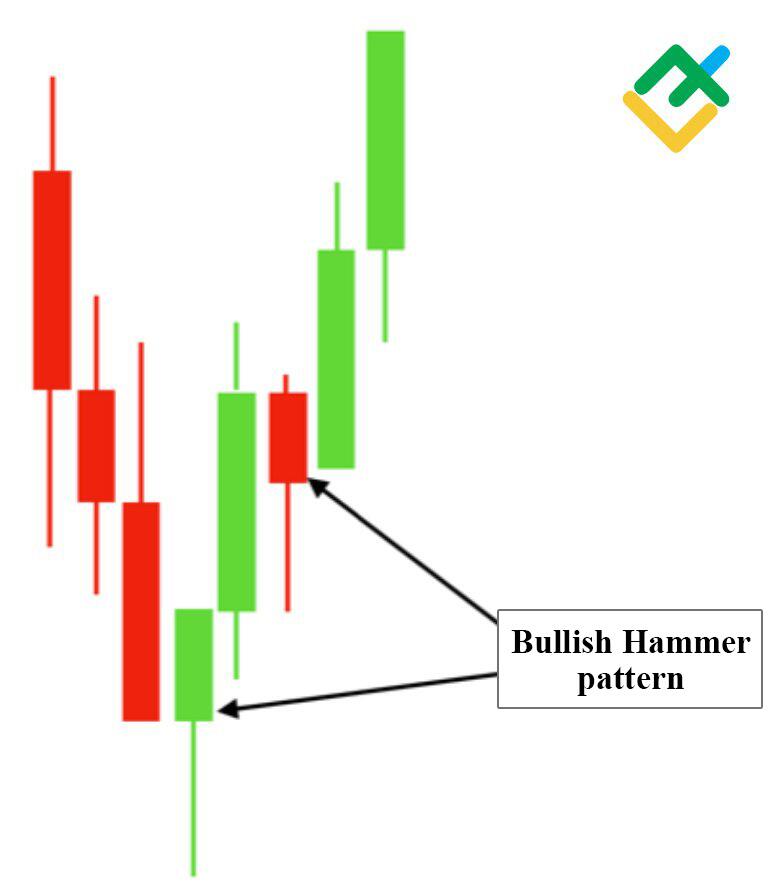

Bilateral patterns triangular hoty hein jin me prices bounded hui hoti hein, is tarah k patterns kafi tricky hoty hein, kyun k last moment tak prices kisi confirm direction me move nahi karti hein, ye hamein both sides me moment k signals da rahay hotay hein, jo top side ki taraf b ho sakti ha aur down side ki taraf b, is tarah ki situation ma hme pending orders ko use karna chyay aur aik order top ki taraf set karain aur dusra bottom ki taraf. jb dono ma sa koi aik order active ho jay to dusray ko cancel kar dain, in ma sirf aik problem false break ka ha.

Types of Bilateral Chart Pattern

Bilateral chart pattern k three types hoti hn Jo k most important hn forex market me...

1. Ascending Triangles.

2. Symmetrical triangles.

3. Descending triangles.

Bilateral patterns k sath trading strategy :

Bilateral patterns triangular me kam karna hy tu sab say phly is me pratice karen qk jab tak pratice nahi hoti hein tu kamyabi b nahi mil skti hein kamyab hony k liye pratice karna parta hein kamyab hony k liye regular learning karna parta hein kamyab hony kliye forex trading me storng learning ki need hein forex trading ka busniess kafi he strong busniess hein jis ne hardwork k sath kam kia us ne full kamyabi hasil ki forex trading me learning karny walay traders kamyabi paaty hein kamyab hone k liye learning ko increase karna parta hein kamyab hony k liye forex trading me hardwork karna parta hein forex trading k business me har person ko regular hardwork ki zarurat hoti hy

Assalam o Alaikum Dear Friends and Fellows Bilateral chart patterns forex trading me ahem hein, kyun ke ye dono taraf, yaani bullish aur bearish price movements ko indicate kar sakty hein.In patterns ka maqsad market me honey waly potential price moves ko traders ko batana hota hy.Is pattern me price chart par aik triangle ban jata hy, jahan pe price lines doosri taraf se milti hein aur triangle ke darmiyan aik horizontal line hoti hy.Symmetrical triangle bullish ya bearish breakout indicate kar sakti hy, isay confirm karny ke liye traders doosri technical indicators ka bhi istemal karty hein. Rectangle pattern me price chart par aik rectangle ban jata hy jahan pe price horizontal lines ke darmiyan trade hoti hy. Rectangle bullish ya bearish breakout ka indication ho sakta hy.Pennant pattern me price chart par aik flag jaisa pattern ban jata hy, jo triangle ki tarah hota hy.Yeh pattern typically strong price move ke baad aata hy aur breakout ka hint deta hy.Bilateral chart patterns ek important tool hein, lekin trading me hamesha risk hota hy, isliye risk management ka bhi khayal rakhna zaroori hy.

Bilateral Chart Pattern and its Types

Bilateral patterns triangular hoty hein jin me prices bounded hui hoti hein, is tarah k patterns kafi tricky hoty hein, kyun k last moment tak prices kisi confirm direction me move nahi karti hein, ye hamein both sides me moment k signals da rahay hotay hein, jo top side ki taraf b ho sakti ha aur down side ki taraf b, is tarah ki situation ma hme pending orders ko use karna chyay aur aik order top ki taraf set karain aur dusra bottom ki taraf. jb dono ma sa koi aik order active ho jay to dusray ko cancel kar dain, in ma sirf aik problem false break ka ha.

Types of Bilateral Chart Pattern

Bilateral chart pattern k three types hoti hn Jo k most important hn forex market me...

1. Ascending Triangles.

2. Symmetrical triangles.

3. Descending triangles.

Bilateral patterns k sath trading strategy :

Bilateral patterns triangular me kam karna hy tu sab say phly is me pratice karen qk jab tak pratice nahi hoti hein tu kamyabi b nahi mil skti hein kamyab hony k liye pratice karna parta hein kamyab hony k liye regular learning karna parta hein kamyab hony kliye forex trading me storng learning ki need hein forex trading ka busniess kafi he strong busniess hein jis ne hardwork k sath kam kia us ne full kamyabi hasil ki forex trading me learning karny walay traders kamyabi paaty hein kamyab hone k liye learning ko increase karna parta hein kamyab hony k liye forex trading me hardwork karna parta hein forex trading k business me har person ko regular hardwork ki zarurat hoti hy

تبصرہ

Расширенный режим Обычный режим