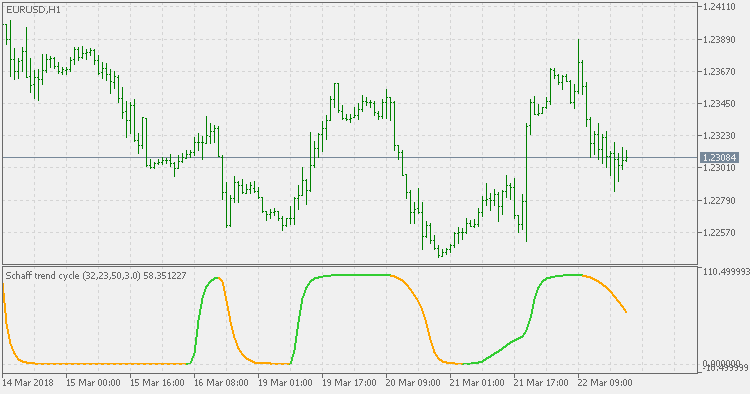

Schaff Trend Cycle (STC) Indicator:

Forex trading mein ek ahem tool jo traders ke liye ahem hota hai woh hai "Schaff Trend Cycle" (STC) Indicator. Yeh ek technical indicator hai jo market trends ko samajhne aur trade signals generate karne mein madad karta hai. Forex trading mein, Schaff Trend Cycle (STC) ek ahem technical indicator hai jo trend analysis aur entry/exit points ka tajziya karta hai. Yeh indicator price data ko istemal karta hai takay traders ko market ki direction aur momentum ka andaza lagaya ja sake.

Understanding:

STC Indicator market ki trend aur uski cyclical nature ko analyze karta hai. Iska matlab hai ke yeh indicator market ke uptrends aur downtrends ko detect karta hai, sath hi sath unke cycles ko bhi dhundh leta hai. Schaff Trend Cycle (STC) indicator ek momentum oscillator hai jo market trends ko determine karta hai. Iska maqsad market ki direction aur momentum ko samajhna hai taake traders ko sahi waqt par entry aur exit points ka faisla karne mein madad mile.

Components:

STC Indicator teen components par mabni hota hai: Fast EMA (Exponential Moving Average), Slow EMA, aur Cycle. Fast EMA aur Slow EMA price movements ko analyze karte hain jabke Cycle component trend ka strength determine karta hai. STC indicator do components se bana hota hai: Fast and Slow. Fast component, Exponential Moving Average (EMA) ka ek modification hai jo short-term price momentum ko represent karta hai. Slow component, Fast EMA ka ek moving average hai jo long-term price momentum ko darust karta hai.

Using the STC Indicator:

STC Indicator ko istemal karke traders market trends ko samajh sakte hain aur unke entry aur exit points ko identify kar sakte hain. Agar STC Indicator ki line upar hoti hai, toh yeh ek uptrend ko indicate karta hai, jabke agar line neeche hoti hai, toh yeh ek downtrend ko darust karti hai.

Trading Strategies:

STC Indicator ke istemal se traders various trading strategies develop kar sakte hain. Misal ke tor par, agar STC line neeche se upar chali jati hai aur price bhi uptrend mein hai, toh yeh ek buy signal provide karta hai. Isi tarah, agar STC line upar se neeche aati hai aur price downtrend mein hai, toh yeh ek sell signal hota hai. Traders STC indicator ko trading strategies mein istemal karte hain. Jaise ke, jab Fast component Slow component ko upar se neeche cross karta hai, yeh ek sell signal hai. Aur jab Fast component Slow component ko neeche se upar cross karta hai, yeh ek buy signal hai.

Conclusion:

Schaff Trend Cycle (STC) Indicator forex trading mein ek ahem tool hai jo traders ko market trends ko samajhne aur trading decisions ko improve karne mein madad karta hai. Iske components aur istemal ke tareeqe ko samajh kar, traders apni trading strategies ko enhance kar sakte hain aur market mein successful ho sakte hain.

تبصرہ

Расширенный режим Обычный режим