KEY POINTS OF STICK SANDWICH CANDLESTICK IN FOREX

DEFINITION

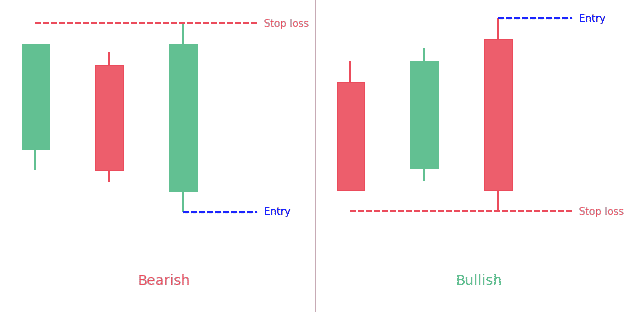

Forex market mein technical analysis ka ek aham hissa hai candlestick patterns ka istemal. "Stick Sandwich candlestick" pattern bhi isi series ka ek pattern hai jo traders ko market ke potential reversal ya continuation signals provide karta hai. Yeh pattern teen candles se banta hai aur yeh do different types ke ho sakte hain:

1- BULLISH STICK SANDWICH CANDLESTICK PATTERN

2- BEARISH STICK SANDWICH CANDLESTICK PATTERN

BULLISH STICK SANDWICH CANDLESTICK PATTERN

Yeh ek bearish candle hoti hai jo indicate karta hai ke market mein sellers zyada active hain. Yeh chhoti bearish ya bullish candle hoti hai, jo pehli candle ke close price ke near close hoti hai. Yeh candle market mein indecision ko darshata hai. Yeh ek strong bullish candle hoti hai jo doosri candle ko cover karta hai aur ideally pehli candle ke close price se oopar close hoti hai. Yeh dikhata hai ke buyers ne control sambhal liya hai aur market upward move kar sakta hai.

BEARISH STICK SANDWICH CANDLESTICK PATTERN

Yeh ek bullish candle hoti hai, indicating ke buyers market mein dominant hain. Yeh ek chhoti bullish ya bearish candle hoti hai, jo pehli candle ke close ke near close hoti hai. Yeh bhi market mein indecision ko show karta hai. Yeh ek strong bearish candle hoti hai jo doosri candle ko cover karti hai aur ideally pehli candle ke close price se neeche close hoti hai. Yeh indicate karta hai ke sellers ne market control me le liya hai aur price neeche ja sakta hai.

TRADING STRATEGY

Traders is pattern ka use karke buy ya sell decisions le sakte hain. Agar bullish sandwich pattern dekha jaye to buy ka signal samjha jata hai, aur agar bearish pattern hai to sell ka signal mana jata hai. Hamesha yeh yaad rakhna chahiye ke kisi bhi trading decision se pehle additional confirmation aur risk management techniques ka use zaroori hai, jaise ki stop-loss orders.

DEFINITION

Forex market mein technical analysis ka ek aham hissa hai candlestick patterns ka istemal. "Stick Sandwich candlestick" pattern bhi isi series ka ek pattern hai jo traders ko market ke potential reversal ya continuation signals provide karta hai. Yeh pattern teen candles se banta hai aur yeh do different types ke ho sakte hain:

1- BULLISH STICK SANDWICH CANDLESTICK PATTERN

2- BEARISH STICK SANDWICH CANDLESTICK PATTERN

BULLISH STICK SANDWICH CANDLESTICK PATTERN

Yeh ek bearish candle hoti hai jo indicate karta hai ke market mein sellers zyada active hain. Yeh chhoti bearish ya bullish candle hoti hai, jo pehli candle ke close price ke near close hoti hai. Yeh candle market mein indecision ko darshata hai. Yeh ek strong bullish candle hoti hai jo doosri candle ko cover karta hai aur ideally pehli candle ke close price se oopar close hoti hai. Yeh dikhata hai ke buyers ne control sambhal liya hai aur market upward move kar sakta hai.

BEARISH STICK SANDWICH CANDLESTICK PATTERN

Yeh ek bullish candle hoti hai, indicating ke buyers market mein dominant hain. Yeh ek chhoti bullish ya bearish candle hoti hai, jo pehli candle ke close ke near close hoti hai. Yeh bhi market mein indecision ko show karta hai. Yeh ek strong bearish candle hoti hai jo doosri candle ko cover karti hai aur ideally pehli candle ke close price se neeche close hoti hai. Yeh indicate karta hai ke sellers ne market control me le liya hai aur price neeche ja sakta hai.

TRADING STRATEGY

Traders is pattern ka use karke buy ya sell decisions le sakte hain. Agar bullish sandwich pattern dekha jaye to buy ka signal samjha jata hai, aur agar bearish pattern hai to sell ka signal mana jata hai. Hamesha yeh yaad rakhna chahiye ke kisi bhi trading decision se pehle additional confirmation aur risk management techniques ka use zaroori hai, jaise ki stop-loss orders.

تبصرہ

Расширенный режим Обычный режим