TRI-STAR CANDLESTICK IN FOREX

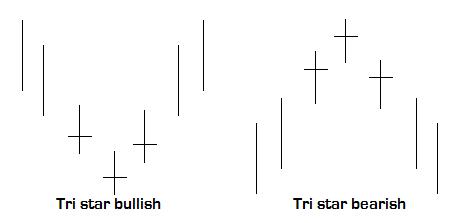

Tri-Star candlestick pattern forex mein ek mukhtasar lekin ahem technical analysis tool hai jo traders ko price movement ka trend samajhne mein madad deta hai. Tri-Star pattern mein teen consecutive dojis hote hain. Doji candlesticks woh hote hain jo open aur close price barabar ya qareeb barabar hoti hai. Yeh dojis ek dosre ke baad lagte hain, aur inka size barabar hota hai.

FORMATION AND DIFFERENT PARTS

FIRST DOJI

Pehla doji existing trend ke against aata hai aur indicate karta hai ke market mein indecision hai.

SECOND DOJI

Dusra doji bhi trend ke against hota hai aur indecision ko darust karta hai.

THIRD DOJI

Teesra doji bhi trend ke against hota hai aur yeh confirm karta hai ke market mein indecision hai.

STOP LOSS AND TAKE PROFIT

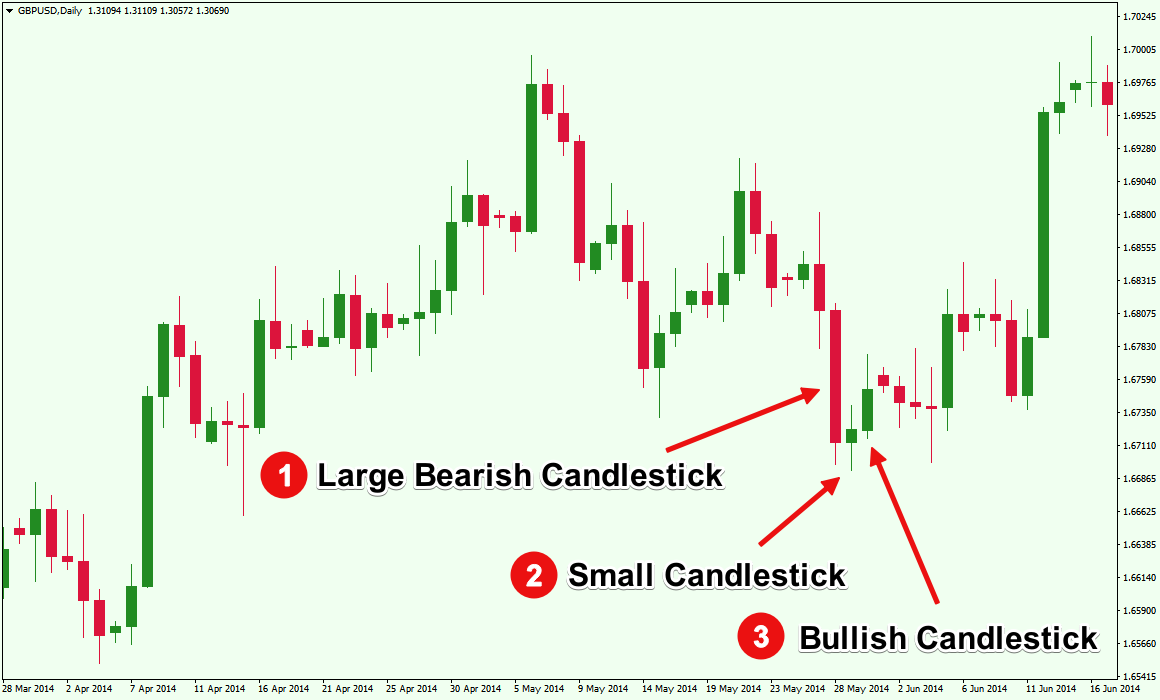

Tri-Star pattern dekh kar, traders price ka direction predict kar sakte hain. Agar Tri-Star bullish trend ke baad aata hai toh yeh bearish reversal ki nishani ho sakti hai, aur agar downtrend ke baad aata hai toh yeh bullish reversal ki indication ho sakti hai.Yah pattern kabhi kabar false signals bhi de sakta hai, is liye cautious trading approach zaroori hai.

TECHNICAL STRATEGIES

Tri-Star pattern ko confirm karne ke liye, traders ko doji ke sath volume aur other technical indicators ko bhi madda lena chahiye. Yah pattern kabhi kabar false signals bhi de sakta hai, is liye cautious trading approach zaroori hai.

Agar Tri-Star bullish trend ke baad aata hai toh yeh bearish reversal ki nishani ho sakti hai, aur agar downtrend ke baad aata hai toh yeh bullish reversal ki indication ho sakti hai.

Tri-Star candlestick pattern forex mein ek mukhtasar lekin ahem technical analysis tool hai jo traders ko price movement ka trend samajhne mein madad deta hai. Tri-Star pattern mein teen consecutive dojis hote hain. Doji candlesticks woh hote hain jo open aur close price barabar ya qareeb barabar hoti hai. Yeh dojis ek dosre ke baad lagte hain, aur inka size barabar hota hai.

FORMATION AND DIFFERENT PARTS

FIRST DOJI

Pehla doji existing trend ke against aata hai aur indicate karta hai ke market mein indecision hai.

SECOND DOJI

Dusra doji bhi trend ke against hota hai aur indecision ko darust karta hai.

THIRD DOJI

Teesra doji bhi trend ke against hota hai aur yeh confirm karta hai ke market mein indecision hai.

STOP LOSS AND TAKE PROFIT

Tri-Star pattern dekh kar, traders price ka direction predict kar sakte hain. Agar Tri-Star bullish trend ke baad aata hai toh yeh bearish reversal ki nishani ho sakti hai, aur agar downtrend ke baad aata hai toh yeh bullish reversal ki indication ho sakti hai.Yah pattern kabhi kabar false signals bhi de sakta hai, is liye cautious trading approach zaroori hai.

TECHNICAL STRATEGIES

Tri-Star pattern ko confirm karne ke liye, traders ko doji ke sath volume aur other technical indicators ko bhi madda lena chahiye. Yah pattern kabhi kabar false signals bhi de sakta hai, is liye cautious trading approach zaroori hai.

Agar Tri-Star bullish trend ke baad aata hai toh yeh bearish reversal ki nishani ho sakti hai, aur agar downtrend ke baad aata hai toh yeh bullish reversal ki indication ho sakti hai.

تبصرہ

Расширенный режим Обычный режим