Introduction:

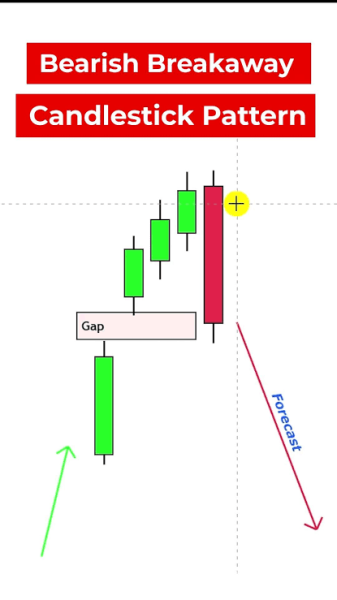

Bearish Breakaway Candlestick Pattern ek reversal pattern hai jo uptrend ko indicate karta hai. Is pattern mein initial large green candle ke baad bearish candles sequence hoti hai, indicating a potential trend reversal.

Characteristics:

Is pattern ki pehchan karne ke liye kuch characteristics hain:

1. Ek uptrend ke baad, ek large green candle hoti hai, jo higher high aur higher low ke saath close hoti hai.

2. Iske baad, ek series of small bearish candles follow hoti hain, indicating selling pressure.

3. Breakaway gap, jisme price gap down hoti hai, ek strong indicator hota hai is pattern ka confirmation ke liye.

Interpretation:

Bearish Breakaway Candlestick Pattern ka interpretation ye hai ke uptrend weak ho raha hai aur bearish momentum barh raha hai. Is pattern ko dekh kar traders apne positions ko adjust karte hain ya new short positions enter karte hain.

Trading Strategies:

Kuch trading strategies jo is pattern ka istemal karte hain:

1. Short entry: Breakaway gap ke neeche short entry lena ek common strategy hai.

2. Stop-loss placement: Stop-loss ko breakaway candle ke high ke just above place karna prudent hota hai.

3. Target setting: Target setting mein traders support levels ko consider karte hain.

Example:

Maan lijiye, ek stock ka price uptrend mein hai aur ek large green candle ke baad breakaway gap aur bearish candles sequence nazar aata hai, ye ek example ho sakta hai bearish breakaway candlestick pattern ka.

Conclusion:

Bearish Breakaway Candlestick Pattern ek powerful reversal pattern hai jo traders ko bearish trend ke shuruaat mein indicate karta hai. Is pattern ko samajh kar traders apne trading strategies ko optimize kar sakte hain.

Bearish Breakaway Candlestick Pattern ek reversal pattern hai jo uptrend ko indicate karta hai. Is pattern mein initial large green candle ke baad bearish candles sequence hoti hai, indicating a potential trend reversal.

Characteristics:

Is pattern ki pehchan karne ke liye kuch characteristics hain:

1. Ek uptrend ke baad, ek large green candle hoti hai, jo higher high aur higher low ke saath close hoti hai.

2. Iske baad, ek series of small bearish candles follow hoti hain, indicating selling pressure.

3. Breakaway gap, jisme price gap down hoti hai, ek strong indicator hota hai is pattern ka confirmation ke liye.

Interpretation:

Bearish Breakaway Candlestick Pattern ka interpretation ye hai ke uptrend weak ho raha hai aur bearish momentum barh raha hai. Is pattern ko dekh kar traders apne positions ko adjust karte hain ya new short positions enter karte hain.

Trading Strategies:

Kuch trading strategies jo is pattern ka istemal karte hain:

1. Short entry: Breakaway gap ke neeche short entry lena ek common strategy hai.

2. Stop-loss placement: Stop-loss ko breakaway candle ke high ke just above place karna prudent hota hai.

3. Target setting: Target setting mein traders support levels ko consider karte hain.

Example:

Maan lijiye, ek stock ka price uptrend mein hai aur ek large green candle ke baad breakaway gap aur bearish candles sequence nazar aata hai, ye ek example ho sakta hai bearish breakaway candlestick pattern ka.

Conclusion:

Bearish Breakaway Candlestick Pattern ek powerful reversal pattern hai jo traders ko bearish trend ke shuruaat mein indicate karta hai. Is pattern ko samajh kar traders apne trading strategies ko optimize kar sakte hain.

تبصرہ

Расширенный режим Обычный режим