Forex Trading aur PIP:

Pehchan

Forex, ya foreign exchange, ek market hai jahan currencies trade hoti hain. PIP (Percentage in Point) ek important concept hai Forex trading mein.

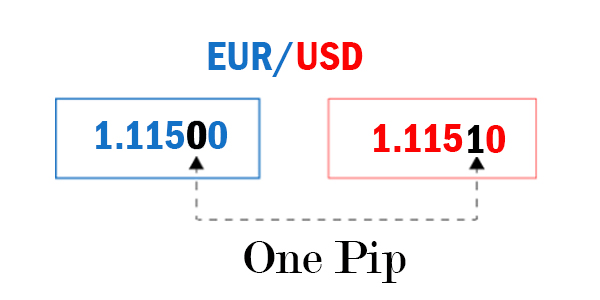

PIP ka Matlab

PIP ek measurement unit hai jis se currency price ki movement ka pata chalta hai. PIP usually decimal points ke form mein express hota hai.

PIP ka Hesab

PIP calculate karne ke liye, traders currency pairs ke movement ko dekhte hain. Ek standard lot ke liye, ek PIP ka value typically $10 hota hai.

PIP ki Ahmiyat

PIP ke through traders currency price ki choti se choti movement ko bhi track kar sakte hain, jo unhe trading mein madad deta hai.

PIP ki Variability

Different currency pairs ke PIP values alag ho sakte hain. For example, JPY pairs ki PIP value generally kam hoti hai compared to other pairs.

PIP aur Spread

Spread ek aur important concept hai Forex trading mein. Spread, bid aur ask price ke darmiyan ka difference hota hai, jo traders ko trading cost ka idea deta hai.

PIP aur Profit

Traders PIP ke through apne profits ko measure karte hain. Har PIP movement ek trader ke profit ya loss ko affect karta hai, depending on their position.

PIP aur Lot Size

Lot size determine karta hai ke ek trader kitne PIPs pe trade karta hai. Larger lot size, zyada PIP movement ke liye exposure hota hai.

PIP aur Risk Management

Traders PIP ke through apne trades ka risk assess karte hain. PIP movement ko consider kar ke, wo apni position size aur stop loss levels ko set karte hain.

PIP aur Technical Analysis

Technical analysis mein PIP movement ka use hota hai to analyze price charts aur trends ko samajhne ke liye.

PIP aur Position Sizing

Position sizing mein PIP movement ko consider karte hue traders apne trades ki size ko adjust karte hain, taake unka risk manage ho sake.

PIP aur Trading Strategies

Traders apni trading strategies mein PIP movement ko incorporate karte hain, jisse unka trading decision making improve hota hai.

PIP aur Scalping

Scalping mein traders chhoti chhoti PIP movements ka faida uthate hain, aur in movements ko capture karke profits earn karte hain.

PIP ki Limitations

PIP movement ke limitations hote hain, especially jab market volatile hota hai ya spread widen hota hai.

PIP aur Emotional Impact

Traders ko PIP movements se hone wale profit ya loss se emotional impact hota hai, jo unke trading decisions ko influence kar sakta hai.

PIP ki Learning aur Practice

New traders ko PIP concept ko samajhne aur practice karne mein time lag sakta hai, lekin practice se wo ise master kar sakte hain.

PIP aur Education

Educational resources se traders PIP concept ko aur behtar tariqe se samajh sakte hain, jisse unki trading skills improve hoti hai.

PIP aur Market Analysis

Market analysis mein PIP movement ka consideration karna important hota hai, taake traders sahi trading decisions le sakein.

PIP aur Long Term Investing

Long term investors bhi PIP concept ko samajhte hain, kyunke even small PIP movements long term profits ko affect kar sakte hain.PIP ek vital concept hai Forex trading mein jo traders ko market movement ko analyze karne aur trading decisions ko improve karne mein madad deta hai. Isliye, har trader ko PIP ke bare mein achhi tarah se samajhna zaroori hai.

Pehchan

Forex, ya foreign exchange, ek market hai jahan currencies trade hoti hain. PIP (Percentage in Point) ek important concept hai Forex trading mein.

PIP ka Matlab

PIP ek measurement unit hai jis se currency price ki movement ka pata chalta hai. PIP usually decimal points ke form mein express hota hai.

PIP ka Hesab

PIP calculate karne ke liye, traders currency pairs ke movement ko dekhte hain. Ek standard lot ke liye, ek PIP ka value typically $10 hota hai.

PIP ki Ahmiyat

PIP ke through traders currency price ki choti se choti movement ko bhi track kar sakte hain, jo unhe trading mein madad deta hai.

PIP ki Variability

Different currency pairs ke PIP values alag ho sakte hain. For example, JPY pairs ki PIP value generally kam hoti hai compared to other pairs.

PIP aur Spread

Spread ek aur important concept hai Forex trading mein. Spread, bid aur ask price ke darmiyan ka difference hota hai, jo traders ko trading cost ka idea deta hai.

PIP aur Profit

Traders PIP ke through apne profits ko measure karte hain. Har PIP movement ek trader ke profit ya loss ko affect karta hai, depending on their position.

PIP aur Lot Size

Lot size determine karta hai ke ek trader kitne PIPs pe trade karta hai. Larger lot size, zyada PIP movement ke liye exposure hota hai.

PIP aur Risk Management

Traders PIP ke through apne trades ka risk assess karte hain. PIP movement ko consider kar ke, wo apni position size aur stop loss levels ko set karte hain.

PIP aur Technical Analysis

Technical analysis mein PIP movement ka use hota hai to analyze price charts aur trends ko samajhne ke liye.

PIP aur Position Sizing

Position sizing mein PIP movement ko consider karte hue traders apne trades ki size ko adjust karte hain, taake unka risk manage ho sake.

PIP aur Trading Strategies

Traders apni trading strategies mein PIP movement ko incorporate karte hain, jisse unka trading decision making improve hota hai.

PIP aur Scalping

Scalping mein traders chhoti chhoti PIP movements ka faida uthate hain, aur in movements ko capture karke profits earn karte hain.

PIP ki Limitations

PIP movement ke limitations hote hain, especially jab market volatile hota hai ya spread widen hota hai.

PIP aur Emotional Impact

Traders ko PIP movements se hone wale profit ya loss se emotional impact hota hai, jo unke trading decisions ko influence kar sakta hai.

PIP ki Learning aur Practice

New traders ko PIP concept ko samajhne aur practice karne mein time lag sakta hai, lekin practice se wo ise master kar sakte hain.

PIP aur Education

Educational resources se traders PIP concept ko aur behtar tariqe se samajh sakte hain, jisse unki trading skills improve hoti hai.

PIP aur Market Analysis

Market analysis mein PIP movement ka consideration karna important hota hai, taake traders sahi trading decisions le sakein.

PIP aur Long Term Investing

Long term investors bhi PIP concept ko samajhte hain, kyunke even small PIP movements long term profits ko affect kar sakte hain.PIP ek vital concept hai Forex trading mein jo traders ko market movement ko analyze karne aur trading decisions ko improve karne mein madad deta hai. Isliye, har trader ko PIP ke bare mein achhi tarah se samajhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим