Explained.

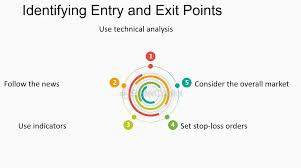

Forex trading mein, entry aur exit points ko pehchana bohot zaroori hai. Yeh aapke trade ke success ka ek bohot bada hissa hota hai. Entry point ka matlab hota hai aap kab apna trade start karenge aur exit point ka matlab hota hai aap kab apna trade close karenge. Yahaan kuch tips diye gaye hain jinse aap entry aur exit points ko pehchana sikh sakte hain.

Use Fundamental and technical analysis.

Forex trading mein, fundamental aur technical analysis ke bina entry aur exit points pehchana bohot mushkil hai. Fundamental analysis mein, aap desh ke economic indicators aur news ko dekhte hain jaise ki GDP, inflation rate, employment rate, etc. Technical analysis mein, aap charts aur graphs ke madad se price movements ko analyze karte hain. Isse aap entry aur exit points ko pehchan sakte hain.

Examine Support and Resistance levels.

Support aur resistance levels ko pehchana bohot zaroori hai. Support level us point ko represent karta hai jahaan price ko support milta hai aur resistance level us point ko represent karta hai jahaan price ko resistance milta hai. Is se aap entry aur exit points ko pehchan sakte hain.

Make Trend analysis.

Trend analysis ke madad se aap entry aur exit points ko pehchan sakte hain. Agar price uptrend mein hai to aap buy kar sakte hain aur agar price downtrend mein hai to aap sell kar sakte hain. Isse aap entry aur exit points ko pehchan sakte hain.

Risk and reward ratio.

Risk aur reward ratio ko pehchana bohot zaroori hai. Agar aapka risk aur reward ratio sahi hai to aap entry aur exit points ko acche se pehchan sakte hain. Aapko apne trade mein kitna risk lena hai aur kitna reward lena hai isse pehle hi decide karna hoga.

In sab tips ke madad se aap entry aur exit points ko pehchan sakte hain. Agar aap sahi tareeke se entry aur exit points ko pehchan lete hain to aapka trade successful ho sakta hai.

Forex trading mein, entry aur exit points ko pehchana bohot zaroori hai. Yeh aapke trade ke success ka ek bohot bada hissa hota hai. Entry point ka matlab hota hai aap kab apna trade start karenge aur exit point ka matlab hota hai aap kab apna trade close karenge. Yahaan kuch tips diye gaye hain jinse aap entry aur exit points ko pehchana sikh sakte hain.

Use Fundamental and technical analysis.

Forex trading mein, fundamental aur technical analysis ke bina entry aur exit points pehchana bohot mushkil hai. Fundamental analysis mein, aap desh ke economic indicators aur news ko dekhte hain jaise ki GDP, inflation rate, employment rate, etc. Technical analysis mein, aap charts aur graphs ke madad se price movements ko analyze karte hain. Isse aap entry aur exit points ko pehchan sakte hain.

Examine Support and Resistance levels.

Support aur resistance levels ko pehchana bohot zaroori hai. Support level us point ko represent karta hai jahaan price ko support milta hai aur resistance level us point ko represent karta hai jahaan price ko resistance milta hai. Is se aap entry aur exit points ko pehchan sakte hain.

Make Trend analysis.

Trend analysis ke madad se aap entry aur exit points ko pehchan sakte hain. Agar price uptrend mein hai to aap buy kar sakte hain aur agar price downtrend mein hai to aap sell kar sakte hain. Isse aap entry aur exit points ko pehchan sakte hain.

Risk and reward ratio.

Risk aur reward ratio ko pehchana bohot zaroori hai. Agar aapka risk aur reward ratio sahi hai to aap entry aur exit points ko acche se pehchan sakte hain. Aapko apne trade mein kitna risk lena hai aur kitna reward lena hai isse pehle hi decide karna hoga.

In sab tips ke madad se aap entry aur exit points ko pehchan sakte hain. Agar aap sahi tareeke se entry aur exit points ko pehchan lete hain to aapka trade successful ho sakta hai.

تبصرہ

Расширенный режим Обычный режим