Introduction:

Triangle chart patterns forex traders ke darmiyan sambhalne wale mukhtalif trend points ko pehchanne ke liye istemal hoti hain. Ye patterns milti julti trendlines se bani hoti hain, jo ke ek potential breakout se pehle ek period of consolidation ko darust karti hain.

Triangle Chart Pattern:

Triangle chart pattern ek technical analysis tool hai jise traders use karte hain price movements ko samajhne ke liye.Ye pattern jab price ke do converging trend lines ke darmiyaan banta hai, jaise ke uptrend line aur downtrend line, to ise triangle chart pattern kaha jata hai.

Triangle Chart Patterns Types:

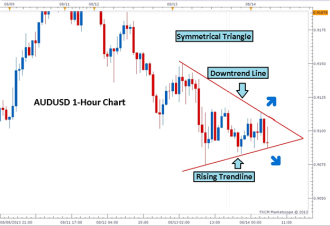

Symmetrical Triangle:

Symmetrical triangle tab banti hai jab ke qeemat buland hoti hai aur sath hi sath niche bhi hoti hai, jo ke ek point ki taraf milte hain jahan breakout mutawaqa hota hai.

Ascending Triangle:

Ascending triangle ka pehchan hai ek horizontal resistance level aur aik upar ki taraf ishtihaar ke liye ek trendline jo ke higher lows ke liye hoti hai, jo ke bullish momentum ko darust karti hai.

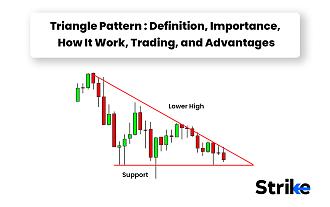

Descending Triangle:

Descending triangle mein ek horizontal support level aur ek downward sloping trendline hoti hai jo ke lower highs ke liye hoti hai, jo ke bearish pressure ko darust karti hai.

Trading Strategies:

Traders triangle pattern ko dekhte hue entry aur exit points ka faisla karte hain.

Breakout ke baad, traders ko stop-loss aur take-profit levels tay karna hota hai.

Risk management ko madde nazar rakhte hue trading strategies ko implement kiya jata hai.

Breakout Strategy:

Traders aksar intezar karte hain ke qeemat triangle ke trendlines ke upar ya neeche se break kare, taake woh breakout ke rukh mein ek trade mein dakhil ho saken.

Measuring Targets:

Triangle pattern ki unchai ko napaya ja sakta hai aur isko breakout point par lagaya ja sakta hai taake potential price targets ka andaza lagaya ja sake.

Volume Confirmation:

Traders breakout ke doran barhne wale volume ki tasdeeq ke liye talash kar sakte hain taake move ki taqat ko tasleem kiya ja sake.

Risk Management:

Stop Loss Placement:

Stop loss orders aam tor par bullish patterns mein support line ke neeche aur bearish patterns mein resistance line ke upar rakhe jate hain taake risk ko sambhal sakein.

Position Sizing:

Traders ko apne risk tolerance aur unke stop loss level ki duri ke buniyad par munasib position size ka tayun karna chahiye.

Conclusion:

Triangle chart patterns forex traders ke liye ahem tools hain taake woh potential trading opportunities ko pehchane aur risk ko behtar tareeqe se sambhal sakein. Ye patterns ko samajh kar aur munasib strategies ko amal mein la kar, traders forex ke dynamic market mein apne faislon ki achi tarah tayari kar sakte hain.

Triangle chart pattern forex trading mein important hai kyun ke ye price movements ka ek significant aspect darust karta hai.Traders ko sahi samay par entry aur exit points tay karna sikhna chahiye, triangle patterns ko samajhte hue.

Triangle chart patterns forex traders ke darmiyan sambhalne wale mukhtalif trend points ko pehchanne ke liye istemal hoti hain. Ye patterns milti julti trendlines se bani hoti hain, jo ke ek potential breakout se pehle ek period of consolidation ko darust karti hain.

Triangle Chart Pattern:

Triangle chart pattern ek technical analysis tool hai jise traders use karte hain price movements ko samajhne ke liye.Ye pattern jab price ke do converging trend lines ke darmiyaan banta hai, jaise ke uptrend line aur downtrend line, to ise triangle chart pattern kaha jata hai.

Triangle Chart Patterns Types:

Symmetrical Triangle:

Symmetrical triangle tab banti hai jab ke qeemat buland hoti hai aur sath hi sath niche bhi hoti hai, jo ke ek point ki taraf milte hain jahan breakout mutawaqa hota hai.

Ascending Triangle:

Ascending triangle ka pehchan hai ek horizontal resistance level aur aik upar ki taraf ishtihaar ke liye ek trendline jo ke higher lows ke liye hoti hai, jo ke bullish momentum ko darust karti hai.

Descending Triangle:

Descending triangle mein ek horizontal support level aur ek downward sloping trendline hoti hai jo ke lower highs ke liye hoti hai, jo ke bearish pressure ko darust karti hai.

Trading Strategies:

Traders triangle pattern ko dekhte hue entry aur exit points ka faisla karte hain.

Breakout ke baad, traders ko stop-loss aur take-profit levels tay karna hota hai.

Risk management ko madde nazar rakhte hue trading strategies ko implement kiya jata hai.

Breakout Strategy:

Traders aksar intezar karte hain ke qeemat triangle ke trendlines ke upar ya neeche se break kare, taake woh breakout ke rukh mein ek trade mein dakhil ho saken.

Measuring Targets:

Triangle pattern ki unchai ko napaya ja sakta hai aur isko breakout point par lagaya ja sakta hai taake potential price targets ka andaza lagaya ja sake.

Volume Confirmation:

Traders breakout ke doran barhne wale volume ki tasdeeq ke liye talash kar sakte hain taake move ki taqat ko tasleem kiya ja sake.

Risk Management:

Stop Loss Placement:

Stop loss orders aam tor par bullish patterns mein support line ke neeche aur bearish patterns mein resistance line ke upar rakhe jate hain taake risk ko sambhal sakein.

Position Sizing:

Traders ko apne risk tolerance aur unke stop loss level ki duri ke buniyad par munasib position size ka tayun karna chahiye.

Conclusion:

Triangle chart patterns forex traders ke liye ahem tools hain taake woh potential trading opportunities ko pehchane aur risk ko behtar tareeqe se sambhal sakein. Ye patterns ko samajh kar aur munasib strategies ko amal mein la kar, traders forex ke dynamic market mein apne faislon ki achi tarah tayari kar sakte hain.

Triangle chart pattern forex trading mein important hai kyun ke ye price movements ka ek significant aspect darust karta hai.Traders ko sahi samay par entry aur exit points tay karna sikhna chahiye, triangle patterns ko samajhte hue.

تبصرہ

Расширенный режим Обычный режим