Introduction:

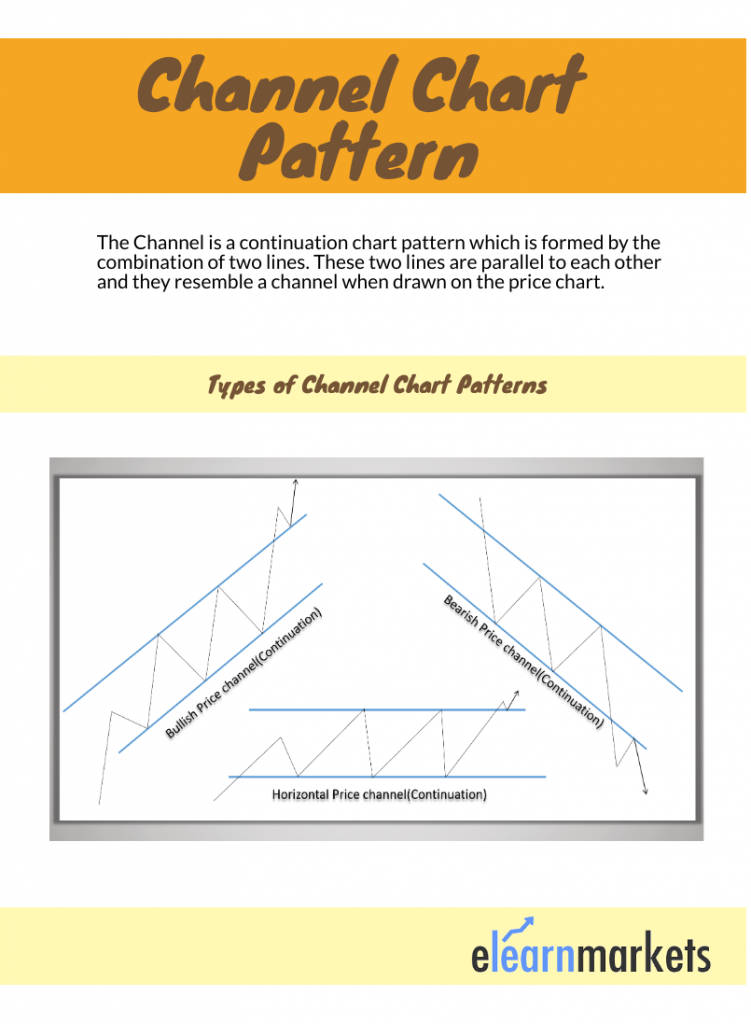

Bullish channel aik traing mathod hai jis main market aik support aur resistance k darmiyan kam krti hai.

in lines k darmiyan movement krti haiyah chennel do trend libe say mil kr banta hai. oper aik resistance hoti hai nechy aik support hoti hai. market

. qk market aik range main movement krti hai is liy ap ko but si trades lainy ka moka mil jata hai.is say ap ko makrt k trend ka pat chata hai

Tareef:

Bullish channel ek tijarati munfarid raftaar hai jahan ek maqbool asbaab se taqreeban ek se do tijarati kheton ko jorhne ka tareeqa hai.

Khasoosiyat:

Tareeqa-e-Amal:

Bullish channel ka tareeqa-e-amal samajhna zaroori hai. Is mein shehron se guzar kar anjaan rastay tak ja kar faida uthana shamil hai.

Misalain:

Nateejah:

Bullish channel tijarat ke aise aham tareeqon mein se hai jo sahi tajurba aur samajh ke saath faida utha sakta hai. Iske zarieye tijarat mein naye darwazay khul sakte hain aur

Bullish channel aik traing mathod hai jis main market aik support aur resistance k darmiyan kam krti hai.

in lines k darmiyan movement krti haiyah chennel do trend libe say mil kr banta hai. oper aik resistance hoti hai nechy aik support hoti hai. market

. qk market aik range main movement krti hai is liy ap ko but si trades lainy ka moka mil jata hai.is say ap ko makrt k trend ka pat chata hai

Tareef:

Bullish channel ek tijarati munfarid raftaar hai jahan ek maqbool asbaab se taqreeban ek se do tijarati kheton ko jorhne ka tareeqa hai.

Khasoosiyat:

- Umeed Afza Hona: Bullish channel ka sab se ahem pehlu hai ke iska umeed afza hona. Is mein tijarat ko izafay ka sahara hota hai.

- Mufeed Faida: Is tareeqay se jo faida hota hai woh munfarid hota hai aur aksar tijarat ko buland karti hai.

- Zamanay Ke Mutabiq Hona: Bullish channel ka aham pehlu yeh hai ke iska mufeed faida zamany ke mutabiq hota hai.

Tareeqa-e-Amal:

Bullish channel ka tareeqa-e-amal samajhna zaroori hai. Is mein shehron se guzar kar anjaan rastay tak ja kar faida uthana shamil hai.

Misalain:

- Shahar se Door Galla: Ek mukhtalif sheher se door galla ek behtareen misal hai bullish channel ka.

- Naye Market Ko Dhundna: Naye marketon ko dhoond kar un mein dakhil ho kar faida uthana bhi iska aham hissa hai.

Nateejah:

Bullish channel tijarat ke aise aham tareeqon mein se hai jo sahi tajurba aur samajh ke saath faida utha sakta hai. Iske zarieye tijarat mein naye darwazay khul sakte hain aur

تبصرہ

Расширенный режим Обычный режим