Introduction :

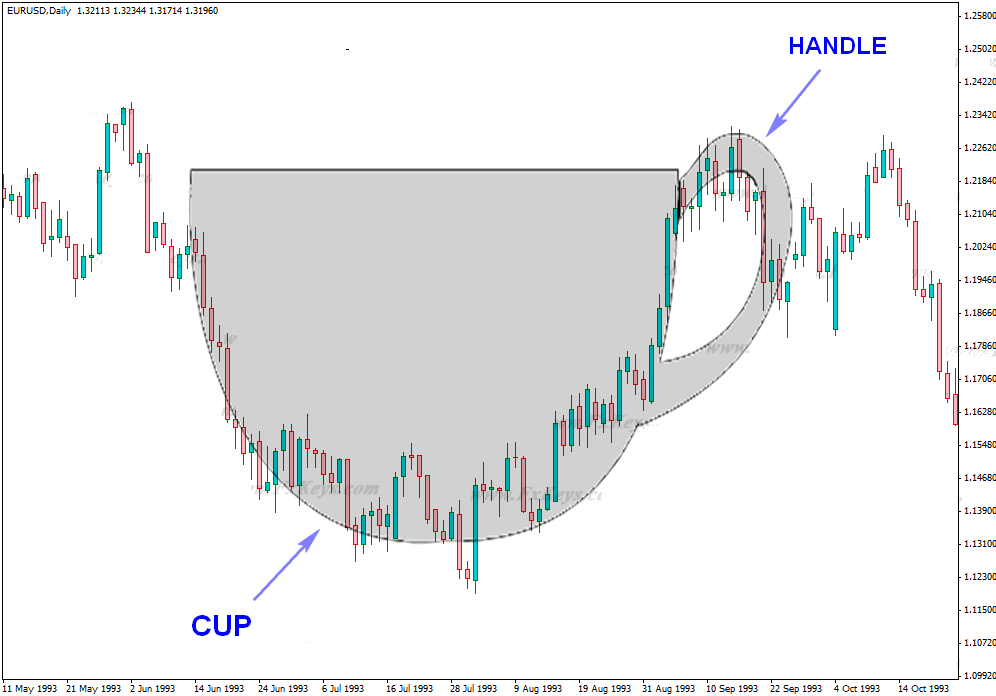

"Cup aur Handle" ek chart pattern hai jo forex trading mein istemal hota hai. Ye pattern usually uptrend ke doran develop hota hai aur price ke reversal ya continuation ko darust karne ke liye istemal hota hai.Forex mein Cup and Handle ka matlab hai ke ek chart pattern hai jisme price ka movement cup ki shape banata hai aur baad mein handle ki shape banata hai. Is pattern ko technical analysis mein use kiya jata hai price ki future prediction ke liye.

Cup :

Cup pattern mein price ka movement cup ki shape banata hai jisme price initially upar jata hai aur phir down trend mein chala jata hai. Cup ki shape ko banana ke liye price ka movement curve ke shape ko follow karta hai. Cup ki shape 1 se 6 months ke beech mein ban sakti hai.Cup, price action ka phase hota hai jab price ek rounded shape banata hai jaise cup. Yeh phase usually gradual uptrend ke baad hota hai aur price higher highs aur higher lows banata hai.

Handle :

Handle pattern mein price ka movement handle ki shape banata hai jo usually cup ki shape ke neeche hota hai. Handle ka shape banana ke liye price ka movement flat ya sideways hota hai aur handle ki shape 1 se 4 weeks ke beech mein ban sakti hai. Handle phase mein, price ek chhote se consolidation ya sideways movement ka pattern banata hai. Ye usually cup ke baad hota hai aur ek downward movement ke baad hota hai.

Cup and Handle uses:

Cup and Handle pattern ka use price ki future prediction ke liye kiya jata hai. Jab cup and handle pattern ban jata hai to traders ko buy signal milta hai aur unhe yeh samajh aata hai ke price upar jaane wala hai. Cup and handle pattern ke baad traders stop loss aur target price set karte hai.

Cup and Handle Pattern Significance:

Ye pattern traders ko indicate karta hai ke uptrend shayad continue hoga. Agar price cup aur handle pattern banata hai, toh traders uptrend ke continuation ka expectation rakhte hain.

Trading Cup and Handle Pattern:

Traders usually entry point determine karne ke liye handle ke breakout ka wait karte hain. Agar handle breakout hota hai, toh traders long positions enter karte hain, hoping ke uptrend continue hoga.

Cup and Handle Pattern Entry And Exit Strategy:

Entry point usually handle ke breakout ke baad hota hai, jab price cup ke upper trendline ko break karta hai.Traders usually stop-loss set karte hain just below handle ke lowest point.Target price ko usually cup ki height se calculate kiya jata hai aur us point par take-profit set kiya jata hai.

Risk Management:

Har trade mein risk management ka dhyan rakhna zaroori hai. Stop loss aur proper position sizing ke istemal se traders apne risk ko minimize kar sakte hain.

Conclusion:

Cup aur handle chart pattern forex trading mein ek important tool hai jo uptrend continuation ya reversal ko identify karne mein madad karta hai. Lekin, ye sirf ek tool hai aur dusre technical indicators ke saath istemal kiya jana chahiye trading decisions ke liye.Cup and Handle" pattern ek powerful bullish continuation pattern hai jo traders ko potential uptrend ke continuation ko identify karne mein madad karta hai. Is pattern ko samajhna aur sahi tareeke se istemal karna traders ke liye important hota hai.

"Cup aur Handle" ek chart pattern hai jo forex trading mein istemal hota hai. Ye pattern usually uptrend ke doran develop hota hai aur price ke reversal ya continuation ko darust karne ke liye istemal hota hai.Forex mein Cup and Handle ka matlab hai ke ek chart pattern hai jisme price ka movement cup ki shape banata hai aur baad mein handle ki shape banata hai. Is pattern ko technical analysis mein use kiya jata hai price ki future prediction ke liye.

Cup :

Cup pattern mein price ka movement cup ki shape banata hai jisme price initially upar jata hai aur phir down trend mein chala jata hai. Cup ki shape ko banana ke liye price ka movement curve ke shape ko follow karta hai. Cup ki shape 1 se 6 months ke beech mein ban sakti hai.Cup, price action ka phase hota hai jab price ek rounded shape banata hai jaise cup. Yeh phase usually gradual uptrend ke baad hota hai aur price higher highs aur higher lows banata hai.

Handle :

Handle pattern mein price ka movement handle ki shape banata hai jo usually cup ki shape ke neeche hota hai. Handle ka shape banana ke liye price ka movement flat ya sideways hota hai aur handle ki shape 1 se 4 weeks ke beech mein ban sakti hai. Handle phase mein, price ek chhote se consolidation ya sideways movement ka pattern banata hai. Ye usually cup ke baad hota hai aur ek downward movement ke baad hota hai.

Cup and Handle uses:

Cup and Handle pattern ka use price ki future prediction ke liye kiya jata hai. Jab cup and handle pattern ban jata hai to traders ko buy signal milta hai aur unhe yeh samajh aata hai ke price upar jaane wala hai. Cup and handle pattern ke baad traders stop loss aur target price set karte hai.

Cup and Handle Pattern Significance:

Ye pattern traders ko indicate karta hai ke uptrend shayad continue hoga. Agar price cup aur handle pattern banata hai, toh traders uptrend ke continuation ka expectation rakhte hain.

Trading Cup and Handle Pattern:

Traders usually entry point determine karne ke liye handle ke breakout ka wait karte hain. Agar handle breakout hota hai, toh traders long positions enter karte hain, hoping ke uptrend continue hoga.

Cup and Handle Pattern Entry And Exit Strategy:

Entry point usually handle ke breakout ke baad hota hai, jab price cup ke upper trendline ko break karta hai.Traders usually stop-loss set karte hain just below handle ke lowest point.Target price ko usually cup ki height se calculate kiya jata hai aur us point par take-profit set kiya jata hai.

Risk Management:

Har trade mein risk management ka dhyan rakhna zaroori hai. Stop loss aur proper position sizing ke istemal se traders apne risk ko minimize kar sakte hain.

Conclusion:

Cup aur handle chart pattern forex trading mein ek important tool hai jo uptrend continuation ya reversal ko identify karne mein madad karta hai. Lekin, ye sirf ek tool hai aur dusre technical indicators ke saath istemal kiya jana chahiye trading decisions ke liye.Cup and Handle" pattern ek powerful bullish continuation pattern hai jo traders ko potential uptrend ke continuation ko identify karne mein madad karta hai. Is pattern ko samajhna aur sahi tareeke se istemal karna traders ke liye important hota hai.

تبصرہ

Расширенный режим Обычный режим